TCF Bank 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In rhythm

as one

TCF Financial Corporation

2015 Annual Report

Table of contents

-

Page 1

In rhythm as one TCF Financial Corporation 2015 Annual Report -

Page 2

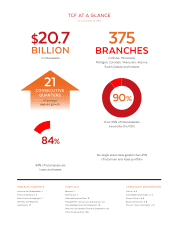

... 31, 2015) $20.7 BILLION in total assets BRANCHES in Illinois, Minnesota, Michigan, Colorado, Wisconsin, Arizona, South Dakota and Indiana 375 90% CONSECUTIVE QUARTERS of average deposit growth 21 Over 90% of total deposits insured by the FDIC 84% 84% of total assets are loans and leases... -

Page 3

...retail bank franchise and put this money to work by funding a diverse portfolio of loans and leases. Our retail bank has grown average deposits for 21 consecutive quarters, a streak we were proud to continue throughout 2015. Our focus on providing banking services whenever and wherever our customers... -

Page 4

... of more than 200 ATMs in Target® retail stores in Minnesota, Chicago and Michigan. We introduced an entirely new website experience that provides fingertip access to the information our customers need the most. In addition, we introduced the latest mobile payment solutions - Apple PayTM , Samsung... -

Page 5

...focus are our new mission, vision and values that were introduced in 2015. Our team members come to work every day with a passion to serve our customers and help them achieve their personal and business goals. Now, as we move forward as "One TCF," we have all of the right pieces in place to maximize... -

Page 6

..., executive vice president of wholesale banking; Barbara E. Shaw, director of corporate human resources; Mark A Bagley, chief credit officer; Brian W. Maass, chief financial officer; James M. Costa, chief risk officer and Tamara K. Schuette, corporate controller. Our strong origination, loan sale... -

Page 7

... our relationships with existing customers. New product offerings such as credit cards and mortgages give us additional opportunities to capture greater wallet share. M&A opportunities may also provide a way for us to supplement our funding capabilities. A potential deposit acquisition that makes... -

Page 8

... (1 1.1) 7.6 (17.5) Financial Ratios Return on average assets Return on average common equity Net interest margin Net charge-offs as a percentage of average loans and leases Common equity Tier 1 capital ratio Total risk-based capital ratio N.A. Not applicable 2015 2014 % Change 1.03% 9.19 4.42... -

Page 9

... 2013 2014 2015 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 Total Loans & Leases Average Yield on Loans & Leases Total Deposits Average Interest Rate on Deposits Net Charge-offs (Percent) 1.45% 1.54% Non-accrual Loans & Leases and Other Real Estate Owned (Millions of dollars... -

Page 10

... online and mobile banking applications, improved customers' ability to open accounts online and unveiled a real-time customer feedback mechanism to track and measure their service experience. In addition, we enhanced access through a 28 percent expansion in our ATM network across our retail banking... -

Page 11

... evolution of our service experience. Relevance. Flexibility. "In Rhythm." Our new brand platform is relevant to all audiences, whether we are communicating to businesses or individuals. Our first campaign under the new brand emphasizes how TCF is "in rhythm" with our customers' needs and provides... -

Page 12

...communities. Since 2013, we have offered unbiased, online financial education in partnership with EverFi, one of the leading education technology companies. Our program for adults, the Financial Learning Center, and our program for high school students, the Financial Scholars program, reached nearly... -

Page 13

2015 FORM 10-K TCF FINANCIAL CORPORATION For the fiscal year ended December 31, 2015 -

Page 14

... Employer Identification No.) 200 Lake Street East Wayzata, Minnesota 55391-1693 (Address and Zip Code of principal executive offices) (952) 745-2760 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: (Title of each class) Common Stock... -

Page 15

... 7A. Item 8. Page Business Risk Factors Unresolved Staff Comments Properties Legal Proceedings Mine Safety Disclosures 1 7 14 14 15 15 Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and... -

Page 16

..., TCF National Bank ("TCF Bank"), is headquartered in Sioux Falls, South Dakota. TCF Bank operates bank branches in Illinois, Minnesota, Michigan, Colorado, Wisconsin, Arizona, South Dakota and Indiana (TCF's primary banking markets). TCF delivers retail banking products in 44 states and commercial... -

Page 17

... checking accounts, savings accounts, money market accounts and certificates of deposit. Such deposit accounts are a source of low cost funds and provide fee income, including banking fees and service charges. TCF provides an online and mobile banking platform to further enhance the customer banking... -

Page 18

.... Key drivers of bank fees and service charges are the number of deposit accounts and related transaction activity. TCF offers retail checking account customers low-cost, convenient access to funds at local merchants and ATMs through its debit card programs. TCF's debit card programs are supported... -

Page 19

... minimum leverage ratio of 4.0%; placed an emphasis on common equity Tier 1 capital and changed the risk weights assigned to certain instruments. Failure to meet these standards would result in limitations on capital distributions as well as executive bonuses. TCF and TCF Bank exceeded the Basel III... -

Page 20

... rate for 2015 was 60 cents for each $100 of deposits. Financing Corporation assessments of $1.0 million, $1.0 million and $1.1 million were paid by TCF Bank in 2015, 2014 and 2013, respectively. The Dodd-Frank Act also gave the FDIC much greater discretion to manage the Deposit Insurance Fund... -

Page 21

... Guidelines, Codes of Ethics and information on all of TCF's securities are also available on this website. Stockholders may request these documents in print free of charge by contacting the Corporate Secretary at TCF Financial Corporation, 200 Lake Street East, Mail Code EX0-01-G, Wayzata, MN 55391... -

Page 22

...in TCF's credit ratings could adversely affect the ability of TCF Bank and its subsidiaries to lend and its liquidity and competitive position, increase its borrowing costs, limit its access to the capital markets or trigger unfavorable contractual obligations. An inability to meet its funding needs... -

Page 23

...large number of complex transactions. Third party vendors provide key components of TCF's business infrastructure, such as internet connections, network access and transaction and other processing services. While TCF has selected these third party vendors carefully, it does not control their actions... -

Page 24

...the supermarket branches. At December 31, 2015, TCF had 177 supermarket branches. Supermarket banking continues to play an important role in TCF's deposit account strategy. TCF is subject to the risk, among others, that its license or lease for a location or locations will terminate upon the sale or... -

Page 25

... of enforcement actions brought by regulatory agencies, such as the CFPB, dealing with matters such as indirect auto lending, fair lending, account fees, loan servicing and other products and services provided to customers. For example, on October 29, 2015, TCF received a Notice and Opportunity to... -

Page 26

...report and analyze the types of risk to which TCF is subject, including legal and compliance, operational, reputational, strategic and market risk such as interest rate, credit, liquidity and foreign currency risk. However, as with any risk management framework, there are inherent limitations to TCF... -

Page 27

...impact on TCF's business because of their skills, market knowledge, industry experience and the difficulty of promptly finding qualified replacements. On January 1, 2016, several management changes became effective, including Craig R. Dahl assuming the role of Chief Executive Officer, Brian W. Maass... -

Page 28

...purpose reloadable prepaid cards. Consumers can also complete transactions such as paying bills and transferring funds directly without the assistance of banks. The process of eliminating banks as intermediaries could result in the loss of fee income, as well as the loss of customer deposits and the... -

Page 29

... Staff Comments None. Item 2. Properties Offices TCF owns its headquarters office in Wayzata, Minnesota. Other operations facilities, located in Minnesota, Illinois, California and South Dakota, are either owned or leased. These facilities are predominantly utilized by the Lending and Funding... -

Page 30

...regulatory compliance. From time to time, borrowers and other customers, and employees and former employees, have also brought actions against TCF, in some cases claiming substantial damages. TCF and other financial services companies are subject to the risk of class action litigation. Litigation is... -

Page 31

...of Equity Securities TCF's common stock trades on the New York Stock Exchange under the symbol "TCB." The following table sets forth the high and low prices and the dividends declared for TCF's common stock. As of February 22, 2016, there were 5,945 holders of record of TCF's common stock. High 2015... -

Page 32

... as of September 30, 2014, including: New York Community Bancorp, Inc.; First Republic Bank; First Niagara Financial Group, Inc.; Hudson City Bancorp, Inc.; SVB Financial Group; People's United Financial, Inc.; Popular, Inc.; City National Corporation; BOK Financial Corporation; East West Bancorp... -

Page 33

... affected by new legislation or regulations or by changes in regulatory policies. This authorization does not have an expiration date. (2) Represents restricted stock withheld pursuant to the terms of awards granted on or prior to April 22, 2015 under the TCF Financial Incentive Stock Program to... -

Page 34

...) attributable to TCF Financial Corporation Preferred stock dividends Net income (loss) available to common stockholders $ Net income (loss) per common share: Basic Diluted Dividends declared Consolidated Financial Condition: Loans and leases Total assets Deposits Borrowings Total equity Book value... -

Page 35

...Securities Available for Sale and Securities Held to Maturity Loans and Leases Credit Quality Other Real Estate Owned and Repossessed and Returned Assets Liquidity Management Deposits Borrowings Contractual Obligations and Commitments Capital Management Critical Accounting Policies Recent Accounting... -

Page 36

... to TCF Financial Corporation on an unconsolidated basis. Its principal subsidiary, TCF National Bank ("TCF Bank"), is headquartered in Sioux Falls, South Dakota. At December 31, 2015, TCF had 375 branches in Illinois, Minnesota, Michigan, Colorado, Wisconsin, Arizona, South Dakota and Indiana (TCF... -

Page 37

... for 2014 and 2013, respectively. Reportable Segment Results Lending TCF's lending strategy is primarily to originate high credit quality secured loans and leases for investment and for sale. The lending portfolio consists of consumer real estate, commercial real estate and business lending, leasing... -

Page 38

...fees and service charges due to consumer behavior changes, including customers maintaining higher average checking account balances. Funding non-interest expense totaled $436.2 million for 2015, which remained consistent with $435.2 million for 2014, which decreased 1.6% from $442.5 million for 2013... -

Page 39

...Total loans and leases Total interest-earning assets Other assets(4) Total assets Liabilities and Equity: Non-interest bearing deposits: Retail Small business Commercial and custodial Total non-interest bearing deposits Interest-bearing deposits: Checking Savings Money market Certificates of deposit... -

Page 40

...Total loans and leases Total interest-earning assets Other assets(3) Total assets Liabilities and Equity: Non-interest bearing deposits: Retail Small business Commercial and custodial Total non-interest bearing deposits Interest-bearing deposits: Checking Savings Money market Certificates of deposit... -

Page 41

... with 4.61% and 4.68% for 2014 and 2013, respectively. The decrease in 2015 was primarily due to margin compression resulting from the competitive, low interest rate environment and higher rates on certificates of deposit and money market accounts, as well as a change in the asset portfolio mix due... -

Page 42

...million and $118.4 million for 2014 and 2013, respectively. The decrease in 2015 was primarily driven by the TDR loan sale and improved credit quality in the consumer real estate portfolio, partially offset by an increase in provision for credit losses in the auto finance portfolio due to growth and... -

Page 43

...service charges represented 65.6% of banking fee revenue for 2015, compared with 67.7% and 69.1% for 2014 and 2013, respectively. The decreases in both periods were primarily due to consumer behavior changes, including customers maintaining higher average checking account balances. Card Revenue Card... -

Page 44

... million for 2014 and 2013, respectively. The increase in 2015 was primarily due to the increased staff levels to support the growth of auto finance and further build-out of the risk management function, partially offset by non-recurring items, including the annual pension plan valuation adjustment... -

Page 45

... Federal Deposit Insurance Corporation ("FDIC") insurance expense totaled $20.3 million for 2015, compared with $25.1 million and $32.1 million for 2014 and 2013, respectively. The decrease in 2015 was due to a lower assessment rate primarily as a result of the TDR loan sale and improved credit... -

Page 46

... are presented on a fully tax-equivalent basis. At December 31, 2015 Taxequivalent Yield 2014 Taxequivalent Yield (Dollars in thousands) Amortized Cost Fair Value Amortized Cost Fair Value Securities available for sale: Mortgage-backed securities: Due in one year or less Due in 1-5 years Due... -

Page 47

...Minnesota Illinois California Michigan Wisconsin Texas Colorado Florida Canada New York Pennsylvania Ohio Georgia New Jersey Arizona North Carolina Washington Massachusetts Virginia Indiana Tennessee Other Total Loans... management's interest-rate risk analysis. Company experience indicates that loans... -

Page 48

..., of TCF's consumer real estate loans were in TCF's primary banking markets. The average Fair Isaac Corporation ("FICO®") credit score at loan origination for the consumer real estate lending portfolio was 734 at both December 31, 2015 and 2014. As part of TCF's credit risk monitoring, TCF obtains... -

Page 49

...Multi-family housing Warehouse/industrial buildings Office buildings Health care facilities Retail services(1) Self-storage Hotels and motels Other Total (1) Primarily retail strip shopping centers and malls, convenience stores, supermarkets, restaurants and automobile related businesses. Leasing... -

Page 50

... dealers at December 31, 2014. The auto finance portfolio consisted of 24.4% new car loans and 75.6% used car loans at December 31, 2015, compared with 25.4% and 74.6%, respectively, at December 31, 2014. The average original FICO score for the held for investment auto finance portfolio was 725 and... -

Page 51

... 22,348 88 22,436 2014 Percentage of Portfolio 0.49% 0.08 0.30 - 0.07 - 0.22 - 0.14 0.03 0.14 (Dollars in thousands) Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial Leasing and equipment finance Inventory finance Auto finance Other Subtotal Delinquencies... -

Page 52

...TDR loans Accruing TDR loans at December 31, 2015 decreased $58.6 million, or 30.2%, from December 31, 2014, primarily due to the improved credit quality and continued strong customer payment performance in the commercial portfolio. TCF modifies loans through reductions in interest rates, extension... -

Page 53

..., 2015 decreased $16.3 million, or 7.5%, from December 31, 2014, primarily due to improved credit quality trends and continued efforts to actively work out problem loans in the commercial portfolio. See Note 1, Summary of Significant Accounting Policies of Notes to Consolidated Financial Statements... -

Page 54

... 150 days past due. Delinquent consumer real estate junior lien loans are also placed on non-accrual status when there is evidence that the related third-party first lien mortgage may be 90 days or more past due, or foreclosure, charge-off or collection action has been initiated. Commercial loans... -

Page 55

Loan Credit Classifications TCF assesses the risk of its loan and lease portfolio utilizing numerous risk characteristics as outlined in the previous sections. The loan credit classifications represent an additional characteristic that is closely monitored in the overall credit risk process. The ... -

Page 56

...,128 Consumer real estate: First mortgage lien Junior lien Consumer real estate Commercial: Commercial real estate Commercial business Total commercial Leasing and equipment finance Inventory finance Auto finance Other Total allowance for loan and lease losses Other credit loss reserves: Reserves... -

Page 57

..., (Dollars in thousands) 2015 $ 164,169 $ 2014 252,230 $ 2013 267,128 $ 2012 255,672 $ 2011 265,819 Balance, beginning of period Charge-offs: Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate Commercial business Total commercial... -

Page 58

... offset by sales of 578 properties. The average length of time of consumer real estate properties sold during 2015 and 2014 was approximately 5.7 months and 5.4 months, respectively, from the date the properties were listed for sale. Consumer real estate loans in process of foreclosure were $44... -

Page 59

... access to overnight federal funds purchased lines, brokered deposits and capital markets. The primary source of funding for TCF Commercial Finance Canada, Inc. ("TCFCFC") is a line of credit with TCF Bank. TCFCFC also maintains a $20.0 million Canadian dollar-denominated line of credit facility... -

Page 60

... three campuses. TCF is obligated to make annual payments for the exclusive marketing rights at these three campuses through 2029. TCF also has various renewal options, which may extend the terms of these agreements. Commitments to extend credit are agreements to lend to a customer provided there is... -

Page 61

... management tools to achieve its capital goals, including, but not limited to, dividends, public offerings of preferred and common stock, common stock repurchases and the issuance or redemption of subordinated debt and other capital instruments. TCF maintains a Capital Planning and Dividend Policy... -

Page 62

.... At December 31, (Dollars in thousands) 2015 2014 2013 2012 2011 Computation of tangible common equity to tangible assets: Total equity Less: Non-controlling interest in subsidiaries Total TCF Financial Corporation stockholders' equity Less: Preferred stock Goodwill Other intangibles... -

Page 63

... No. 2015-04, Compensation-Retirement Benefits (Topic 715): Practical Expedient for the Measurement Date of an Employer's Defined Benefit Obligation and Plan Assets, which allows employers with fiscal year ends that do not coincide with a calendar month end to make an accounting policy election to... -

Page 64

...and securities available for sale portfolios, including declines in commercial or residential real estate values, changes in the allowance for loan and lease losses dictated by new market conditions or regulatory requirements, or the inability of home equity line borrowers to make increased payments... -

Page 65

... Risks. Results of litigation or government enforcement actions, including class action litigation or enforcement actions concerning TCF's lending or deposit activities, including account opening/origination, servicing practices, fees or charges, employment practices, or checking account overdraft... -

Page 66

... to manage interest rate risk. Although TCF manages other risks in the normal course of business, such as credit risk, liquidity risk, foreign currency risk and operational risk, the Company considers interest rate risk to be one of its more significant market risks. Interest Rate Risk TCF's ALCO... -

Page 67

... a Risk Appetite Statement to manage the Company's credit risk by setting (i) a desired balance between asset classes, (ii) concentration limits based on loan type, business line and geographic region and (iii) maximum tolerances for credit performance. To manage credit risk arising from lending and... -

Page 68

... access to overnight federal funds purchased lines, brokered deposits and capital markets. TCF has developed and maintains a contingency funding plan should certain liquidity needs arise. Foreign Currency Risk The Company is also exposed to foreign currency risk as changes in foreign exchange rates... -

Page 69

... with the standards of the Public Company Accounting Oversight Board (United States), TCF Financial Corporation's internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring... -

Page 70

...$ 2014 1,115,250 85,492 214,454 463,294 132,266 Assets: Cash and due from banks Investments Securities held to maturity Securities available for sale Loans and leases held for sale Loans and leases: Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial Leasing... -

Page 71

... for credit losses Non-interest income: Fees and service charges Card revenue ATM revenue Subtotal Gains on sales of auto loans, net Gains on sales of consumer real estate loans, net Servicing fee income Subtotal Leasing and equipment finance Other Fees and other revenue Gains (losses) on securities... -

Page 72

... of Comprehensive Income Year Ended December 31, (In thousands) 2015 $ 197,123 $ 2014 174,187 $ 2013 151,668 Net income attributable to TCF Financial Corporation Other comprehensive income (loss): Securities available for sale: Unrealized gains (losses) arising during the period Reclassification... -

Page 73

... compensation plans, at cost Balance, December 31, 2014 Net income Other comprehensive income (loss) Net investment by (distribution to) non-controlling interest Dividends on preferred stock Dividends on common stock Grants of restricted stock Common shares purchased by TCF employee benefit plans... -

Page 74

... sales of loans Proceeds from sales of lease receivables Proceeds from sales of securities Purchases of securities Proceeds from maturities of and principal collected on securities Purchases of Federal Home Loan Bank stock Redemption of Federal Home Loan Bank stock Proceeds from sales of real estate... -

Page 75

...based in Wayzata, Minnesota. References herein to "TCF Financial" or the "Holding Company" refer to TCF Financial Corporation on an unconsolidated basis. Its principal subsidiary, TCF National Bank ("TCF Bank"), is headquartered in Sioux Falls, South Dakota. All significant intercompany accounts and... -

Page 76

... TCF provides various types of commercial lease financing that are classified for accounting purposes as direct financing, sales-type or operating leases. Leases that transfer substantially all of the benefits and risks of ownership to the lessee are classified as direct financing or sales-type... -

Page 77

... from closing of the statute of limitations on tax returns, new legislation, clarification of existing legislation through government pronouncements, judicial action and through the examination process. TCF's policy is to report interest and penalties, if any, related to unrecognized tax benefits in... -

Page 78

... consumer real estate lines of credit are amortized to service fee income. Non-accrual Loans and Leases Loans and leases are generally placed on non-accrual status when the collection of interest and principal is 90 days or more past due unless, in the case of commercial loans, they are well secured... -

Page 79

... to the guarantees, the investments are supported by the performance of the underlying real estate properties which also mitigates the risk of loss. Tax credits and other tax benefits of $3.9 million, $3.5 million and $5.1 million in 2015, 2014 and 2013, respectively, are recorded in income tax... -

Page 80

... related to the sale and servicing of auto loans. Cash payments received on loans serviced for third parties are generally held in separate accounts until remitted. TCF also retains cash balances for collateral on certain borrowings, forward foreign exchange contracts, interest rate contracts and... -

Page 81

..., were pledged as collateral to secure certain deposits and borrowings. There were no impairment charges recognized on securities available for sale in 2015, 2014, or 2013. Unrealized losses on securities available for sale are due to changes in interest rates. TCF has the ability and intent to... -

Page 82

... amortized over the remaining lives of the transferred securities. Other held to maturity securities consist of bonds which qualify for investment credit under the Community Reinvestment Act. In 2015, 2014, and 2013, TCF recorded an impairment charge of $0.3 million, $0.1 million, and $0.2 million... -

Page 83

...,272 $ 2014 3,139,152 2,543,212 5,682,364 Percent Change (16.4)% 11.6 (3.8) Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate: Permanent Construction and development Total commercial real estate Commercial business Total commercial... -

Page 84

... transactions in 2013. Total interest-only strips and the contractual liabilities related to loan sales are shown below. At December 31, (In thousands) 2015 $ 19,182 $ 25,150 $ 702 $ 185 2014 21,198 48,591 563 699 Interest-only strips attributable to: Consumer real estate loan sales Consumer auto... -

Page 85

... agreements with the automobile dealerships that originated the loans requiring the dealers to repurchase such contracts from TCF. Future minimum lease payments receivable for direct financing, sales-type leases and operating leases as of December 31, 2015 are as follows: (In thousands) 2016... -

Page 86

... allowance for loan and lease losses and balances by type of allowance methodology. At December 31, 2015 Consumer Real Estate $ $ 38,819 29,173 67,992 $ Leasing and Equipment Finance $ $ $ 16,994 2,024 19,018 3,997,544 14,669 35 $ 4,012,248 $ $ Inventory Finance 10,929 199 11,128 $ $ Auto Finance 23... -

Page 87

...real estate: First mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate Commercial business Total commercial Leasing and equipment finance Inventory finance Auto finance Other Subtotal Portfolios acquired with deteriorated credit quality Total At December 31, 2014... -

Page 88

... of loan balances. If, for economic or legal reasons related to the customer's financial difficulties, TCF grants a concession, the modified loan is classified as a TDR loan. TDR loans consist primarily of consumer real estate and commercial loans. Total TDR loans at December 31, 2015 and 2014 were... -

Page 89

... been transferred to other real estate owned or repossessed and returned assets. Year Ended December 31, (Dollars in thousands) 2015 2014 Loan balance:(1) Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate Commercial business Total... -

Page 90

... Unpaid Contractual Balance 2014 Loan Balance Related Allowance Recorded (In thousands) Impaired loans with an allowance recorded: Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate Commercial business Total commercial Leasing and... -

Page 91

... Average Loan Balance Interest Income Recognized Average Loan Balance 2014 Interest Income Recognized (In thousands) Impaired loans with an allowance recorded: Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate Commercial business... -

Page 92

... for 2016, $0.5 million for 2017, $0.4 million for 2018, $0.3 million for 2019 and $0.3 million for 2020. There was no impairment of goodwill or the intangible assets in 2015, 2014 and 2013. Note 9. Deposits Deposits consisted of the following. At December 31, 2015 WeightedAverage Rate -% $ 0.02... -

Page 93

... Average daily balances for the period ended: Federal Home Loan Bank advances Federal funds purchased Securities sold under repurchase agreements Line of Credit - TCF Commercial Finance Canada, Inc. Total Maximum month-end balances for the period ended: Federal Home Loan Bank advances Securities... -

Page 94

... secured by residential and commercial real estate and FHLB stock with an aggregate carrying value of $4.6 billion as collateral for FHLB advances. At December 31, 2015, $125.0 million of FHLB advances outstanding were prepayable monthly at TCF's option. On February 27, 2015, TCF Bank issued $150... -

Page 95

.... While management currently intends to indefinitely reinvest all of TCF's foreign earnings, should circumstances or tax laws change, TCF may need to record additional income tax expense in the period in which such determination or tax law change occurs. As of December 31, 2015 and 2014, TCF has not... -

Page 96

... Stock compensation and deferred compensation plans Net operating losses and tax credit carryforwards Valuation allowance Securities available for sale Accrued expense Non-accrual interest Other Total deferred tax assets Deferred tax liabilities: Lease financing Premises and equipment Loan fees... -

Page 97

...Plans Executive, Senior Officer, Winthrop and Directors Deferred Compensation Plans TCF has maintained the deferred compensation plans listed, which previously allowed eligible employees and non-employee directors to defer a portion of certain payments, and, in some cases, grants of restricted stock... -

Page 98

... $1.5 million and $0.8 million in 2015, 2014 and 2013, respectively. The Company made no other contributions to this plan, other than payment of administrative expenses. The amounts deferred under this plan are invested in TCF common stock or mutual funds. At December 31, 2015, the fair value of the... -

Page 99

... 1, 2015 and are applicable to TCF Bank. Note 15. Stock Compensation The TCF Financial 2015 Omnibus Incentive Plan ("Omnibus Incentive Plan") and the TCF Financial Incentive Stock Program ("Incentive Stock Program") were adopted to enable TCF to attract and retain key personnel. In April 2015, TCF... -

Page 100

... term (years) Risk-free interest rate 6.25 2.58 % 28.5 % 28.5 % 3.5 % 6.75 2.91 % The following table reflects TCF's restricted stock and stock option transactions under the Incentive Stock Program and Omnibus Incentive Plan since December 31, 2012. Restricted Stock WeightedAverage Grant Date Fair... -

Page 101

... compensation limitation imposed by the IRS. Matching contributions made after January 1, 2016 will vest immediately. Employees have the opportunity to diversify and invest their account balance, including matching contributions, in various mutual funds or TCF common stock. At December 31, 2015... -

Page 102

... benefit obligation for the Pension Plan was $36.0 million and $39.5 million at December 31, 2015 and 2014, respectively. TCF's Pension Plan investment policy states that assets may be invested in direct fixed income securities to include cash, money market mutual funds, U.S. Treasury securities... -

Page 103

...benefit plan costs were as follows. Pension Plan Year Ended December 31, Assumptions used to determine estimated net benefit plan cost Discount rate Expected long-term rate of return on plan assets N.A. Not Applicable. Postretirement Plan Year Ended December 31, 2015 3.25% N.A. 2014 4.00% N.A. 2013... -

Page 104

... 31, 2015 and are expected to be recognized as components of net periodic benefit cost during 2016. The actuarial assumptions used in the Pension Plan valuation are reviewed annually. The expected long-term rate of return on plan assets is determined by reference to historical market returns and... -

Page 105

... instrument, for commitments to extend credit and standby letters of credit is represented by the contractual amount of the commitments. TCF uses the same credit policies in making these commitments as it does for making direct loans. TCF evaluates each customer's creditworthiness on a case-by-case... -

Page 106

... settled within 35 days. Changes in the fair value of these forward foreign exchange contracts are reflected in non-interest expense. TCF executes interest rate swap agreements with commercial banking customers to facilitate their respective risk management strategies. Those interest rate swaps are... -

Page 107

... quarter of 2012, TCF sold its Visa® Class B stock. In conjunction with the sale, TCF and the purchaser entered into a derivative transaction whereby TCF may receive or be required to make cash payments whenever the conversion ratio of the Visa Class B stock into Visa Class A stock is adjusted. The... -

Page 108

... to transfer a liability in an orderly transaction between market participants at the measurement date. Securities available for sale, certain loans and leases held for sale, forward foreign exchange contracts, interest rate contracts, interest rate lock commitments, forward loan sales commitments... -

Page 109

... real estate and auto finance loans. The fair value of the collateral is determined based on internal estimates and assessments provided by third-party appraisers. Forward Foreign Exchange Contracts TCF's forward foreign exchange contracts are currency contracts executed in over-the-counter markets... -

Page 110

... rate swap agreements with commercial banking customers to facilitate the customer's risk management strategy. These interest rate swaps are simultaneously hedged by offsetting interest rate swaps TCF executes with a third party, minimizing TCF's net risk exposure resulting from such transactions... -

Page 111

... Value Measurements: Securities available for sale: Mortgage-backed securities: U.S. Government sponsored enterprises and federal agencies Other Obligations of states and political subdivisions Loans and leases held for sale Forward foreign exchange contracts(1) Interest rate contracts(1) Interest... -

Page 112

...31, 2014 (In thousands) Level 1 Level 2 Level 3 Total Recurring Fair Value Measurements: Securities available for sale: Mortgage-backed securities: U.S. Government sponsored enterprises and federal agencies Other Loans and leases held for sale Forward foreign exchange contracts(1) Interest rate... -

Page 113

... Asset (liability) balance, December 31, 2015 Fair Value Option In the third quarter of 2014, TCF initiated a correspondent lending program in which TCF Bank originates first mortgage lien loans in its primary banking markets and sells the loans through a correspondent relationship. TCF elected the... -

Page 114

... of TCF's branches and core deposits, leasing operations, goodwill, premises and equipment and the future revenues from TCF's customers are not reflected in this disclosure. Therefore, this information is of limited use in assessing the value of TCF. Estimated Fair Value at December 31, 2015 Level... -

Page 115

... $ 25,885 (47) 25,838 Financial instrument assets: Investments Securities held to maturity Loans and leases held for sale Loans: Consumer real estate Commercial real estate Commercial business Equipment finance Inventory finance Auto finance Other Allowance for loan losses(1) Interest-only strips... -

Page 116

... participating securities. Year Ended December 31, (Dollars in thousands, except per-share data) 2015 $ $ 177,735 45 177,690 165,696,678 $ 1.07 $ $ $ 2014 154,799 40 154,759 163,581,435 0.95 $ $ $ 2013 132,603 71 132,532 161,016,004 0.82 Basic Earnings Per Common Share: Net income available to... -

Page 117

... as reportable segments. Lending includes consumer real estate, commercial real estate and business lending, leasing and equipment finance, inventory finance and auto finance. Funding includes retail banking and treasury services. Support Services includes Holding Company and corporate functions... -

Page 118

... income tax expense (benefit) Income attributable to non-controlling interest Preferred stock dividends Net income (loss) available to common stockholders Total assets Revenues from external customers: Interest income Non-interest income Total At or For the Year Ended December 31, 2014: Net interest... -

Page 119

...interest income: Dividends from TCF Bank Affiliate service fees Other Total non-interest income Non-interest expense: Compensation and employee benefits Occupancy and equipment Other Total non-interest expense Income (loss) before income tax benefit and equity in undistributed earnings of subsidiary... -

Page 120

...and deposit operations, including foreclosure proceedings and other collection actions as part of its lending and leasing collections activities. TCF may also be subject to regulatory examinations and enforcement actions brought by federal regulators, including the Securities and Exchange Commission... -

Page 121

... and Regulation E, §1005.17, in connection with TCF's practices in administering checking account overdraft program "optin" requirements. The purpose of a NORA Letter is to ensure that potential subjects of enforcement actions have the opportunity to present their positions to the CFPB before an... -

Page 122

... of Income. See Note 16, Employee Benefit Plans, for additional information regarding TCF's recognized postretirement prior service cost. Accumulated other comprehensive income (loss) balances are presented in the table below. Securities Available for Sale $ (8,891) $ (1,568) 752 (816) $ $ (9,707... -

Page 123

... data presented below should be read in conjunction with the Consolidated Financial Statements and related notes. SELECTED QUARTERLY FINANCIAL DATA (Unaudited) Three Months Ended (In thousands, except per-share data) Dec. 31, 2015 17,607 188,062 115,659 222,587 81,134 26,614 54,520 2,028 4,847... -

Page 124

... of ensuring that such information is accumulated and communicated to the Company's management, including the Chief Executive Officer (Principal Executive Officer), Chief Financial Officer (Principal Financial Officer) and Chief Accounting Officer (Principal Accounting Officer), as appropriate, to... -

Page 125

...May 2013. Based on this assessment, management concluded that TCF's internal control over financial reporting was effective as of December 31, 2015. KPMG LLP, the Company's independent registered public accounting firm that audited the consolidated financial statements included in this annual report... -

Page 126

... Public Accounting Firm The Board of Directors and Stockholders TCF Financial Corporation: We have audited TCF Financial Corporation's (the Company) internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013... -

Page 127

... "Learn More" under the heading "Corporate Governance" and then either "Code of Ethics Policy" or "Code of Ethics for Senior Financial Management," respectively. Any changes to the Code of Ethics or the Senior Financial Management Code of Ethics will be posted on this site and any waivers granted to... -

Page 128

...Matters Information regarding ownership of TCF's common stock by TCF's directors, executive officers and certain other stockholders and shares authorized under plans is set forth in the following sections of TCF's 2016 Proxy and is incorporated herein by reference: Equity Compensation Plans Approved... -

Page 129

... Financial Statements Other Financial Data Management's Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm 2. Financial Statement Schedules All schedules to the Consolidated Financial Statements normally required by the applicable accounting... -

Page 130

... Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. TCF FINANCIAL CORPORATION /s/ Craig R. Dahl Craig R. Dahl, Vice Chairman, President and Chief Executive Officer (Principal Executive Officer) Dated... -

Page 131

..., 2016 Director, Vice Chairman, President and Chief Executive Officer (Principal Executive Officer) February 29, 2016 Executive Vice President and Chief Financial Officer (Principal Financial Officer) February 29, 2016 Senior Vice President and Chief Accounting Officer (Principal Accounting Officer... -

Page 132

...2013 (No. 13797581)] Form of 2015 Management Incentive Plan - Executive, as executed by certain executives [incorporated by reference to Exhibit 10(c)-1 of TCF Financial Corporation Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (No. 15639563)] Amended and Restated Employment... -

Page 133

..., 2005 (No. 05552640)] Trust Agreement for TCF Financial Senior Officer Deferred Compensation Plan as executed with First National Bank in Sioux Falls as trustee effective as of October 1, 2000 [incorporated by reference to Exhibit 10(m) of TCF Financial Corporation's Annual Report on Form 10-K for... -

Page 134

...Annual Report on Form 10-K of the Company for the year ended December 31, 2015, formatted in XBRL: (i) the Consolidated Statements of Financial Condition, (ii) the Consolidated Statements of Income, (iii) the Consolidated Statements of Comprehensive Income, (iv) the Consolidated Statements of Equity... -

Page 135

CORPORATE INFORMATION -

Page 136

...2015) EXECUTIVE OFFICES TCF Financial Corporation 200 Lake Street East Wayzata, MN 55391-1693 (952) 745-2760 ILLINOIS/WISCONSIN/INDIANA Regional Office 800 Burr Ridge Parkway Burr Ridge, IL 60527 Traditional Branches Chicagoland (37) Milwaukee Area (11) Kenosha/Racine Area (6) Supermarket Branches... -

Page 137

... The Annual Meeting of Stockholders of TCF will be held on Wednesday, April 27, 2016, 4:00 p.m. (local time) at the Marriott Minneapolis West, 9960 Wayzata Boulevard, St. Louis Park, Minnesota. MEDIA CONTACT Mark Goldman Senior Vice President Corporate Communications (952) 475-7050 TRANSFER AGENT... -

Page 138

... 31, (Dollars in thousands) 2015 2014 Standard & Poor's Outlook TCF Financial Corporation: Long-term Counterparty Short-term Counterparty TCF National Bank: Long-term Counterparty Short-term Counterparty Preferred Stock Subordinated Debt Fitch Ratings Outlook TCF Financial Corporation: Long-term... -

Page 139

...Close High Low Year Close High Low 2015 Fourth Quarter Third Quarter Second Quarter First Quarter 2014 Fourth Quarter Third Quarter Second Quarter First Quarter 2013...-15 *Stock split adjusted For more historical information on TCF's stock price and dividend, visit http://ir.tcfbank.com. A-5 -

Page 140

... President, Chief Financial Officer Brian W. Maass Executive Vice President, Consumer Banking Michael S. Jones Executive Vice President, Wholesale Banking William S. Henak Chief Credit Officer Mark A. Bagley Executive Vice President, Chief Information Officer Thomas J. Butterfield Chief Risk Officer... -

Page 141

... A. Powers Information Technology Chief Information Officer Thomas J. Butterfield Executive Vice Presidents Brett Brunick Christopher Chapman Martin F. Crowley Gregg R. Goudy Richard J. Nelson Enterprise Risk Management Chief Risk Officer James M. Costa Executive Vice Presidents Douglass B. Hiatt... -

Page 142

... President and Chief Executive Officer, Key Investment, Inc. Director since 2009 1 James M. Ramstad 3,6,7 Former U.S. Congressman Director since 2011 Advisory Committee - TCF Employees Stock Purchase Plan Audit Committee BSA and Compliance Committee Compensation, Nominating and Corporate... -

Page 143

...core deposits and lends under the fundamental concept of diversification that enables us to consistently achieve superior returns for our employees, customers and shareholders. OUR VALUES Lead with integrity Be nimble Build relationships Be prudent Create opportunities Win as a passionate team A-9 -

Page 144

TCF Financial Corporation 200 Lake Street East Wayzata, MN 55391-1693 tcfbank.com TCFIR9362 E Printed on recycled paper. Please recycle.