Foot Locker 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

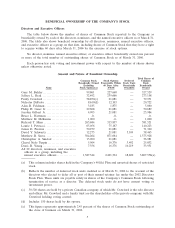

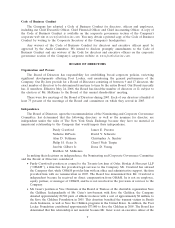

Persons Owning More Than Five Percent of the Company’s Stock

The following table provides information on shareholders who beneficially own more than five

percent of the Company’s Common Stock according to reports filed by those shareholders with the

Securities and Exchange Commission (“SEC’’). To the best of our knowledge, there are no other

shareholders who beneficially own more than five percent of a class of the Company’s voting securities.

Amount and

Name and Address Nature of Percent

of Beneficial Owner Beneficial Ownership of Class

Lord, Abbett & Co. LLC ..................................... 14,601,053(a) 9.36%(a)

90 Hudson Street

Jersey City, NJ 07302

Merrill Lynch & Co., Inc...................................... 9,546,476(b) 6.12%(b)

World Financial Center

North Tower

250 Vesey Street

New York, NY 10381

(a) Reflects shares beneficially owned as of December 30, 2005, according to Amendment No. 3 to

Schedule 13G filed with the SEC. As reported in this schedule, Lord, Abbett & Co. LLC, an

investment adviser, holds sole voting and dispositive power with respect to the 14,601,053 shares.

(b) Reflects shares beneficially owned as of December 31, 2005 by Merrill Lynch & Co., Inc. (on

behalf of Merrill Lynch Investment Managers (“MLIM’’)) according to Amendment No. 2 to

Schedule 13G filed with the SEC. Merrill Lynch & Co., Inc. (on behalf of MLIM), an investment

adviser, reported shared voting and dispositive power with respect to 9,546,476 shares.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company’s directors and

executive officers file with the SEC and The New York Stock Exchange reports of ownership and

changes in ownership of Common Stock and other equity securities of the Company. These persons are

required by SEC rules to furnish us with copies of all Section 16(a) forms they file. Based solely on a

review of the copies of those reports furnished to the Company or written representations that no other

reports were required, we believe that during the 2005 fiscal year, the directors and executive officers

complied with all applicable SEC filing requirements.

CORPORATE GOVERNANCE INFORMATION

Corporate Governance Guidelines

The Board of Directors has adopted Corporate Governance Guidelines. The Board expects

periodically to review and may, if appropriate, revise the guidelines. The Corporate Governance

Guidelines are available on the corporate governance section of the Company’s corporate web site at

www.footlocker-inc.com. You may also obtain a printed copy of the guidelines by writing to the

Corporate Secretary at the Company’s headquarters.

Stock Ownership Guidelines

The Board of Directors has adopted Stock Ownership Guidelines. These guidelines cover the

Board of Directors, the Chief Executive Officer, and Other Principal Officers, as follows:

• Board of Directors. Each non-employee director is required to beneficially own shares of our

Common Stock having a value of at least three times the annual retainer fee paid to the non-

employee directors.

6