Foot Locker 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

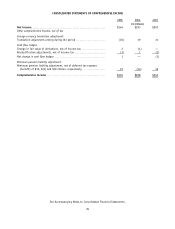

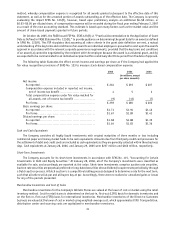

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

2005 2004 2003

Shares Amount Shares Amount Shares Amount

(shares in thousands, amounts in millions)

Common Stock and Paid-In Capital

Par value $0.01 per share,

500 million shares authorized

Issued at beginning of year.......................... 156,155 $ 608 144,009 $ 411 141,180 $ 378

Restricted stock issued under stock option

and award plans .................................. 225 — 400 — 845 —

Forfeitures of restricted stock ........................ —2—2—1

Amortization of stock issued under

restricted stock option plans ...................... —6—8—4

Conversion of convertible debt ....................... — — 9,490 150 — —

Reclassification of convertible debt issuance costs ..... — — — (3) — —

Issued under director and employee stock plans,

net of tax........................................ 900 19 2,256 40 1,984 28

Issued at end of year................................ 157,280 635 156,155 608 144,009 411

Common stock in treasury at beginning of year ........ (64) (2) (57) (1) (105) (1)

Reissued under employee stock plans ................. 90 2 260 5 152 1

Restricted stock issued under stock option

and award plans .................................. — — — — — —

Forfeitures/cancellations of restricted stock ........... (135) (2) (100) (2) (80) (1)

Shares of common stock used to satisfy tax

withholding obligations ........................... (49) (1) (137) (3) — —

Stock repurchases................................... (1,590) (35) — — — —

Exchange of options ................................ (28) — (30) (1) (24) —

Common stock in treasury at end of year .............. (1,776) (38) (64) (2) (57) (1)

155,504 597 156,091 606 143,952 410

Retained Earnings

Balance at beginning of year ........................ 1,386 1,132 946

Net income......................................... 264 293 207

Cash dividends declared on common stock

$0.32, $0.26 and $0.15 per share, respectively ...... (49) (39) (21)

Balance at end of year .............................. 1,601 1,386 1,132

Accumulated Other Comprehensive Loss

Foreign Currency Translation Adjustment ...............

Balance at beginning of year ........................ 35 16 (15)

Translation adjustment arising during the period ...... (25) 19 31

Balance at end of year .............................. 10 35 16

Cash Flow Hedges

Balance at beginning of year ........................ (1) (1) —

Change during year, net of tax ....................... 1 — (1)

Balance at end of year .............................. — (1) (1)

Minimum Pension Liability Adjustment

Balance at beginning of year ........................ (196) (182) (198)

Change during year, net of tax ....................... 15 (14) 16

Balance at end of year .............................. (181) (196) (182)

Total Accumulated Other Comprehensive Loss ...... (171) (162) (167)

Total Shareholders’ Equity ......................... $2,027 $1,830 $1,375

See Accompanying Notes to Consolidated Financial Statements.

27