Foot Locker 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

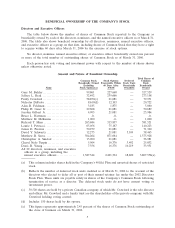

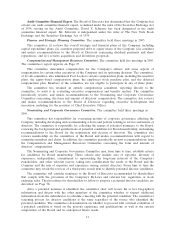

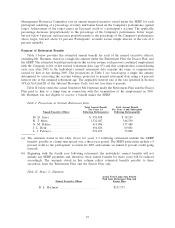

2005 Compensation of Non-Employee Directors

Annual Annual Lead

Retainer/Committee Retainer/Committee Director

Chair Retainer Chair Retainer Fee Paid in Meeting

Director Paid in Cash $ Paid in Stock Cash $ Fees $ Total

J. C. Bacot* .................... 21,875 21,875 25,000 7,500 76,250

P. Crawford ..................... 45,000 45,000 — 28,500 118,500

N. DiPaolo ..................... 40,000 40,000 — 39,000 119,000

A. Feldman ..................... — 73,333 — 10,500 83,833

P. Geier Jr. ..................... 40,000 40,000 — 15,000 95,000

J. Gilbert Jr .................... 45,938 45,938 — 31,500 123,376

J. Preston ....................... 43,750 43,750 — 18,000 105,500

D. Schwartz .................... 40,000 40,000** — 30,000 110,000

C. Sinclair ...................... 43,750 43,750 — 19,500 107,000

C. Turpin ....................... 20,000 60,000** — 12,000 92,000

D. Young ....................... — 80,000** — 25,500 105,500

* Served as a director until his death on April 7, 2005.

** Payment deferred under the Foot Locker 2002 Directors Stock Plan.

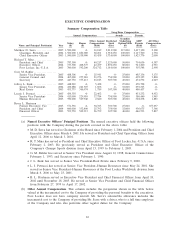

2005 Stock Option Grants to Non-Employee Directors

Annual Stock

Option Grant Fair Market Value

Director (# of Shares) Date of Grant on Date of Grant $

J. C. Bacot*.......................................... 1,878 01/31/05 26.61

P. Crawford ........................................... 1,878 01/31/05 26.61

N. DiPaolo ........................................... 1,878 01/31/05 26.61

A. Feldman .......................................... 1,875 02/16/05 26.66

P. Geier Jr. ........................................... 1,878 01/31/05 26.61

J. Gilbert Jr .......................................... 1,878 01/31/05 26.61

J. Preston ............................................ 1,878 01/31/05 26.61

D. Schwartz .......................................... 1,878 01/31/05 26.61

C. Sinclair ............................................ 1,878 01/31/05 26.61

C. Turpin ............................................. 1,878 01/31/05 26.61

D. Young ............................................. 1,878 01/31/05 26.61

* Option automatically cancelled as a result of Mr. Bacot’s death on April 7, 2005.

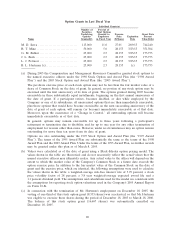

Directors’ Retirement Plan

The Directors’ Retirement Plan was frozen as of December 31, 1995. Consequently, only Jarobin

Gilbert Jr. and James E. Preston, who had each completed at least five years of service as a director on

the date the plan was frozen, are entitled to receive a benefit under this plan when their service as

directors ends. Messrs. Gilbert and Preston will receive an annual retirement benefit of $24,000 for a

period of 10 years after they leave the Board or until their death, if sooner.

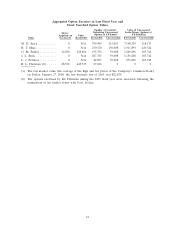

Directors and Officers Indemnification and Insurance

We have purchased directors and officers liability and corporation reimbursement insurance from a

group of insurers comprising ACE American Insurance Co., St. Paul Mercury Insurance, RLI Insurance

Co., Starr Excess, American Casualty Company of Reading, PA (CNA), Allied World Assurance

Company, Ltd., and XL Bermuda. These policies insure the Company and all of the Company’s wholly

owned subsidiaries. They also insure all of the directors and officers of the Company and the covered

subsidiaries. The policies were written for a term of 12 months, from September 12, 2005 until

14