Foot Locker 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

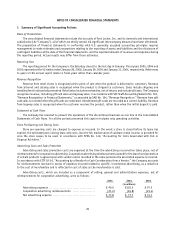

5 Hurricanes

Hurricanes Katrina, Rita and Wilma adversely affected the Company’s third quarter and fourth quarter operations and

resulted in the closure of approximately 400 of the Company’s retail stores for varying periods of time. As of January 28,

2006, 25 of these stores remain closed. The Company expects to re-open up to 7 of the remaining stores in the early part

of 2006 and continues to examine additional potential re-openings with the respective landlords and government agencies.

The hurricanes caused approximately $15 million in property and inventory losses and other costs. The Company

recorded a loss of $3 million in the third quarter of 2005 as a component of selling, general and administrative expenses

in the Consolidated Statements of Operations which included probable insurance recoveries of $12 million. The Company

received $5 million from its insurance carriers in the third quarter of 2005.

In the fourth quarter of 2005, the Company received an additional $10 million from its insurance carriers. As a result

the Company recorded a gain of $3 million in the fourth quarter of 2005, which was recorded as a component of other

income in the Consolidated Statements of Operations. Additionally, the Company revised its original estimates of

inventory losses considering proceeds received from liquidators, resulting in a reversal of $3 million recorded in selling,

general and administrative expenses.

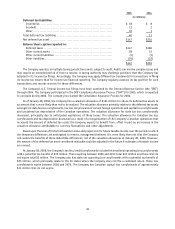

6 Short-Term Investments

The Company’s auction rate security investments are accounted for as available-for-sale securities. The fair value

of all investments approximate their carrying cost as the investments are generally not held for more than 49 days and

they are traded at par value. The following represents the composition of the Company’s auction rate securities by

underlying investment.

2005 2004

(in millions)

Tax exempt municipal bonds .............................................. $ 41 $ 50

Taxable bonds ............................................................. — 40

Equity securities .......................................................... 257 177

$298 $267

Contractual maturities of the bonds outstanding at January 28, 2006 range from 2018 to 2042.

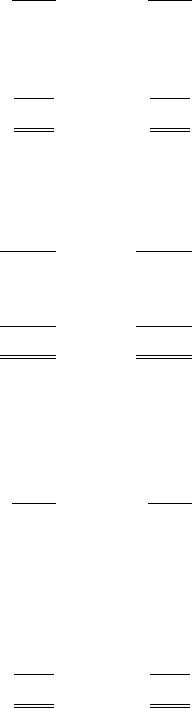

7 Merchandise Inventories

2005 2004

(in millions)

LIFO inventories .......................................................... $ 939 $ 856

FIFO inventories ........................................................... 315 295

Total merchandise inventories ............................................. $1,254 $1,151

The value of the Company’s LIFO inventories, as calculated on a LIFO basis, approximates their value as calculated

on a FIFO basis.

8 Other Current Assets

2005 2004

(in millions)

Net receivables ............................................................ $ 49 $ 47

Prepaid expenses and other current assets ................................ 46 47

Prepaid income taxes ..................................................... 49 40

Deferred taxes ............................................................. 28 53

Current portion of Northern Group note receivable ........................ 1 1

Assets of discontinued operations ......................................... — 1

$173 $189

37