Foot Locker 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

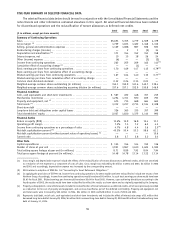

The change in the additional minimum liability was a decrease of $15 million after-tax in 2005 and an increase of

$14 million after-tax in 2004 to accumulated other comprehensive loss.

As of January 28, 2006 and January 29, 2005, the accumulated benefit obligation for all pension plans, totaling $688

million and $702 million, respectively, exceeded plan assets.

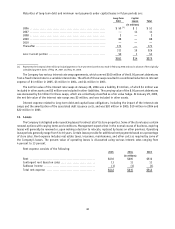

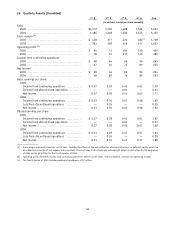

The following weighted-average assumptions were used to determine the benefit obligations under the plans:

Pension Benefits Postretirement Benefits

2005 2004 2005 2004

Discount rate .................................................... 5.43% 5.50% 5.50% 5.50%

Rate of compensation increase .................................. 3.77% 3.79%

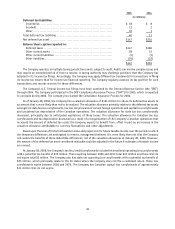

The components of net benefit expense (income) are:

Pension Benefits Postretirement Benefits

2005 2004 2003 2005 2004 2003

(in millions)

Service cost ...................................... $ 9 $ 9 $ 8 $ — $ — $ —

Interest cost ..................................... 36 39 43 1 1 2

Expected return on plan assets ................... (49) (48) (46) — — —

Amortization of prior service cost (benefit) ...... 1 1 — (1) (1) (1)

Amortization of net (gain) loss ................... 13 11 9 (12) (13) (16)

Net benefit expense (income) .................... $ 10 $ 12 $ 14 $(12) $(13) $(15)

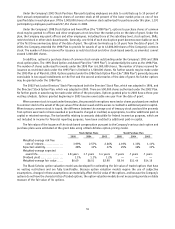

The following weighted-average assumptions were used to determine net benefit cost:

Pension Benefits Postretirement Benefits

2005 2004 2003 2005 2004 2003

Discount rate ..................................... 5.50% 5.90% 6.50% 5.50% 5.90% 6.50%

Rate of compensation increase ................... 3.77% 3.79% 3.72%

Expected long-term rate of return on assets ...... 8.88% 8.89% 8.88%

The expected long-term rate of return on invested plan assets is based on historical long-term performance and future

expected performance of those assets based upon current asset allocations.

Beginning with 2001, new retirees were charged the expected full cost of the medical plan and existing retirees will

incur 100 percent of the expected future increase in medical plan costs. Any changes in the health care cost trend rates

assumed would not affect the accumulated benefit obligation or net benefit income since retirees will incur 100 percent

of such expected future increases.

In December 2003, the United States enacted into law the Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (the “Act”). The Act establishes a prescription drug benefit under Medicare, known as “Medicare

Part D,” and a Federal subsidy to sponsors of retiree health care benefit plans that provide a benefit that is at least

actuarially equivalent to Medicare Part D. In May 2004, the FASB issued FASB Staff Position No. 106-2, “Accounting and

Disclosure Requirements Related to the Medicare Prescription Drug, Improvement and Modernization Act of 2003” (“FSP

106-2”). FSP 106-2 requires companies to account for the effect of the subsidy on benefits attributable to past service

as an actuarial experience gain and as a reduction of the service cost component of net postretirement health care costs

for amounts attributable to current service, if the benefit provided is at least actuarially equivalent to Medicare Part D.

During 2005, the Company reviewed its retiree health care benefit plans in light of the final regulations for implementing

Medicare Part D by the Centers for Medicare and Medicaid Services. The Company has determined that it will qualify for

the subsidy, however the effect of the subsidy will not be significant to either the benefit obligation or net benefit income.

49