Foot Locker 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

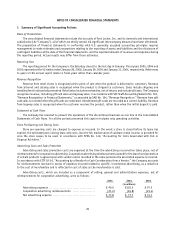

allocation of fixed production overheads to the costs of conversions be based on the normal capacity of the production

facilities. The Statement is effective for inventory costs incurred during fiscal years beginning after June 15, 2005.

Management does not believe that the effect of the adoption of this Statement will have a material effect on its financial

position and results of operations.

In December 2004, the FASB issued SFAS No. 153, “Exchanges of Nonmonetary Assets — an amendment of APB

Opinion No. 29, Accounting for Nonmonetary Transactions.” This Statement requires that exchanges should be recorded

and measured at the fair value of the assets exchanged, with certain exceptions. The Statement is effective for

nonmonetary asset exchanges occurring in fiscal periods beginning after June 15, 2005. Management does not believe

that the adoption of this Statement will have a material effect on its financial position and results of operations as the

Company does not currently have any exchanges of nonmonetary assets.

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections,” (“SFAS No. 154”). SFAS

No. 154 replaces APB No. 20, “Accounting Changes,” and SFAS No. 3, “Reporting Changes in Interim Financial Statements.”

SFAS No. 154 changes the accounting for, and reporting of, a change in accounting principle. SFAS No. 154 requires

retrospective application to the prior period’s financial statements of voluntary changes in accounting principle and

changes required by new accounting standards when the standard does not include specific transition provisions, unless

it is impractical to do so. SFAS No. 154 is effective for accounting changes and corrections of errors in fiscal years beginning

after December 15, 2005. Currently, the Company is not aware of any financial impact that the adoption of this Statement

will have on our consolidated financial statements.

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments.” This

Statement amends SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities” and SFAS No. 140,

“Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities” and provides for simplified

accounting for certain hybrid financial instruments by permitting fair value remeasurement for any hybrid financial

instrument that contains an embedded derivative that otherwise would require bifurcation and by eliminating a restriction

on the passive derivative instruments that a qualifying special-purpose entity (SPE) may hold. This Statement is effective

for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after

September 15, 2006. Management does not believe that the effect of the adoption of this Statement will have a material

effect on its financial position and results of operations.

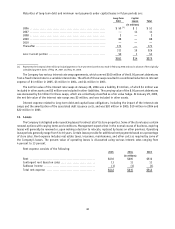

2 Goodwill

The carrying value of goodwill related to the Athletic Stores segment was $183 million at January 28, 2006 and $191

million at January 29, 2005. The carrying value of goodwill related to the Direct-to-Customers segment was $80 million

at January 28, 2006 and January 29, 2005.

The goodwill activity during the fiscal year ended January 28, 2006 represents adjustments of $5 million reducing

goodwill relating to the Footaction acquisition as a result of the Company’s decision to continue operating a store that

the Company had originally intended to close at the acquisition date. Additionally, the Company resolved the remaining

Footaction lease related matter and received $1 million return from the escrow account, thereby reducing goodwill. The

effect of foreign exchange fluctuations for the fiscal year ended January 28, 2006 reduced goodwill by $2 million, resulting

from the decline in the value of the euro in relation to the U.S. dollar.

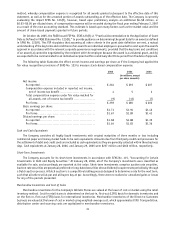

3 Intangible Assets, net

2005 2004

(in millions)

Intangible assets not subject to amortization ............................. $ 4 $ 4

Intangible assets subject to amortization (net of accumulated

amortization of $84 and $70, respectively) ............................. 113 131

$117 $135

Intangible assets not subject to amortization at January 28, 2006, includes $3 million related to the trademark of

the 11 stores acquired in the Republic of Ireland. The minimum pension liability required at January 28, 2006 and

January 29, 2005, which represented the amount by which the accumulated benefit obligation exceeded the fair market

value of U.S. defined benefit plan’s assets, was offset by an intangible asset to the extent of previously unrecognized prior

service costs of $1 million at both January 28, 2006 and January 29, 2005.

34