Foot Locker 2005 Annual Report Download - page 118

Download and view the complete annual report

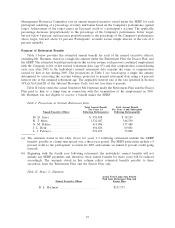

Please find page 118 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.her annual bonus at target multiplied by the executive’s years of service, with a minimum

severance benefit of 52 weeks’ salary.

Change in Control. If the employment of any of the executives is terminated by him or her for

Good Reason or by the Company without Cause within 24 months following a Change in

Control, then the executive would be entitled to a severance benefit calculated using the same

formula described in the preceding paragraph, except that the minimum severance benefit would

be 104 weeks’ salary plus two times the executive’s annual bonus at target. In addition, all

unvested shares of restricted stock and stock options would vest.

If payments or benefits received by any of the executives under these circumstances are subject

to the excise tax imposed by Section 4999 of the Internal Revenue Code, then we would

automatically reduce his or her payments and benefits to an amount equal to $1 less than the

amount that would subject the executive to the excise tax, provided that this reduced amount

would result in a greater benefit to the executive compared to the unreduced amount on a net

after-tax basis.

•Continuation of Benefits. The executives would be eligible to continue to participate during their

severance periods in any group medical, dental or life insurance plan he or she participated in prior to

termination under substantially the same terms as an active employee. This extended participation

would continue for 52 weeks or, following a change in control, for 104 weeks, unless the executive

becomes eligible for a future employer’s plans or violates the post-employment non-compete and

confidentiality provisions before the end of the severance period.

•Non-Competition. Mr. Mina is subject to a non-competition and non-solicitation provision for two

years following the termination of his employment, and each of the other executives is subject to a

one-year non-competition and non-solicitation provision.

B. L. Hartman

We had an employment agreement with Mr. Hartman as Executive Vice President and Chief

Financial Officer in the same form as the agreements described above for the named executive officers

other than Mr. Serra. Mr. Hartman’s service as Executive Vice President and Chief Financial Officer of

the Company ended at the close of business on November 18, 2005. On December 21, 2005, the

Company and Mr. Hartman entered into a letter agreement (the “Letter Agreement’’) regarding his

resignation, and the termination of his employment effective December 18, 2005 (the “Termination

Date’’). The Letter Agreement provided for:

•a severance payment of $650,500 to Mr. Hartman payable in June 2006, which reflects the

amount of severance provided for under his Employment Agreement;

•a non-competition period, including a prohibition on hiring employees of the Company, for one

year following the Termination Date;

•the accelerated vesting of stock options covering a total of 32,334 shares at exercise prices

ranging from $10.245 to $28.155, which were scheduled to vest in March and April 2006;

•continuation of participation in certain benefit programs for one year following his employment

termination date, including the medical, drug, dental, and life insurance programs for active

employees of the Company, the executive medical reimbursement program, the executive

financial planning program, the automobile expense reimbursement program, and the executive

life insurance program;

•a General Release from Mr. Hartman to the Company; and

•the forfeiture of all unvested shares of restricted stock previously granted to Mr. Hartman.

Mr. Hartman was not eligible to receive bonus payments under the Annual Plan for 2005 or under the

Long-Term Plan for any performance period ending after his termination date.

26