Foot Locker 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

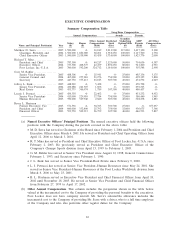

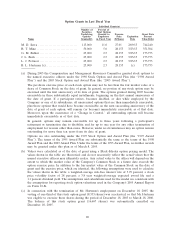

The New York Stock Exchange on the individual grant dates by the total number of shares of

restricted stock awarded on those dates.

Closing Price

Date of # of on Date of Vesting Grant Date

Name Grant Shares Grant Date $ Value

M. D. Serra ......................... 02/09/05 105,000 26.78 (*) 2,811,900

02/18/04 75,000 25.55 03/15/05 1,916,250

09/11/03 100,000 16.46 09/11/04 1,646,000

09/11/03 100,000 16.46 09/11/05 1,646,000

02/02/03 240,000 10.10 02/03/06 2,424,000

R. T. Mina .......................... 03/23/05 40,000 28.14 03/15/08 1,125,600

04/01/04 75,000 25.23 03/15/07 1,892,250

02/02/03 100,000 10.10 02/03/06 1,010,000

G. M. Bahler ........................ 04/01/04 30,000 25.23 03/15/07 756,900

04/16/03 30,000 10.25 04/16/06 307,500

J. L. Berk ........................... 04/16/03 30,000 10.25 04/16/06 307,500

L. J. Petrucci ........................ 04/01/04 30,000 25.23 03/15/07 756,900

04/16/03 30,000 10.25 04/16/06 307,500

B. L. Hartman ....................... 03/23/05 25,000 28.14 Forfeited 703,500

04/01/04 30,000 25.23 Forfeited 756,900

04/16/03 30,000 10.25 Forfeited 307,500

* Award vests over a three-year period, as follows: 35,000 shares on 3/15/06; 35,000 shares on

3/15/07; and 35,000 shares on 2/1/08.

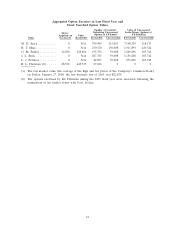

•Dividends Paid on Unvested Restricted Stock. The named executive officers received non-

preferential dividends paid on the shares of unvested restricted stock that they held during the

covered fiscal years, as itemized in the table below.

Name Fiscal Year Dividends Paid $

M. D. Serra ........................................... 2005 123,675

2004 117,825

2003 76,500

R. T. Mina............................................ 2005 67,725

2004 44,625

2003 30,000

G. M. Bahler ......................................... 2005 18,900

2004 15,300

2003 9,000

J. L. Berk ............................................. 2005 9,450

2004 7,650

2003 7,500

L. J. Petrucci .......................................... 2005 18,900

2004 15,300

2003 4,500

B. L. Hartman ........................................ 2005 19,125

2004 15,300

2003 18,000

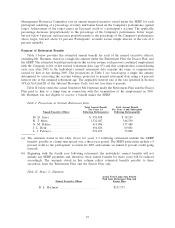

(d) Long-Term Incentive Plan Payouts. The amounts stated in this column reflect payments made to

the executives under the Company’s Long-Term Incentive Compensation Plan. The 2005 payouts

were paid for the 2003-2005 Performance Period; the 2004 payouts were for the 2002-2004

Performance Period; and the payouts for 2003 were for the 2001-2003 Performance Period.

Although Mr. Hartman participated in the Long-Term Plan, his award for the 2003-2005

Performance Period was cancelled upon the termination of his employment.

(e) All Other Compensation. This column includes, where applicable, the dollar value of the premium

we paid for a universal life insurance policy for the benefit of the named executive and the dollar

18