Foot Locker 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

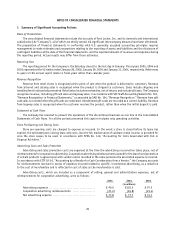

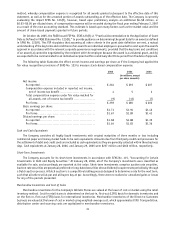

The changes in the carrying amount of intangibles subject to amortization for the year ended January 28, 2006 are

as follows:

2004 Additions

Amortization

/ Other

(1)

2005

Wtd.

Avg.

Useful Life

in Years

(in millions)

Finite life intangible assets

Lease acquisition costs ........................ $102 $ 8 $(22) $ 88 11.9

Trademark ..................................... 20 — (1) 19 20.0

Loyalty program ............................... 1 — (1) — 2.0

Favorable leases ............................... 8 — (2) 6 3.8

Total ....................................... $131 $ 8 $(26) $113 12.3

(1) Includes effect of foreign currency translation of $8 million primarily related to the decline in the value of the euro in relation to the U.S. dollar.

Lease acquisition costs represent amounts that are required to secure prime lease locations and other lease rights,

primarily in Europe. Included in finite life intangibles, as a result of the Footaction and Republic of Ireland purchases,

are the trademark for the Footaction name, amounts paid for leased locations with rents below their fair value for both

acquisitions and amounts paid to obtain names of members of the Footaction loyalty program.

Amortization expense for the intangibles subject to amortization was approximately $18 million, $17 million and

$11 million for 2005, 2004 and 2003, respectively. Annual estimated amortization expense for finite life intangible assets

is expected to approximate $19 million for 2006, $18 million for 2007, $16 million for 2008, $13 million for 2009 and

$12 million for 2010.

4 Segment Information

The Company has determined that its reportable segments are those that are based on its method of internal

reporting. As of January 28, 2006, the Company has two reportable segments, Athletic Stores, which sells athletic

footwear and apparel through its various retail stores, and Direct-to-Customers, which includes the Company’s catalogs

and Internet business.

The accounting policies of both segments are the same as those described in the “Summary of Significant Accounting

Policies.” The Company evaluates performance based on several factors, of which the primary financial measure is division

results. Division profit reflects income from continuing operations before income taxes, corporate expense, non-operating

income and net interest expense.

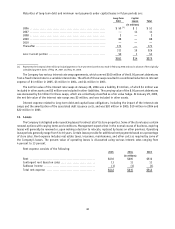

Sales

2005 2004 2003

(in millions)

Athletic Stores ............................................. $5,272 $4,989 $4,413

Direct-to-Customers ........................................ 381 366 366

Total sales ............................................... $5,653 $5,355 $4,779

35