Foot Locker 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

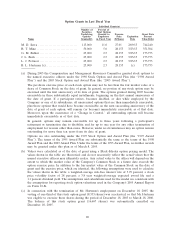

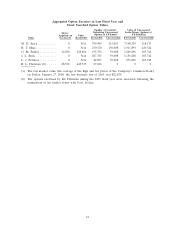

Option Grants in Last Fiscal Year

Individual Grants(a)

Number of Percent of

Securities Total Options

Underlying Granted to Exercise Grant Date

Options Employees Price Expiration Present

Name Granted(#) in Fiscal Year ($/Share) Date Value($)(b)

M. D. Serra .............................. 115,000 11.6 27.01 2/09/15 744,240

R. T. Mina ............................... 50,000 5.0 28.155 3/23/15 351,504

G. M. Bahler ............................. 25,000 2.5 28.155 3/23/15 175,753

J. L. Berk ................................ 25,000 2.5 28.155 3/23/15 175,753

L. J. Petrucci ............................. 25,000 2.5 28.155 3/23/15 175,753

B. L. Hartman (c) ........................ 25,000 2.5 28.155 (c) 175,753

(a) During 2005 the Compensation and Management Resources Committee granted stock options to

the named executive officers under the 1998 Stock Option and Award Plan (the “1998 Award

Plan’’) and the 2003 Stock Option and Award Plan (the “2003 Award Plan’’).

The per-share exercise price of each stock option may not be less than the fair market value of a

share of Common Stock on the date of grant. In general, no portion of any stock option may be

exercised until the first anniversary of its date of grant. The options granted during 2005 become

exercisable in three substantially equal installments, beginning on the first annual anniversary of

the date of grant. If a participant retires, becomes disabled, or dies while employed by the

Company or one of its subsidiaries, all unexercised options that are then immediately exercisable,

plus those options that would have become exercisable on the next succeeding anniversary of the

date of grant of each option, will remain (or become) immediately exercisable as of that date.

Moreover, upon the occurrence of a “Change in Control,’’ all outstanding options will become

immediately exercisable as of that date.

In general, options may remain exercisable for up to three years following a participant’s

retirement or termination due to disability, and for up to one year for any other termination of

employment for reasons other than cause. However, under no circumstances may an option remain

outstanding for more than ten years from its date of grant.

Options are also outstanding under the 1995 Stock Option and Award Plan (the “1995 Award

Plan’’). The terms of the 1995 Award Plan are substantially the same as the terms of the 1998

Award Plan and the 2003 Award Plan. Under the terms of the 1995 Award Plan, no further awards

may be granted under this plan as of March 8, 2005.

(b) Values were calculated as of the date of grant using a Black-Scholes option pricing model. The

values shown in the table are theoretical and do not necessarily reflect the actual values that the

named executive officers may ultimately realize. Any actual value to the officer will depend on the

extent to which the market value of the Company’s Common Stock at a future date exceeds the

option exercise price. In addition to the fair market value of the Common Stock on the date of

grant and the exercise price, which are identical, the following assumptions were used to calculate

the values shown in the table: a weighted-average risk-free interest rate of 3.99 percent; a stock

price volatility factor of 28 percent; a 3.8 year weighted-average expected award life and a

1.1 percent dividend yield. The assumptions and calculations used for the model are consistent with

the assumptions for reporting stock option valuations used in the Company’s 2005 Annual Report

on Form 10-K.

(c) In connection with the termination of Mr. Hartman’s employment on December 18, 2005, the

vesting of one-third of this stock option grant (8,333 shares) was accelerated, so that Mr. Hartman

was eligible to exercise these shares during the period of December 18, 2005 to March 18, 2006.

The balance of this stock option grant (16,667 shares) was automatically cancelled on

December 18, 2005.

20