Foot Locker 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

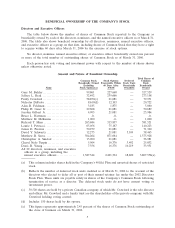

BENEFICIAL OWNERSHIP OF THE COMPANY’S STOCK

Directors and Executive Officers

The table below shows the number of shares of Common Stock reported to the Company as

beneficially owned by each of the directors, nominees, and the named executive officers as of March 31,

2006. The table also shows beneficial ownership by all directors, nominees, named executive officers,

and executive officers as a group on that date, including shares of Common Stock that they have a right

to acquire within 60 days after March 31, 2006 by the exercise of stock options.

No director, nominee, named executive officer, or executive officer beneficially owned one percent

or more of the total number of outstanding shares of Common Stock as of March 31, 2006.

Each person has sole voting and investment power with respect to the number of shares shown

unless otherwise noted.

Amount and Nature of Beneficial Ownership

Total Shares of

Common Stock Stock Options Deferred Common

Beneficially Owned Exercisable Within Stock Units Stock

Excluding 60 Days After Beneficially Beneficially

Name Stock Options(a) 3/31/06 Owned(b) Owned

Gary M. Bahler .......................... 99,861 227,668 — 327,529

Jeffrey L. Berk .......................... 32,492 239,666 — 273,158

Purdy Crawford .......................... 58,870(c) 21,081 — 79,951

Nicholas DiPaolo ........................ 8,619(d) 12,103 — 20,722

Alan D. Feldman ........................ 3,185 1,875 — 5,060

Philip H. Geier Jr. ....................... 29,608 21,081 — 50,689

Jarobin Gilbert Jr. ....................... 4,903 21,081 — 25,984

Bruce L. Hartman ....................... -0- -0- — -0-

Matthew M. McKenna ................... 1,000 -0- — 1,000

Richard T. Mina ......................... 265,684 315,837 — 581,521

Laurie J. Petrucci ........................ 65,056 75,167 — 140,223

James E. Preston ........................ 50,279 21,081 — 71,360

David Y. Schwartz ....................... 12,275 21,081 5,109 38,465

Matthew D. Serra........................ 504,264 871,664 — 1,375,928

Christopher A. Sinclair .................. 15,900 21,081 — 36,981

Cheryl Nido Turpin ...................... 5,964 16,376 3,492 25,832

Dona D. Young .......................... 7,356 16,376 10,219 33,951

All 22 directors, nominees, and executive

officers as a group, including the

named executive officers ............... 1,387,344 2,401,394 18,820 3,807,558(e)

(a) This column includes shares held in the Company’s 401(k) Plan and unvested shares of restricted

stock.

(b) Reflects the number of deferred stock units credited as of March 31, 2006 to the account of the

directors who elected to defer all or part of their annual retainer fee under the 2002 Directors

Stock Plan. These units are payable solely in shares of the Company’s Common Stock following

termination of service as a director. The deferred stock units do not have current voting or

investment power.

(c) 50,520 shares are held by a private Canadian company of which Mr. Crawford is the sole director

and officer. Mr. Crawford and a family trust are the shareholders of the private company, with Mr.

Crawford holding voting control.

(d) Includes 150 shares held by his spouse.

(e) This figure represents approximately 2.45 percent of the shares of Common Stock outstanding at

the close of business on March 31, 2006.

5