Foot Locker 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 Revolving Credit Facility

At January 28, 2006, the Company had unused domestic lines of credit of $186 million, pursuant to a $200 million

unsecured revolving credit agreement. $14 million of the line of credit was committed to support standby letters of credit.

These letters of credit are primarily used for insurance programs.

In May 2004, shortly after the Footaction acquisition, the Company amended its revolving credit agreement, thereby

extending the maturity date to May 2009 from July 2006. The agreement includes various restrictive financial covenants

with which the Company was in compliance on January 28, 2006. Deferred financing fees are amortized over the life of

the facility on a straight-line basis, which is comparable to the interest method. The unamortized balance at January 28,

2006 approximates $2.7 million. Interest is determined at the time of borrowing based on variable rates and the Company’s

fixed charge coverage ratio, as defined in the agreement. The rates range from LIBOR plus 0.875 percent to LIBOR plus

1.625 percent. The quarterly facility fees paid on the unused portion during 2005, which are also based on the Company’s

fixed charge coverage ratio, ranged from 0.175 percent to 0.25 percent. Quarterly facility fees paid in 2004 ranged from

0.175 percent to 0.25 percent. There were no short-term borrowings during 2005 or 2004.

Interest expense, including facility fees, related to the revolving credit facility was $2 million in both 2005 and 2004

and $3 million in 2003.

13 Long-Term Debt and Obligations under Capital Leases

In 2001, the Company issued $150 million of subordinated convertible notes due 2008, at an interest rate of 5.50

percent. The notes were convertible into the Company’s common stock at the option of the holder at a conversion price

of $15.806 per share. In 2004, the Company notified The Bank of New York, as Trustee under the indenture, that it intended

to redeem its entire $150 million outstanding 5.50 percent convertible subordinated notes. Effective June 4, 2004, all

of the convertible subordinated notes were cancelled and approximately 9.5 million new shares of the Company’s common

stock were issued. The Company reclassified the remaining $3 million of unamortized deferred costs related to the original

issuance of the convertible debt to equity as a result of the conversion.

In 2003, the Company purchased and retired $19 million of the $200 million debentures, bringing the total amount

retired to date to $27 million.

In May 2004, the Company obtained a 5-year, $175 million amortizing term loan from the bank group participating

in its existing revolving credit facility to finance a portion of the purchase price of the Footaction stores. The interest

rate on the LIBOR-based, floating-rate loan was 5.568 percent on January 28, 2006 and was 3.875 percent on January 29,

2005. The loan requires minimum principal payments each May, equal to a percentage of the original principal amount

of 10 percent in 2005 and 2006, 15 percent in years 2007 and 2008 and 50 percent in year 2009. Closing and upfront

fees totaling approximately $1 million were paid for the term loan and these fees are being amortized using the interest

rate method as determined by the principal repayment schedule. During 2005, the Company repaid $35 million of its 5-year

term loan. This payment was in advance of the originally scheduled payment dates of May 19, 2005 and May 19, 2006

as permitted by the agreement. In February of 2006, the Company repaid an additional $50 million of its 5-year term loan.

This payment was in advance of the originally scheduled payment dates of May 19, 2007 and May 19, 2008.

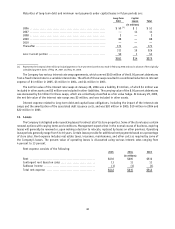

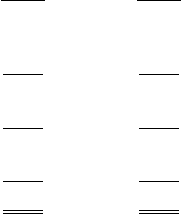

Following is a summary of long-term debt and obligations under capital leases:

2005 2004

(in millions)

8.50% debentures payable 2022 ........................................... $171 $176

$175 million term loan .................................................... 140 175

Total long-term debt .................................................... 311 351

Obligations under capital leases ........................................... 15 14

326 365

Less: Current portion ................................................... 51 18

$275 $347

39