Foot Locker 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23 Legal Proceedings

Legal proceedings pending against the Company or its consolidated subsidiaries consist of ordinary, routine

litigation, including administrative proceedings, incidental to the business of the Company, as well as litigation incidental

to the sale and disposition of businesses that have occurred in past years. These legal proceedings include commercial,

intellectual property, customer, and labor-and-employment-related claims, including class action lawsuits in which

plaintiffs allege violations by the Company of state wage and hour and other laws. Management does not believe that

the outcome of such proceedings would have a material adverse effect on the Company’s consolidated financial position,

liquidity, or results of operations, taken as a whole.

24 Commitments

In connection with the sale of various businesses and assets, the Company may be obligated for certain lease

commitments transferred to third parties and pursuant to certain normal representations, warranties, or indemnifications

entered into with the purchasers of such businesses or assets. Although the maximum potential amounts for such obligations

cannot be readily determined, management believes that the resolution of such contingencies will not have a material effect

on the Company’s consolidated financial position, liquidity, or results of operations. The Company is also operating certain

stores and making rental payments for which lease agreements are in the process of being negotiated with landlords.

Although there is no contractual commitment to make these payments, it is likely that a lease will be executed.

The Company does not have any off-balance sheet financing, other than operating leases entered into in the

normal course of business and disclosed above or unconsolidated special purpose entities. The Company does not

participate in transactions that generate relationships with unconsolidated entities or financial partnerships, including

variable interest entities.

25 Shareholder Information and Market Prices (Unaudited)

Foot Locker, Inc. common stock is listed on The New York Stock Exchange as well as on the bo¨erse-stuttgart stock

exchange in Germany and the Elektronische Bo¨rse Schweiz (EBS) stock exchange in Switzerland. In addition, the stock

is traded on the Cincinnati stock exchange.

As of January 28, 2006, the Company had 24,933 shareholders of record owning 155,503,606 common shares.

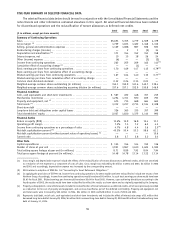

Market prices for the Company’s common stock were as follows:

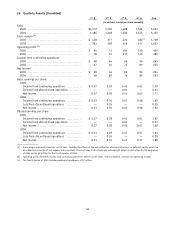

2005 2004

High Low High Low

Common Stock

Quarter

1

st

Q ....................................................... $29.95 $25.88 $27.59 $21.75

2

nd

Q ....................................................... 27.65 24.31 25.03 19.97

3

rd

Q ....................................................... 25.37 18.75 24.80 19.98

4

th

Q ...................................................... 24.07 18.74 27.26 22.75

During 2005, the Company declared quarterly dividends of $0.075 per share during the first, second and third

quarters. On November 16, 2005, the Company increased the quarterly dividend per share by 20 percent to $0.09, beginning

in the fourth quarter of 2005.

During 2004, the Company declared quarterly dividends of $0.06 per share during the first, second and third quarters.

On November 17, 2004, the Company increased the quarterly dividend per share to $0.075, beginning in the fourth

quarter of 2004.

53