Foot Locker 2005 Annual Report Download - page 121

Download and view the complete annual report

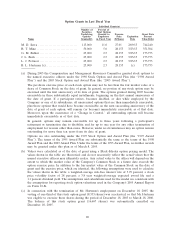

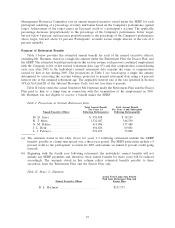

Please find page 121 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.plan. This compares to an annual bonus payment of $1,662,000 to Mr. Serra in 2004 when the Company

slightly exceeded its pre-tax income and return-on-invested-capital plan for the year.

• Mr. Serra’s long-term bonus payment of $1,617,120 was calculated in the same manner as that of

other participants in the Long-Term Incentive Compensation Plan, and was the result of the Company

exceeding its return-on-invested-capital plan for 2003-2005. This compares to a long-term bonus

payment of $2,117,700 in 2004, when the Company significantly exceeded its return-on-invested-capital

plan for the performance period.

• The stock option grant of 115,000 shares at $27.01 per share, the fair market value on the date of

grant, made to Mr. Serra in February 2005 reflected Mr. Serra’s performance, responsibilities and his

ability, through his efforts, to improve the value of the Company’s Common Stock. Consistent with

stock option grants made to other executives, this grant vests in three equal annual installments. The

value of the stock option grant is wholly dependent on increases in the price of the Company’s Common

Stock over the price on the date of grant.

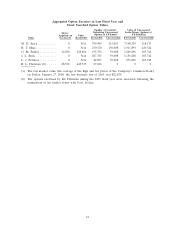

• The restricted stock grant of 105,000 shares made to Mr. Serra in February 2005 reflected

Mr. Serra’s performance, responsibilities, the Company’s desire to retain his services, and his ability,

through his efforts, to improve the value of the Company’s Common Stock. A portion of the value that

Mr. Serra is expected to receive on the vesting of the restricted shares is dependent on increases in the

price of the Company’s Common Stock.

Consistent with the Company’s executive compensation policies, the great majority of Mr. Serra’s

compensation is at risk, dependent upon the Company’s performance or the share price of its Common

Stock.

In determining Mr. Serra’s compensation, the Committee considered appropriate compensation for

an executive of Mr. Serra’s background and experience, Mr. Serra’s performance as the Company’s Chief

Executive Officer, the benefits to the Company and its shareholders that are expected to result from

retaining his services as the Company’s Chief Executive Officer and providing him with a meaningful

compensation opportunity tied to the performance of the Company and the price of its Common Stock,

and the compensation of chief executive officers of other companies in the retail and athletic footwear

and apparel industries. This Committee, acting jointly with the Nominating and Corporate Governance

Committee, annually reviews Mr. Serra’s performance as the Company’s Chief Executive Officer and

the results of this review are one factor in determining Mr. Serra’s compensation.

One Million Dollar Pay Deductibility Cap

In general, it is the Company’s position that compensation paid to its executive officers should be

fully deductible for U.S. tax purposes, and the Company has structured its bonus and stock option

programs so that payments made under them are deductible. In certain instances, however, the

Committee believes that it is in the best interests of the Company and its shareholders to have the

flexibility to pay compensation that is not deductible under the limitations set by Section 162(m) of the

Internal Revenue Code in order to provide a compensation package consistent with the executive

compensation policies discussed in this report. In particular, that portion of Mr. Serra’s base salary that

exceeds $1,000,000 and the value of restricted stock awards made to Mr. Serra and, potentially, a portion

of the restricted stock awards made to the other executive officers named in the compensation table are

not expected to be deductible. It is the Committee’s view that the benefits of securing the services of

Mr. Serra and these officers, and their potential contribution to the performance of the Company,

outweigh the Company’s inability to obtain a deduction for those elements of compensation.

James E. Preston, Chairman

Purdy Crawford

Philip H. Geier Jr.

Christopher A. Sinclair

Cheryl Nido Turpin

29