Foot Locker 2005 Annual Report Download - page 120

Download and view the complete annual report

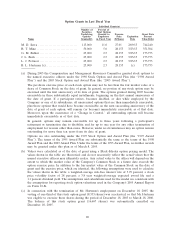

Please find page 120 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.II. Long-Term Compensation

Long-Term Bonus. Executive officers participate in the long-term bonus program, which provides

for payment of a percentage multiple of the executive’s base salary at the beginning of each three-year

performance period depending upon the Company’s performance over the period in relation to targets

established by the Committee at the beginning of each period. For recent performance periods,

including that for 2005-2007, these targets have been based on three-year average return-on-invested-

capital. These performance targets are based on the three-year plan reviewed and approved by the

Finance and Strategic Planning Committee and the Board of Directors at the beginning of each

performance period.

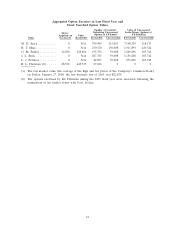

Stock Awards. The Company makes grants of stock options and, in some cases, restricted stock to

executive officers in order to strengthen the tie between an executive officer’s compensation opportunity

and the shareholders’ interest in increasing the price of Common Stock, and for retention purposes.

Stock options are granted at fair market value on the grant date and are normally exercisable in one-

third increments in each of the first three years following the date of grant. Restricted stock awards vest

after an executive’s continued employment by the Company for a specified period.

The Committee, advised by an independent, nationally recognized compensation consultant that

reports directly to the Committee, at least annually conducts a review of the Company’s executive

compensation program, including the compensation of its Chief Executive Officer. Based upon those

reviews, the Committee believes that the Company’s executive compensation program is competitive,

and is reasonable and appropriate for the Company, taking into consideration its revenues, profitability,

market position, complexity, and multinational operations, and that the program is effective in tying

executive compensation to performance. The Company has a similar compensation program for other

officers and for the senior management of its business units.

Except in the case of mid-year promotions or new hires, or other special circumstances, the

Committee makes decisions on base salaries, incentive plan targets and awards, and stock awards at a

meeting held in the first quarter of each year. The Chief Executive Officer makes recommendations to

the Committee with regard to base salaries and stock awards for senior officers other than himself.

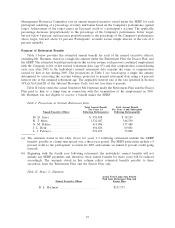

Executives participate in the Annual Incentive Compensation Plan and the Long-Term Incentive

Compensation Plan based upon their position, and target awards under those plans, as a percentage of

base salary, are also based on position. In making compensation decisions, the Committee considers

information developed through its annual compensation review, including national and industry

compensation trends and executive compensation at peer companies, which the Committee has had an

opportunity to consider at earlier meetings. In addition, the Committee considers the Company’s over-

all performance and individual performance and responsibilities. The Committee reviews a tally sheet

indicating each element of compensation paid to the executive in the prior year and each element

proposed for the upcoming year, as well as total compensation in each year.

In February 2006, the Board of Directors adopted stock ownership guidelines for directors and

senior executives. These guidelines, which are described more fully on Page 6, call for the Chief

Executive Officer to hold shares having a value at least equal to four times base salary and other senior

executives to hold shares having a value at least equal to two times base salary. Currently the Chief

Executive Officer and most other executives covered by the guidelines are in compliance with them.

Chief Executive Officer’s Compensation

The compensation reported for 2005 for Mr. Serra, the Company’s Chairman of the Board and

Chief Executive Officer, was based on the same policies, described above, that apply to all of the

Company’s executive officers.

• Mr. Serra’s base salary of $1,500,000, unchanged from his base salary in 2004, was established

based upon his responsibilities, his performance, and salaries for comparable positions.

• Neither Mr. Serra nor the other corporate officers received an annual bonus payment for 2005, as

the Company’s pre-tax income and return-on-invested capital results for 2005 did not meet the

threshold established by the Committee at the beginning of the year for a payment under the annual

28