Foot Locker 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

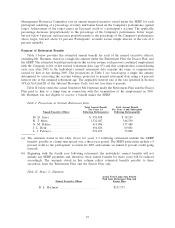

RETIREMENT PLANS

Foot Locker Retirement Plan

The Company maintains the Foot Locker Retirement Plan (the “Retirement Plan’’), a defined

benefit plan with a cash balance formula, which covers associates of the Company and substantially all

of its United States subsidiaries. All qualified associates at least 21 years of age are covered by the

Retirement Plan, and plan participants become fully vested in their benefits under this plan generally

upon completion of five years of service or upon attainment of normal retirement age while actively

employed.

Under the cash balance formula, each participant has an account, for record keeping purposes only,

to which credits are allocated annually based upon a percentage of the participant’s W-2 Compensation,

as defined in the Retirement Plan. This percentage is determined by the participant’s years of service

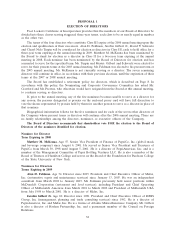

with the Company as of the beginning of each calendar year. The following table shows the percentage

used to determine credits at the years of service indicated.

Percent of W-2

Percent of All Compensation

Years of Service W-2 Compensation Over $22,000

+

Less than 6............................... 1.10 0.55

6–10...................................... 1.50 0.75

11–15..................................... 2.00 1.00

16–20..................................... 2.70 1.35

21–25..................................... 3.70 1.85

26–30..................................... 4.90 2.45

31–35..................................... 6.60 3.30

More than 35 ............................ 8.90 4.45

In addition, all balances in the participants’ accounts earn interest at the fixed rate of 6 percent,

which is credited annually. At retirement or other termination of employment, an amount equal to the

vested balance then credited to the account under the Retirement Plan is payable to the participant in

the form of a qualified joint and survivor annuity (if the participant is married) or a life annuity (if the

participant is not married). The participant may elect to waive the annuity form of benefit described

above and receive benefits under the Retirement Plan upon retirement in an optional annuity form or

an immediate or deferred lump sum, or, upon other termination of employment, in a lump sum.

Participants may elect one of the optional forms of benefit with respect to the accrued benefit as of

December 31, 1995 if the individual participated in the Retirement Plan as of that date.

Foot Locker Excess Cash Balance Plan

The Internal Revenue Code limits annual retirement benefits that may be paid to, and

compensation that may be taken into account in the determination of benefits for, any person under a

qualified retirement plan such as the Retirement Plan. Accordingly, for any person covered by the

Retirement Plan whose annual retirement benefit, calculated in accordance with the terms of the

Retirement Plan, exceeds the limitations of the Internal Revenue Code, the Company has adopted the

Foot Locker Excess Cash Balance Plan (the “Excess Plan’’). The Excess Plan is an unfunded,

nonqualified benefit plan, under which the individual is paid the difference between the Internal

Revenue Code limitations and the retirement benefit to which he or she would otherwise be entitled

under the Retirement Plan.

Foot Locker Supplemental Executive Retirement Plan

In addition, the Foot Locker Supplemental Executive Retirement Plan (the “SERP’’), which is an

unfunded, nonqualified benefit plan, provides for payment by the Company of supplemental retirement,

death and disability benefits to certain executive officers and certain other key employees of the

Company and its subsidiaries. The named executive officers, excluding Bruce L. Hartman, and three of

the other executive officers of the Company currently participate in the SERP. The Compensation and

22