Foot Locker 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Future adjustments, if any, to the carrying value of the Note will be recorded pursuant to SEC Staff Accounting Bulletin

Topic 5:Z:5, “Accounting and Disclosure Regarding Discontinued Operations,” which requires changes in the carrying value

of assets received as consideration from the disposal of a discontinued operation to be classified within continuing

operations. Interest income will also be recorded within continuing operations. The Company will recognize an impairment

loss when, and if, circumstances indicate that the carrying value of the Note may not be recoverable. Such circumstances

would include deterioration in the business, as evidenced by significant operating losses incurred by the purchaser or

nonpayment of an amount due under the terms of the Note. The purchaser has made all payments required under the terms

of the Note, however the business had sustained unexpected operating losses in prior years. During the current year, the

operations have improved. The Company has evaluated the projected performance of the business and will continue to

monitor its results during the coming year.

At January 28, 2006 and January 29, 2005, US$1million is classified as a current receivable, with the remainder

classified as long term within other assets in the accompanying Consolidated Balance Sheets. All scheduled principal and

interest payments have been received and in accordance with the terms of the Note.

As indicated above, as the assignor of the Northern Canada leases, the Company remained secondarily liable under

these leases. As of January 28, 2006, the Company estimates that its gross contingent lease liability is CAD$19 million

(approximately US$16 million). The Company currently estimates the expected value of the lease liability to be

approximately US$1 million. The Company believes that, because it is secondarily liable on the leases, it is unlikely that

it would be required to make such contingent payments.

During 2003, a charge in the amount of $1 million before-tax was recorded related to the Northern Group

discontinuance to cover additional liabilities related to the exiting of the former leased corporate office in excess of the

previous estimate. Subsequently in 2003, the Company made a CAD$10 million payment (approximately US$7 million) to

the landlord, which released the Company from all future liability related to the lease.

In 1998, the Company exited both its International General Merchandise and Specialty Footwear segments. During

2005, the Company recorded a charge of $2 million to revise estimates on its lease liability for one store in the International

General Merchandise segment. During 2004, the Company recorded income of $1 million, after-tax, related to a refund

of Canadian customs duties related to certain of the businesses that comprised the Specialty Footwear segment.

In 1997, the Company exited its Domestic General Merchandise segment. In 2002, the successor-assignee of the

leases of a former business included in the Domestic General Merchandise segment filed a petition in bankruptcy, and

rejected in the bankruptcy proceeding certain leases it originally acquired from a subsidiary of the Company. During 2003,

the Company recorded charges totaling $4 million related to claims with regard to certain of these leases, as well as others

that have been settled. At January 28, 2006, one of these actions remains unresolved, the court has granted the Company’s

motion for summary judgment. The landlord is currently appealing the matter.

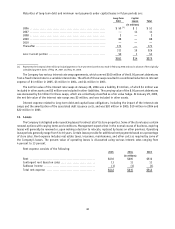

The major components of the pre-tax losses (gains) on disposal and disposition activity related to the reserves are

presented below. The remaining reserve balances as of January 28, 2006 primarily represent lease obligations; $8 million

is expected to be utilized within twelve months and the remaining $14 million thereafter.

2002 2003 2004 2005

Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

(in millions)

Northern Group .................... $ 7 $ 1 $ (6) $ 2 $— $ 1 $ 3 $— $ 2 $ 5

International General Merchandise .... 7 — (2) 5 — — 5 2 1 8

Specialty Footwear ................. 3 — (1) 2 (1) 1 2 — (1) 1

Domestic General Merchandise ........ 10 4 (4) 10 — (2) 8 — — 8

Total ............................ $27 $ 5 $(13) $19 $ (1) $— $18 $ 2 $ 2 $22

* Net usage includes effect of foreign exchange translation adjustments.

42