Foot Locker 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.– his long-term bonus at target for the performance period ending in the year his

termination occurred, prorated to his termination date,

– outplacement services for a period of one year following his termination date, and

– all unvested shares of restricted stock would vest.

Termination Following a Change in Control. If Mr. Serra’s employment terminates following a

Change in Control, as provided under the agreement, he would receive the following payments

and benefits, but the minimum amount of cash payments to Mr. Serra may not be less than 1.5

times his base salary and annual bonus at target:

– his base salary to the end of the contract term,

– his annual bonus at target, prorated to his termination date,

– his long-term bonus at target for the performance period ending in the year his

termination occurred, prorated to his termination date,

– outplacement services for a period of one year following his termination date, and

– all unvested shares of restricted stock and stock options would vest.

If the payments or benefits received by Mr. Serra following a Change in Control are subject to

the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, as amended (the

“Internal Revenue Code’’), we would make a gross-up payment to Mr. Serra in order to put him

in the same after-tax position he would have been in had no excise tax been imposed. In addition

to termination of the employment by the Company or by Mr. Serra for Good Reason, Mr. Serra

may trigger the termination of his employment within the 30-day period commencing three

months following a Change in Control and, in that case, he would be entitled to receive the

payments and benefits specified above.

•Non-Competition. Mr. Serra is subject to a non-competition and non-solicitation provision for

two years following the termination of his employment agreement.

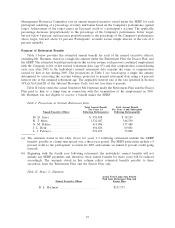

R. T. Mina, G. M. Bahler, J. L. Berk, and L. J. Petrucci

We also have employment agreements with Richard T. Mina, as President and Chief Executive

Officer of Foot Locker, Inc.-U.S.A., and with Gary M. Bahler, Jeffrey L. Berk and Laurie J. Petrucci, as

Senior Vice Presidents of the Company.

•Term. The current term of Mr. Mina’s agreement ends on May 1, 2007 and will automatically be

extended for additional one-year periods unless notice is given by the Company or Mr. Mina that

the term will not be extended. The current terms of the agreements with Ms. Petrucci and

Messrs. Bahler and Berk end on December 31, 2006 and will automatically be extended for

additional one-year periods unless notice is given by the Company that the term will not be

extended.

•Benefits Plans and Perquisites. The executives are entitled to participate in all benefit plans and

arrangements in effect on the effective date of their agreements, including the retirement plans,

annual and long-term incentive compensation plans, and medical, dental and disability plans, as

well as any other plans subsequently offered to senior executives of Foot Locker.

•Payments and Benefits on Termination.

For Cause, Death or Disability. If the employment of any of the executives is terminated for

Cause, death or disability, he or she would receive payment of his or her annual base salary

through the termination date. The executive would also receive those benefits, if any, that the

Company provides under its policies to employees whose employment is terminated for these

reasons and any benefits required to be provided under the terms of any benefit or incentive

plan.

Without Cause or Good Reason. If the Company terminates the employment of any of the

executives without Cause or if the executive terminates his or her employment for Good Reason,

we will pay the executive his or her base salary through the termination date and a severance

benefit. The severance benefit would be equal to the sum of two weeks’ salary plus

1

⁄

26

of his or

25