Foot Locker 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

There were no disagreements between the Company and its independent registered public accounting firm on matters

of accounting principles or practices.

Item 9A. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures.

The Company’s management performed an evaluation under the supervision and with the participation of the

Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), and completed an evaluation of

the effectiveness of the design and operation of the Company’s disclosure controls and procedures (as that

term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”)) as of January 28, 2006. Based on that evaluation, the Company’s CEO and CFO concluded

that the Company’s disclosure controls and procedures were effective as of January 28, 2006 in alerting them

in a timely manner to all material information required to be disclosed in this report.

(b) Management’s Annual Report on Internal Control over Financial Reporting.

The Company’s management is responsible for establishing and maintaining adequate internal control over

financial reporting (as that term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f)). To evaluate the

effectiveness of the Company’s internal control over financial reporting, the Company uses the framework in

Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway

Commission (the “COSO Framework”). Using the COSO Framework, the Company’s management, including the

CEO and CFO, evaluated the Company’s internal control over financial reporting and concluded that the

Company’s internal control over financial reporting was effective as of January 28, 2006. KPMG LLP, the

independent registered public accounting firm that audits the Company’s consolidated financial statements

included in this annual report, has issued an attestation report on the Company’s assessment of and

effectiveness of internal control over financial reporting, which is included herein under the caption

“Management’s Report on Internal Control over Financial Reporting” in “Item 8. Consolidated Financial

Statements and Supplementary Data.”

(c) Attestation Report of the Independent Registered Public Accounting Firm.

(d) Changes in Internal Control over Financial Reporting.

During the Company’s last fiscal quarter there were no changes in internal control over financial reporting

that materially affected, or is reasonably likely to materially affect, the Company’s internal control over

financial reporting.

PART III

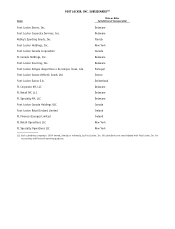

Item 10. Directors and Executive Officers of the Company

(a) Directors of the Company

Information relative to directors of the Company is set forth under the section captioned “Election of

Directors” in the Proxy Statement and is incorporated herein by reference.

(b) Executive Officers of the Company

Information with respect to executive officers of the Company is set forth immediately following Item 4

in Part I.

(c) Information with respect to compliance with Section 16(a) of the Securities Exchange Act of 1934 is set forth

under the section captioned “Section 16(a) Beneficial Ownership Reporting Compliance” in the Proxy Statement

and is incorporated herein by reference.

(d) Information on our audit committee financial expert is contained in the Proxy Statement under the section

captioned “Committees of the Board of Directors” and is incorporated herein by reference.

(e) Information about the Code of Business Conduct governing our employees, including our Chief Executive Officer,

Chief Financial Officer, Chief Accounting Officer, and the Board of Directors, is set forth under the heading “Code

of Business Conduct” under the Corporate Governance Information section of the Proxy Statement and is

incorporated herein by reference.

56