Foot Locker 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

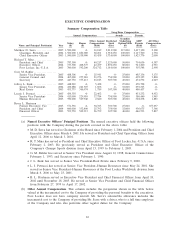

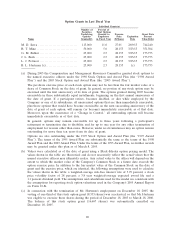

value of the Company’s matching contribution under the 401(k) Plan made to the named

executive’s account in shares of Common Stock. The shares of Common Stock for the matching

contributions for 2005, 2004, and 2003 were valued at $23.40, $26.93, and $23.45 per share,

respectively. This column also includes the severance payment for Mr. Hartman, which is payable

in June 2006, under the terms of his severance agreement described on Page 26.

Employer Matching

Life Insurance Contribution Under Severance

Name Year Premium 401(k) Plan Payment

M. D. Serra ...................................... 2005 $ -0- $2,100 $ —

2004 -0- 1,738 —

2003 -0- 2,000 —

R. T. Mina ....................................... 2005 4,287 2,100 —

2004 3,225 1,738 —

2003 2,998 -0- —

G. M. Bahler ..................................... 2005 3,075 2,100 —

2004 2,130 1,738 —

2003 2,049 2,000 —

L. J. Petrucci ..................................... 2005 2,852 2,100 —

2004 1,963 -0- —

2003 1,883 -0- —

B. L. Hartman ................................... 2005 7,137 -0- 650,500

2004 5,628 1,738 —

2003 5,817 2,000 —

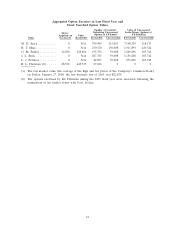

Long-Term Incentive Plan — Awards in Last Fiscal Year(a)

Performance Estimated Future Payouts Under

Number of Period Non-Stock Price-Based Plan

Shares, Units Until

Name or Other Rights(#) Payout Threshold($) Target($) Maximum($)

M. D. Serra ..................... 1,500,000 2005-2007 337,500 1,350,000 2,700,000

R. T. Mina...................... 800,000 2005-2007 180,000 720,000 1,440,000

G. M. Bahler ................... 494,700 2005-2007 111,308 445,230 890,460

J. L. Berk ....................... 453,100 2005-2007 101,948 407,790 815,580

L. J. Petrucci ................... 442,100 2005-2007 99,473 397,890 795,780

B. L. Hartman .................. 650,500 2005-2007 N/A N/A N/A

(a) The named executive officers, excluding B. L. Hartman, participate in the Long-Term Incentive

Compensation Plan (the “Long-Term Plan’’). Mr. Hartman participated in the Long-Term Plan

while he was a senior officer of the Company. Individual target awards under the Long-Term Plan

are expressed as a percentage of the participant’s Annual Base Salary. In 2005 the Compensation

and Management Resources Committee approved awards to the participants for the Performance

Period of 2005–2007. The amounts shown in the table above under the column headed “Number of

Shares, Units or Other Rights’’ represent the annual rate of base salary for 2005 for each of the

named executive officers. The amounts shown in the columns headed “Threshold,’’ “Target,’’ and

“Maximum’’ represent 22.5 percent, 90 percent and 180 percent, respectively, of each of the named

executive officers’ annual base salary rate in the first year of the Performance Period and represent

the amount that would be paid to the participant at the end of the applicable Performance Period if

the Company achieves the established goals. Mr. Hartman is not eligible for any payment under the

Long-Term Plan since his employment terminated before the end of this Performance Period.

The principal features of the Long-Term Plan are described beginning on Page 36.

19