Foot Locker 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

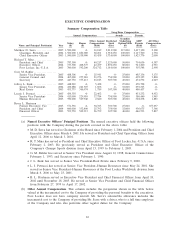

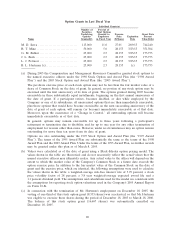

Tax Gross-

Medical Supp. LTD ups for Emp.

Automobile Financial Expense Insurance Relocation Relocation Agreement

Name Year Allowance Planning Reimbursement Premiums Expenses Expenses Legal Fees Total

M. Serra ...... 2005 $48,277 $ 4,500 $ 4,847 $ -0- $ - 0- $ -0- $5,565 $ 63,189

2004 44,965 4,500 10,796 -0- -0- -0- -0- 60,261

2003 42,447 4,500 9,034 -0- -0- -0- 7,477 63,458

R. Mina ....... 2005 30,402 1,250 5,924 2,641 -0- -0- -0- 40,217

2004 15,844 7,500 2,896 2,641 7,706 5,892 -0- 42,479

2003 16,702 5,965 4,022 1,981 162,083 133,959 -0- 324,712

G. Bahler ..... 2005 15,819 3,000 1,728 5,394 -0- -0- -0- 25,941

2004 13,465 3,000 1,524 5,287 -0- -0- -0- 23,276

2003 13,280 3,000 2,067 4,838 -0- -0- -0- 23,185

J. Berk ........ 2005 1,493 -0- 3,935 -0- -0- -0- -0- 5,428

2004 915 -0- 691 -0- -0- -0- -0- 1,606

2003 668 -0- 1,121 -0- -0- -0- -0- 1,789

L. Petrucci .... 2005 18,529 3,440 493 -0- -0- -0- -0- 22,462

2004 15,000 2,000 784 -0- -0- -0- -0- 17,784

2003 -0- 1,500 1,340 -0- -0- -0- -0- 2,840

B. Hartman . . . 2005 23,229 10,000 5,496 -0- -0- -0- -0- 38,725

2004 14,459 7,500 3,833 -0- -0- -0- -0- 25,792

2003 14,570 7,500 4,729 -0- -0- -0- -0- 26,799

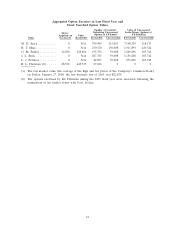

(c) Restricted Stock

•Unvested Shares at End of 2005 Fiscal Year. At January 28, 2006 the named executive officers

held the number of shares of unvested restricted stock, listed in the table below, having the

values stated below, based upon a $22.39 closing price of the Company’s Common Stock as

reported on The New York Stock Exchange on January 27, 2006, the last business day prior to

the end of the fiscal year.

# of Shares of Year-End

Name Restricted Stock $ Value

M. D. Serra ............................................ 345,000 7,724,550

R. T. Mina............................................. 215,000 4,813,850

G. M. Bahler .......................................... 60,000 1,343,400

J. L. Berk .............................................. 30,000 671,700

L. J. Petrucci .......................................... 60,000 1,343,400

B. L. Hartman ......................................... -0- -0-

•Restricted Stock Awards During 2003-2005. The Company granted awards of restricted stock to

the named executive officers in fiscal years 2003–2005 on the dates indicated in the table below.

The shares of restricted stock vest on their respective vesting dates, provided that the executive

remains employed by the Company from the date of grant through the applicable vesting date.

The shares of restricted stock awarded to Bruce Hartman in 2003–2005 were forfeited on

December 18, 2005 because his employment with Foot Locker ended prior to the vesting dates

for these awards. The executives have the right to receive and retain all regular cash dividends

payable after the date of grant to record holders of Common Stock. We calculated the values of

the restricted stock awards by multiplying the closing price of the Company’s Common Stock on

17