Foot Locker 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

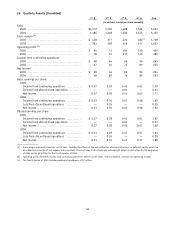

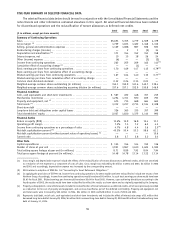

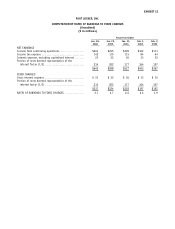

26 Quarterly Results (Unaudited)

1

st

Q2

nd

Q3

rd

Q4

th

Q Year

(in millions, except per share amounts)

Sales

2005 .............................................. $1,377 1,304 1,408 1,564 5,653

2004 .............................................. 1,186 1,268 1,366 1,535 5,355

Gross margin

(a)

2005 .............................................. $ 418 377 430 484

(c)

1,709

2004 .............................................. 361 369 426 477 1,633

Operating profit

(b)

2005 .............................................. $ 94 71 104 140 409

2004 .............................................. 78 61 117 133 389

Income from continuing operations

2005 .............................................. $ 58 44 65 96 263

2004 .............................................. 47 45 74 89 255

Net income

2005 .............................................. $ 58 44 66 96 264

2004 .............................................. 48 82 74 89 293

Basic earnings per share:

2005

Income from continuing operations ............ $ 0.37 0.29 0.42 0.62 1.70

Income from discontinued operations .......... — — 0.01 — 0.01

Net income ..................................... 0.37 0.29 0.43 0.62 1.71

2004

Income from continuing operations ............ $ 0.33 0.30 0.47 0.58 1.69

Loss from discontinued operations ............. — 0.25 — — 0.25

Net income ..................................... 0.33 0.55 0.47 0.58 1.94

Diluted earnings per share:

2005

Income from continuing operations ............ $ 0.37 0.28 0.41 0.61 1.67

Income from discontinued operations .......... — — 0.01 — 0.01

Net income ..................................... 0.37 0.28 0.42 0.61 1.68

2004

Income from continuing operations ............ $ 0.31 0.29 0.47 0.57 1.64

Loss from discontinued operations ............. — 0.24 — — 0.24

Net income ..................................... 0.31 0.53 0.47 0.57 1.88

(a) Gross margin represents sales less cost of sales. Includes the effects of the reclassification of tenant allowances as deferred credits, which are

amortized as a reduction of rent expense as a component of costs of sales. Costs of sales was reduced by $1 million in each of the first three quarters

of 2004 and by $2 million for the fourth quarter of 2004.

(b) Operating profit represents income from continuing operations before income taxes, interest expense, net and non-operating income.

(c) The fourth quarter of 2005 includes permanent markdowns of $7 million.

54