Foot Locker 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

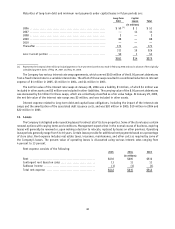

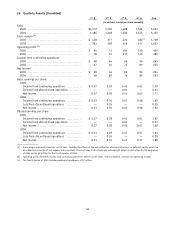

The Company’s pension plan weighted-average asset allocations at January 28, 2006 and January 29, 2005, by asset

category are as follows:

2005 2004

Asset Category

Equity securities .......................................................... 62% 63%

Foot Locker, Inc. common stock ........................................... 2% 2%

Debt securities ............................................................ 34% 33%

Real estate ................................................................ 1% 1%

Other ...................................................................... 1% 1%

Total ...................................................................... 100% 100%

The U.S. defined benefit plan held 396,000 shares of Foot Locker, Inc. common stock as of January 28, 2006 and

January 29, 2005. Currently, the target composition of the weighted-average plan assets is 64 percent equity and 36

percent fixed income securities, although the Company may alter the targets from time to time depending on market

conditions and the funding requirements of the pension plans. The Company believes that plan assets are invested in a

prudent manner with an objective of providing a total return that, over the long term, provides sufficient assets to fund

benefit obligations, taking into account the Company’s expected contributions and the level of risk deemed appropriate.

The Company’s investment strategy is to utilize asset classes with differing rates of return, volatility and correlation to

reduce risk by providing diversification relative to equities. Diversification within asset classes is also utilized to reduce

the effect that the return of any single investment may have on the entire portfolio. The Company contributed $68 million

to its pension plans in February 2006.

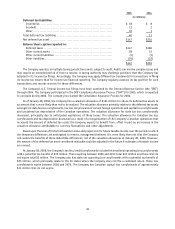

Estimated future benefit payments for each of the next five years and the five years thereafter are as follows:

Pension

Benefits

Postretirement

Benefits

(in millions)

2006 ...................................................................... $ 64 $2

2007 ...................................................................... 62 3

2008 ...................................................................... 60 3

2009 ...................................................................... 60 2

2010 ...................................................................... 58 2

2011–2015 ...................................................................... 263 6

Savings Plans

The Company has two qualified savings plans, a 401(k) Plan that is available to employees whose primary place of

employment is the U.S., and an 1165 (e) Plan, which began during 2004 that is available to employees whose primary

place of employment is in Puerto Rico. Both plans require that the employees have attained at least the age of twenty-one

and have completed one year of service consisting of at least 1,000 hours. The savings plans allow eligible employees to

contribute up to 25 percent and 10 percent, for the U.S. and Puerto Rico plans, respectively, of their compensation on

a pre-tax basis. The Company matches 25 percent of the first 4 percent of the employees’ contributions with Company

stock and such matching Company contributions are vested incrementally over 5 years for both plans. The charge to

operations for the Company’s matching contribution for the U.S. plan was $1.6 million, $1.3 million and $1.5 million in

2005, 2004 and 2003, respectively.

21 Stock Plans

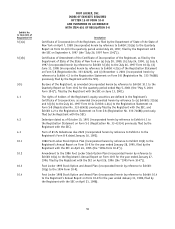

In 2003, the Company adopted the 2003 Stock Option and Award Plan (the “2003 Stock Option Plan”) and the 2003

Employees Stock Purchase Plan (the “2003 Stock Purchase Plan”). Under the 2003 Stock Option Plan, options, restricted

stock, stock appreciation rights (SARs), or other stock-based awards may be granted to officers and other employees at

not less than the market price on the date of the grant. Unless a longer or shorter period is established at the time of

the option grant, generally, one-third of each stock option grant becomes exercisable on each of the first three anniversary

dates of the date of grant. The maximum number of shares of stock reserved for issuance pursuant to the 2003 Stock Option

Plan is 4,000,000 shares. The number of shares reserved for issuance as restricted stock and other stock-based awards

cannot exceed 1,000,000 shares. The Company adopted the 2003 Stock Purchase Plan whose terms are substantially the

same as the 1994 Employees Stock Purchase Plan (the “1994 Stock Purchase Plan”), which expired in June 2004. Under

the 2003 Stock Purchase Plan, 3,000,000 shares of common stock became available for purchase beginning June 2005.

50