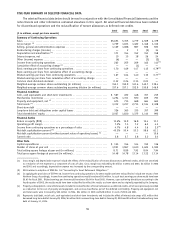

Foot Locker 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Risk

The retailing business is highly competitive. Price, quality and selection of merchandise, reputation, store location,

advertising and customer service are important competitive factors in the Company’s business. The Company operates in

20 countries and purchased approximately 75 percent of its merchandise in 2005 from its top 5 vendors. In 2005, the

Company purchased approximately 49 percent of its athletic merchandise from one major vendor and approximately

8 percent from another major vendor. The Company generally considers all vendor relations to be satisfactory.

Included in the Company’s Consolidated Balance Sheet as of January 28, 2006, are the net assets of the Company’s

European operations totaling $422 million, which are located in 16 countries, 11 of which have adopted the euro as their

functional currency.

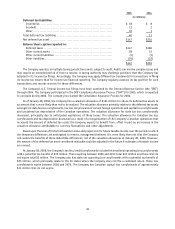

20 Retirement Plans and Other Benefits

Pension and Other Postretirement Plans

The Company has defined benefit pension plans covering most of its North American employees, which are funded

in accordance with the provisions of the laws where the plans are in effect. In addition to providing pension benefits,

the Company sponsors postretirement medical and life insurance plans, which are available to most of its retired U.S.

employees. These plans are contributory and are not funded. The measurement date of the assets and liabilities is the

last day of January each year.

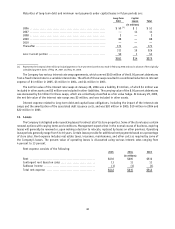

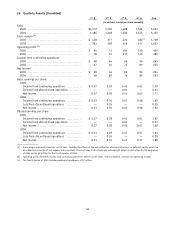

The following tables set forth the plans’ changes in benefit obligations and plan assets, funded status and amounts

recognized in the Consolidated Balance Sheets, measured at January 28, 2006 and January 29, 2005:

Pension Benefits

Postretirement

Benefits

2005 2004 2005 2004

(in millions)

Change in benefit obligation

Benefit obligation at beginning of year .................. $ 703 $ 697 $ 24 $ 27

Service cost ............................................. 9 9 — —

Interest cost ............................................. 36 39 1 1

Plan participants’ contributions .......................... — — 5 5

Actuarial loss (gain) ..................................... — 16 (5) —

Foreign currency translation adjustments ................ 7 5 — —

Benefits paid ............................................ (66) (63) (8) (9)

Benefit obligation at end of year ........................ $ 689 $ 703 $ 17 $ 24

Change in plan assets

Fair value of plan assets at beginning of year ............ $ 551 $ 474

Actual return on plan assets ............................. 60 28

Employer contribution ................................... 29 108

Foreign currency translation adjustments ................ 5 4

Benefits paid ............................................ (66) (63)

Fair value of plan assets at end of year .................. $ 579 $ 551

Funded status

Funded status ........................................... $(110) $(152) $(17) $ (24)

Unrecognized prior service cost (benefit) ................ 3 4 (9) (10)

Unrecognized net (gain) loss ............................ 303 324 (60) (67)

Prepaid asset (accrued liability) ......................... $ 196 $ 176 $(86) $(101)

Balance Sheet caption reported in:

Intangible assets ........................................ $ 1 $ 1 $ — $ —

Accrued liabilities ....................................... (70) (24) (2) (6)

Other liabilities .......................................... (42) (130) (84) (95)

Accumulated other comprehensive loss, pre-tax ......... 307 329 — —

$ 196 $ 176 $(86) $(101)

48