Foot Locker 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

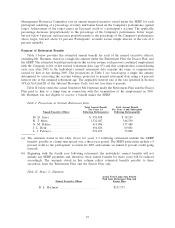

Management Resources Committee sets an annual targeted incentive award under the SERP for each

participant consisting of a percentage of salary and bonus based on the Company’s performance against

target. Achievement of the target causes an 8 percent credit to a participant’s account. The applicable

percentage decreases proportionately to the percentage of the Company’s performance below target,

but not below 4 percent, and increases proportionately to the percentage of the Company’s performance

above target, but not above 12 percent. Participants’ accounts accrue simple interest at the rate of 6

percent annually.

Payment of Retirement Benefits

Table I below provides the estimated annual benefit for each of the named executive officers,

excluding Mr. Hartman, stated as a single life annuity under the Retirement Plan, the Excess Plan, and

the SERP. The estimated benefit projections in this section assume each person’s continued employment

with the Company to his or her normal retirement date (age 65) and that compensation earned during

each year after 2005 to the individual’s normal retirement date remains the same as compensation

earned by him or her during 2005. The projections in Table I are based upon a single life annuity

determined by converting the account balance projected to normal retirement date using a 6 percent

interest rate at the assumed retirement age. The applicable interest rate is the rate specified in Section

417(e)(3)(A)(ii)(II) of the Internal Revenue Code, but not less than 6 percent.

Table II below states the actual benefit for Mr. Hartman under the Retirement Plan and the Excess

Plan paid to him as a lump sum in connection with the termination of his employment in 2005.

Mr. Hartman was not eligible to receive a benefit under the SERP.

Table I. Projections at Normal Retirement Date

Total Annual Benefit Total Annual Benefit

For Years 1-3 For Years 4 and Subsequent

Named Executive Officer Following Retirement(a) Following Retirement(b)

M. D. Serra ....................... $ 950,838 $ 58,259

R. T. Mina ........................ 1,522,027 346,350

G. M. Bahler ...................... 619,006 137,480

J. L. Berk ......................... 694,626 69,862

L. J. Petrucci ...................... 670,455 75,889

(a) The amounts stated in the table above for years 1-3 following retirement include the SERP

benefits, payable as a lump sum spread over a three-year period. The SERP projections include a 4

percent credit to the participants’ accounts for 2005 and assume an annual 8 percent credit going

forward.

(b) Beginning with the fourth year following retirement, the individuals’ annual benefits will not

include any SERP payments and, therefore, their annual benefits for those years will be reduced

accordingly. The amounts stated in this column reflect estimated benefits payable to these

executives from the Retirement Plan and the Excess Plan only.

Table II. Bruce L. Hartman

Actual Total Lump Sum Benefit

Paid from Retirement Plan and

Named Executive Officer Excess Plan

B. L. Hartman ............................... $151,573

23