Foot Locker 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sales

All references to comparable-store sales for a given period relate to sales of stores that are open at the period-end

and that have been open for more than one year and exclude the effect of foreign currency fluctuations. Accordingly, stores

opened and closed during the period are not included. Sales from the Direct-to-Customer segment are included in the

calculation of comparable-store sales for all periods presented. All references to comparable-store sales for 2004 exclude

the acquisition of the 349 Footaction stores and the 11 stores purchased in the Republic of Ireland. Sales from acquired

businesses that include the purchase of inventory will be included in the computation of comparable-store sales after 15

months of operations. Accordingly, Footaction sales are included in the computation of comparable-store sales since

August 2005.

Sales of $5,653 million in 2005 increased by 5.6 percent from sales of $5,355 million in 2004. The effect of foreign

currency fluctuations on sales was not significant. This increase is primarily related to increased sales in the Company’s

Footaction and Champs Sports formats. Comparable-store sales increased by 2.7 percent.

Sales of $5,355 million in 2004 increased by 12.1 percent from sales of $4,779 million in 2003. Excluding the effect

of foreign currency fluctuations, sales increased by 9.8 percent as compared with 2003, primarily as a result of the Company’s

acquisition of 349 Footaction stores in May 2004 and the acquisition of 11 stores in the Republic of Ireland in late October

2004, which accounted for $332 million and $5 million in sales, respectively, for 2004. Comparable-store sales increased

by 0.9 percent. The remaining increase is a result of the Company’s continuation of the new store-opening program.

Gross Margin

Gross margin as a percentage of sales was 30.2 percent in 2005, decreasing by 30 basis points from 30.5 percent

in 2004. This decline is primarily the result of increased markdowns recorded by the European operation. The effect of

vendor allowances on gross margin, as a percentage of sales, as compared with the corresponding prior year period was

not significant.

Gross margin as a percentage of sales was 30.5 percent in 2004, a decrease of 50 basis points from 31.0 percent in

2003. Of the 50 basis points decrease in 2004, approximately 60 basis points is the result of the Footaction chain, offset,

in part, by a decrease in the cost of merchandise. The effect of vendor allowances on gross margin, as a percentage of

sales, as compared with the corresponding prior year period was not significant.

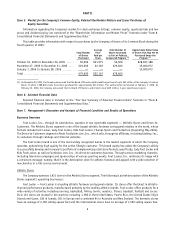

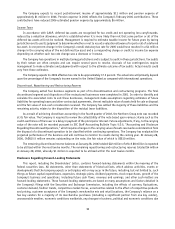

Division Profit

The Company evaluates performance based on several factors, the primary financial measure of which is division

profit. Division profit reflects income from continuing operations before income taxes, corporate expense, non-operating

income and net interest expense. The following table reconciles division profit by segment to income from continuing

operations before income taxes.

2005 2004 2003

(in millions)

Athletic Stores .............................................. $419 $420 $363

Direct-to-Customers......................................... 48 45 53

Division profit .............................................. 467 465 416

Restructuring charges

(1)

.................................... — (2) (1)

Total division profit.................................... 467 463 415

Corporate expense .......................................... (58) (74) (73)

Total operating profit ....................................... 409 389 342

Other income ............................................... 6 — —

Interest expense, net ....................................... (10) (15) (18)

Income from continuing operations before income taxes.... $405 $374 $324

(1) As more fully described in the notes to the consolidated financial statements, restructuring charges of $2 million and $1 million in 2004 and 2003,

respectively, were recorded related to the dispositions of non-core businesses.

8