Foot Locker 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the foreign exchange currency translation adjustment, primarily related to the value of the euro in relation to the U.S. dollar.

The Company declared and paid dividends totaling $49 million during 2005. The Company repurchased approximately 1.6 million

shares for $35 million during the year. During 2005, the Company reduced its minimum liability for the Company’s pension plans

by $15 million, primarily as a result of the plans’ asset performance. The Company contributed $19 million and $7 million to

the Company’s U.S. and Canadian qualified pension plans, respectively in 2005.

Excluding the present value of operating leases, the Company’s cash, cash equivalents and short-term investments, net

of debt and capital lease obligations, increased to $127 million at January 29, 2005 from $113 million at January 31, 2004.

The Company increased debt and capital lease obligations by $25 million while increasing cash, cash equivalents and short-

term investments by $44 million. This improvement was offset by an increase of $306 million in the present value of operating

leases primarily related to the Footaction acquisition and additional lease renewals entered into during 2004. Including the

present value of operating leases, the Company’s net debt capitalization percent improved 2.9 percentage points in 2004.

Total capitalization increased by $742 million in 2004, which was primarily attributable to an increase in shareholders’ equity.

The increase in shareholders’ equity relates to net income of $293 million in 2004, an increase of $147 million resulting from

the conversion of $150 million subordinated notes to equity, net of unamortized deferred issuance costs, $49 million related

to employee stock plans, and an increase of $19 million in the foreign exchange currency translation adjustment, primarily

related to the strength of the euro. The Company declared and paid dividends totaling $39 million during 2004. The Company

also recorded an increase of $14 million to the minimum liability for the Company’s pension plans during 2004. This increase

was primarily a result of the 40 basis point decrease in the discount rate used to calculate present value of the obligations

as of January 29, 2005, offset, in part, by an increase in the plans’ asset performance. The Company contributed $44 million

and $6 million to the Company’s U.S. and Canadian qualified pension plans, respectively, in February 2004 and an additional

$56 million to the Company’s U.S. qualified pension plan in September 2004, in advance of ERISA requirements.

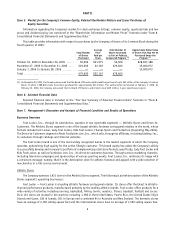

Contractual Obligations and Commitments

The following tables represent the scheduled maturities of the Company’s contractual cash obligations and other

commercial commitments as of January 28, 2006: Payments Due by Period

Contractual Cash Obligations Total

Less than

1 Year

2–3

Years

3–5

Years

After 5

Years

(in millions)

Long-term debt

(1)

............................... $ 311 $ — $ 52 $ 88 $171

Operating leases .................................. 2,600 454 782 561 803

Capital lease obligations .......................... 15 1 14 — —

Other long-term liabilities

(2)

..................... — — — — —

Total contractual cash obligations ................ $2,926 $455 $848 $649 $974

(1) The amounts presented above represent the contractual maturities of the Company’s long-term debt, excluding interest. Additional information

is included in the “Long-Term Debt and Obligations under Capital Leases” footnote under “Item 8. Consolidated Financial Statements and

Supplementary Data.”

(2) The Company’s other liabilities in the Consolidated Balance Sheet as of January 28, 2006 primarily comprise pension and postretirement benefits, deferred

rent liability, income taxes, workers’ compensation and general liability reserves and various other accruals. These liabilities have been excluded from the

above table as the timing and/or amount of any cash payment is uncertain. The timing of the remaining amounts that are known have not been included

as they are minimal and not useful to the presentation. Additional information on the balance sheet caption is included in the “Other Liabilities” footnote

under “Item 8. Consolidated Financial Statements and Supplementary Data.”

Amount of Commitment Expiration by Period

Other Commercial Commitments

Total

Amounts

Committed

Less than

1 Year

1–3

Years

3–5

Years

After 5

Years

(in millions)

Line of credit ..................................... $ 186 $ — $— $186 $—

Stand-by letters of credit ......................... 14 — — 14 —

Purchase commitments

(3)

........................ 1,733 1,726 6 1 —

Other

(4)

.......................................... 60 28 23 9 —

Total commercial commitments ................... $1,993 $1,754 $29 $210 $—

(3) Represents open purchase orders, as well as minimum required purchases under merchandise contractual agreements, at January 28, 2006. The Company

is obligated under the terms of purchase orders; however, the Company is generally able to renegotiate the timing and quantity of these orders with certain

vendors in response to shifts in consumer preferences.

(4) Represents payments required by non-merchandise purchase agreements and minimum royalty requirements. Effective March 31, 2006, the Company

terminated its agreement with the NFL.

15