Foot Locker 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

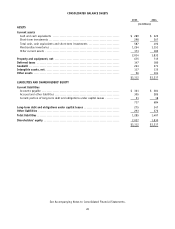

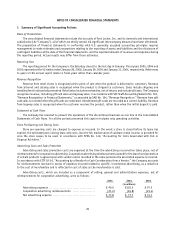

Catalog Costs

Catalog costs, which primarily comprise paper, printing, and postage, are capitalized and amortized over the expected

customer response period to each catalog, generally 90 days. Cooperative reimbursements earned for the promotion of certain

products is agreed upon with vendors and is recorded in the same period as the associated catalog expenses are amortized.

Prepaid catalog costs totaled $3.0 million and $3.5 million at January 28, 2006 and January 29, 2005, respectively.

Catalog costs, which are included as a component of selling, general and administrative expenses, net of

reimbursements for cooperative reimbursements, were as follows:

2005 2004 2003

(in millions)

Catalog costs ............................................... $48.2 $50.3 $42.4

Cooperative reimbursements ............................... (3.0) (2.9) (3.5)

Net catalog expense ........................................ $45.2 $47.4 $38.9

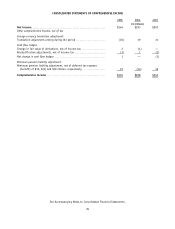

Earnings Per Share

Basic earnings per share is computed as net income divided by the weighted-average number of common shares

outstanding for the period. Diluted earnings per share reflects the potential dilution that could occur from common shares

issuable through stock-based compensation including stock options and the conversion of convertible long-term debt.

The following table reconciles the numerator and denominator used to compute basic and diluted earnings per share for

continuing operations.

2005 2004 2003

(in millions)

Income from continuing operations ........................ $ 263 $ 255 $ 209

Effect of Dilution:

Convertible debt ........................................... — 2 5

Income from continuing operations assuming dilution ..... $ 263 $ 257 $ 214

Weighted-average common shares outstanding ............. 155.1 150.9 141.6

Effect of Dilution:

Stock options and awards .................................. 2.5 3.0 1.8

Convertible debt ........................................... — 3.2 9.5

Weighted-average common shares outstanding

assuming dilution ....................................... 157.6 157.1 152.9

Options to purchase 2.2 million, 1.5 million and 3.6 million shares of common stock as of January 28, 2006,

January 29, 2005, and January 31, 2004 respectively, were not included in the computations because the exercise price

of the options was greater than the average market price of the common shares and, therefore, the effect of their inclusion

would be antidilutive.

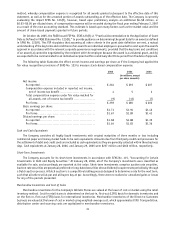

Stock-Based Compensation

The Company accounts for stock-based compensation plans in accordance with the intrinsic-value based method

permitted by SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS No. 123”). This method has not resulted

in compensation cost for stock options and shares purchased under employee stock purchase plans. No compensation

expense for employee stock options is reflected in net income, as all stock options granted under those plans had an

exercise price not less than the quoted market price at the date of grant. The market value at date of grant of restricted

stock is recorded as compensation expense over the period of vesting.

In March 2005, the SEC issued Staff Accounting Bulletin (SAB) No.107 to provide supplemental guidance in adopting

SFAS No.123 (R), “Share-Based Payment” (“SFAS No. 123(R)”). The bulletin provides guidance in accounting for share-

based transactions with non-employees, valuation methods, the classification of compensation expense, accounting for

the income tax effects of share-based payments, and disclosures in Management’s Discussion and Analysis subsequent

to the adoption of SFAS No. 123 (R). We are evaluating this guidance in conjunction with the adoption of SFAS No. 123

(R) and do not expect that the bulletin will have a material effect on the results of operations or financial position.

On April 14, 2005, the Securities and Exchange Commission issued a ruling that amended the effective date for

SFAS No. 123(R). The Company will adopt SFAS No. 123(R) effective January 29, 2006 using the modified prospective

30