Foot Locker 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

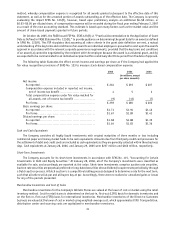

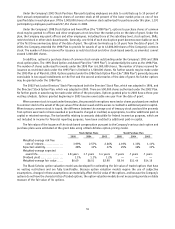

Future minimum lease payments under non-cancelable operating leases are:

(in millions)

2006 ..................................................................................... $ 454

2007 ..................................................................................... 420

2008 ..................................................................................... 362

2009 ..................................................................................... 299

2010 ..................................................................................... 262

Thereafter ................................................................................ 803

Total operating lease commitments ...................................................... $2,600

Present value of operating lease commitments ........................................... $1,934

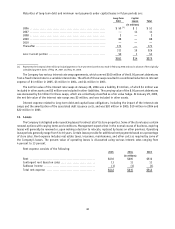

15 Other Liabilities

2005 2004

(in millions)

Pension benefits .......................................................... $ 42 $130

Postretirement benefits ................................................... 84 95

Straight-line rent liability ................................................. 83 77

Income taxes .............................................................. 35 29

Workers’ compensation / general liability reserves ......................... 12 11

Reserve for discontinued operations ....................................... 14 11

Repositioning and restructuring reserves .................................. 3 3

Fair value of derivatives ................................................... 2 —

Unfavorable leases ........................................................ 3 3

Other ...................................................................... 15 17

$293 $376

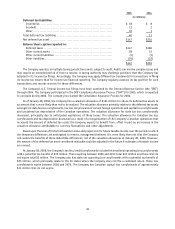

16 Discontinued Operations

On January 23, 2001, the Company announced that it was exiting its 694-store Northern Group segment. During the

second quarter of 2001, the Company completed the liquidation of the 324 stores in the United States. On September 28,

2001, the Company completed the stock transfer of the 370 Northern Group stores in Canada, through one of its wholly

owned subsidiaries for approximately CAD$59 million (approximately US$38 million), which was paid in the form of a note

(the “Note”). Another wholly owned subsidiary of the Company was the assignor of the store leases involved in the

transaction and therefore retains potential liability for such leases. The net amount of the assets and liabilities of the

former operations was written down to the estimated fair value of the Note. The transaction was accounted for pursuant

to SEC Staff Accounting Bulletin Topic 5:E, “Accounting for Divestiture of a Subsidiary or Other Business Operation,” as

a “transfer of assets and liabilities under contractual arrangement” as no cash proceeds were received and the

consideration comprised the Note, the repayment of which was dependent on the future successful operations of

the business.

An agreement in principle had been reached during December 2002 to receive CAD$5 million (approximately US$3

million) cash consideration in partial prepayment of the Note and accrued interest, and further, the Company agreed to

reduce the face value of the Note to CAD$17.5 million (approximately US$12 million). During the fourth quarter of 2002,

circumstances had changed sufficiently such that it became appropriate to recognize the transaction as an accounting

divestiture. Accordingly, the Note was recorded in the financial statements at its estimated fair value of CAD$16 million

(approximately US$10 million). On May 6, 2003, the amendments to the Note were executed and a cash payment of

CAD$5.2 million was received from the purchasers of the Northern Group, representing principal and interest through the

date of the amendment. On January 15, 2004, the Company received an additional payment of CAD$1 million, representing

a partial repayment of the Note. On August 20, 2004, the Company received a contingent payment of CAD$1 million, which

was based upon a certain transaction that occurred. As a result of the settlement of the contingent transaction, the

CAD$17.5 million Note was replaced with a new CAD$15.5 million note. The terms of the new note are substantially the

same as the May 6, 2003 Note, including the expiration date and interest payment terms.

41