Foot Locker 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

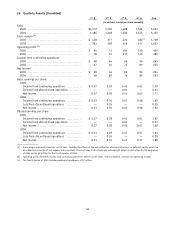

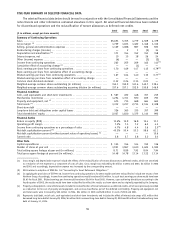

The information set forth in the following table covers options granted under the Company’s stock option plans:

2005 2004 2003

Number

of

Shares

Weighted-

Average

Exercise

Price

Number

of

Shares

Weighted-

Average

Exercise

Price

Number

of

Shares

Weighted-

Average

Exercise

Price

(in thousands, except prices per share)

Options outstanding at beginning of year ... 5,909 $16.69 6,886 $14.73 7,676 $15.18

Granted ..................................... 1,014 $27.42 1,183 $25.20 1,439 $10.81

Exercised .................................... 682 $15.03 1,853 $14.43 1,830 $12.50

Expired or canceled ......................... 279 $22.11 307 $19.13 399 $19.55

Options outstanding at end of year ......... 5,962 $18.45 5,909 $16.69 6,886 $14.73

Options exercisable at end of year .......... 4,042 $16.00 3,441 $15.34 4,075 $15.99

Options available for future grant at

end of year ............................... 5,768 7,464 8,780

The following table summarizes information about stock options outstanding and exercisable at January 28, 2006:

Options Outstanding Options Exercisable

Range of Exercise Prices Shares

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price

(in thousands, except prices per share)

$ 4.53 to $10.89 ......................... 1,012 6.6 $ 9.79 702 $ 9.59

$11.31 to $12.99 ........................ 1,158 5.0 12.24 1,154 12.24

$13.34 to $16.02 ........................ 1,047 6.0 15.83 1,043 15.84

$16.19 to $25.37 ........................ 1,016 4.1 22.93 799 23.15

$25.39 to $27.01 ........................ 1,032 8.3 25.65 327 25.39

$27.10 to $28.50 ........................ 697 9.1 28.04 17 28.15

$ 4.53 to $28.50 ......................... 5,962 6.4 $18.45 4,042 $16.00

22 Restricted Stock

Restricted shares of the Company’s common stock may be awarded to certain officers and key employees of the

Company. There were 225,000, 330,000, and 845,000 restricted shares of common stock granted in 2005, 2004 and 2003,

respectively. In 2005 and 2004, 20,000 and 72,005 restricted stock units, respectively, were granted to certain executives

located outside of the United States; each restricted unit represents the right to receive one share of the Company’s

common stock provided that the vesting conditions are satisfied. The market values of the shares and units at the date

of grant amounted to $6.5 million in 2005, $10.2 million in 2004 and $9.8 million in 2003. The market values are recorded

within shareholders’ equity and are amortized as compensation expense over the related vesting periods. These awards

fully vest after the passage of a restriction period, generally three years, except for certain grants in 2005, 2004 and 2003.

The Company granted 105,000 shares of restricted stock in 2005, which vest in three equal installments on approximately

each of the next three years grant date anniversary, 75,000 shares of restricted stock in 2004, which vest over 13 months

and in 2003 granted 200,000 shares of restricted stock that vested 50 percent one year following the date of grant and

50 percent that will vest two years from the date of grant. During 2005, 2004 and 2003, respectively, 176,135, 30,000

and 80,000 restricted shares and units were forfeited. The deferred compensation balance, reflected as a reduction to

shareholders’ equity, was $6.2 million, $9.0 million and $7.1 million as of January 28, 2006, January 29, 2005 and

January 31, 2004, respectively. The Company recorded compensation expense related to restricted shares, net of

forfeitures, of $6.1 million in 2005, $8.0 million in 2004 and $4.1 million in 2003.

52