Foot Locker 2005 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Philip H. Geier Jr. Age 71. Director since 1994. Chairman of the Board and Chief Executive

Officer of Interpublic Group of Companies, Inc. (advertising agencies and other marketing

communication services) from 1980 to December 31, 2000. He is a director of Fiduciary Trust Company

International, AEA Investors, Inc., Alcon, Inc., Mettler-Toledo, Inc. and IAG Research.

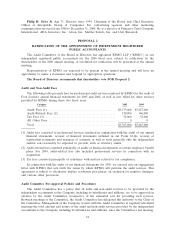

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTANTS

The Audit Committee of the Board of Directors has appointed KPMG LLP (“KPMG’’) as our

independent registered public accountants for the 2006 fiscal year, subject to ratification by the

shareholders at the 2006 annual meeting. A resolution for ratification will be presented at the annual

meeting.

Representatives of KPMG are expected to be present at the annual meeting and will have an

opportunity to make a statement and respond to appropriate questions.

The Board of Directors recommends that shareholders vote FOR Proposal 2.

Audit and Non-Audit Fees

The following table presents fees for professional audit services rendered by KPMG for the audit of

Foot Locker’s annual financial statements for 2005 and 2004, as well as fees billed for other services

provided by KPMG during these two fiscal years.

Category 2005 2004

Audit Fees (1) .................................................... $3,175,000 $3,227,000

Audit-Related Fees (2)............................................ 158,000 166,000

Tax Fees (3) ...................................................... 32,000 52,000

All Other Fees.................................................... 0 0

Total .............................................................. $3,365,000 $3,445,000

(1) Audit fees consisted of professional services rendered in conjunction with the audit of our annual

financial statements, reviews of financial statements included in our Form 10-Qs, reviews of

registration statements and issuances of consents, as well as work generally only the independent

auditor can reasonably be expected to provide, such as statutory audits.

(2) Audit-related fees consisted principally of audits of financial statements of certain employee benefit

plans. For 2004, audit-related fees also included professional services in connection with an

acquisition.

(3) Tax fees consisted principally of assistance with matters related to tax compliance.

In connection with the audit of our financial statements for 2005, we entered into an engagement

letter with KPMG that sets forth the terms by which KPMG will perform the audit services. This

agreement is subject to alternative dispute resolution procedures, an exclusion for punitive damages,

and various other provisions.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has a policy that all audit and non-audit services to be provided by the

independent accountants to the Company, including its subsidiaries and affiliates, are to be approved in

advance by the Audit Committee, irrespective of the estimated cost for providing such services.

Between meetings of the Committee, the Audit Committee has delegated this authority to the Chair of

the Committee. Management of the Company reviews with the Audit Committee at regularly scheduled

meetings the total amount and nature of the audit and non-audit services provided by the independent

accountants to the Company, including its subsidiaries and affiliates, since the Committee’s last meeting.

34