Foot Locker 2005 Annual Report Download - page 103

Download and view the complete annual report

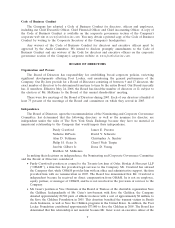

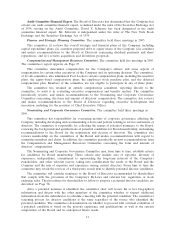

Please find page 103 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Audit Committee Financial Expert. The Board of Directors has determined that the Company has

at least one audit committee financial expert, as defined under the rules of the Securities Exchange Act

of 1934, serving on the Audit Committee. David Y. Schwartz has been designated as the audit

committee financial expert. Mr. Schwartz is independent under the rules of The New York Stock

Exchange and the Securities Exchange Act of 1934.

Finance and Strategic Planning Committee. The committee held three meetings in 2005.

This committee (i) reviews the overall strategic and financial plans of the Company, including

capital expenditure plans, (ii) considers proposed debt or equity issues of the Company, (iii) considers

and makes recommendations to the Board of Directors concerning dividend payments and share

repurchases, and (iv) reviews acquisition and divestiture proposals.

Compensation and Management Resources Committee. The committee held five meetings in 2005.

The committee’s report appears on Page 27.

This committee determines compensation for the Company’s officers and some aspects of

compensation for certain other executives of the Company and its operating divisions. The committee,

or its sub-committee, also administers Foot Locker’s various compensation plans, including the incentive

plans, the equity-based compensation plans, the employees stock purchase plan, and the deferred

compensation plan. Members of the committee are not eligible to participate in any of these plans.

The committee has retained an outside compensation consultant, reporting directly to the

committee, to assist it in evaluating executive compensation and benefits matters. The committee

periodically reviews, and makes recommendations to the Nominating and Corporate Governance

Committee concerning, the form and amount of directors’ compensation. The committee also reviews

and makes recommendations to the Board of Directors regarding executive development and

succession, including for the position of Chief Executive Officer.

Nominating and Corporate Governance Committee. The committee held three meetings in

2005.

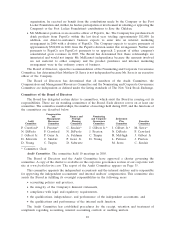

This committee has responsibility for overseeing matters of corporate governance affecting the

Company, including developing and recommending criteria and policies relating to service and tenure of

directors. The committee is responsible for collecting the names of potential nominees to the Board,

reviewing the background and qualifications of potential candidates for Board membership, and making

recommendations to the Board for the nomination and election of directors. The committee also

reviews membership on the committees of the Board and makes recommendations with regard to

committee members and chairs. In addition, the committee periodically reviews recommendations from

the Compensation and Management Resources Committee concerning the form and amount of

directors’ compensation.

The Nominating and Corporate Governance Committee may, from time to time, establish criteria

for candidates for Board membership. These criteria may include area of expertise, diversity of

experience, independence, commitment to representing the long-term interests of the Company’s

stakeholders, and other relevant factors, taking into consideration the needs of the Board and the

Company and the mix of expertise and experience among current directors. From time to time the

committee may retain the services of a third party search firm to identify potential director candidates.

The committee will consider nominees to the Board of Directors recommended by shareholders

that comply with the provisions of the Company’s By-Laws and relevant law, regulation, or stock

exchange rules. The procedures for shareholders to follow to propose a potential director candidate are

described on Page 38.

After a potential nominee is identified, the committee chair will review his or her biographical

information and discuss with the other members of the committee whether to request additional

information about the individual or to schedule a meeting with the potential candidate. The committee’s

screening process for director candidates is the same regardless of the source who identified the

potential candidate. The committee’s determination on whether to proceed with a formal evaluation of

a potential candidate is based on the person’s experience and qualifications, as well as the current

composition of the Board and its anticipated future needs.

11