Foot Locker 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Trust Agreement

The Company has established a trust (the “Trust’’) in connection with certain of its benefit plans,

arrangements, and agreements, including certain of those described above, and other benefit plans,

agreements or arrangements that subsequently may be covered (collectively, the “Benefit Obligations’’).

Under the Trust agreement, in the event of a Change in Control of the Company (as defined in the

Trust agreement), the trustee would pay to the persons entitled to the Benefit Obligations, out of funds

held in the Trust, the amounts to which they may become entitled under the Benefit Obligations. Upon

the occurrence of a Potential Change in Control of the Company (as defined in the Trust agreement),

the Company is required to fund the Trust with an amount sufficient to pay the total amount of the

Benefit Obligations. Following the occurrence, and during the pendency, of a Potential Change in

Control, the trustee is required to make payments of Benefit Obligations to the extent these payments

are not made by the Company.

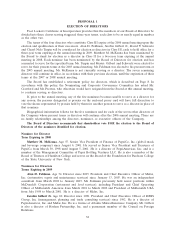

Compensation Committee Interlocks and Insider Participation

During 2005 the following individuals (none of whom had been an officer or employee of the

Company or any of its subsidiaries) served on the Compensation and Management Resources

Committee: Purdy Crawford, Philip H. Geier Jr., James E. Preston, Christopher Sinclair and Cheryl

Nido Turpin. There were no interlocks with other companies within the meaning of the SEC’s proxy

rules. As noted on Page 9, Mr. Crawford is Counsel to the Canadian law firm of Osler, Hoskin &

Harcourt LLP, which provides legal services to the Company. Mr. Crawford does not participate in

decisions regarding awards to executives covered by Section 16(a) of the Securities Exchange Act of

1934 under the Company’s 1998 Award Plan, the 2003 Award Plan or, prior to its expiration, the 1995

Award Plan.

Report of the Compensation and Management Resources Committee on Executive Compensation

The Compensation and Management Resources Committee of the Board of Directors, composed

of the independent directors named below, has responsibility for all compensation matters involving the

Company’s executive officers, and for significant elements of the compensation of the chief executive

officers of its business units.

Compensation Policy

The Company’s executive compensation program is designed to attract, motivate, and retain

talented retail industry executives in order to maintain and enhance the performance of the Company

and its return to shareholders. The Committee believes that executive compensation should be balanced

between annual and long-term compensation and that a substantial portion of the compensation of the

Company’s executive officers, whether paid out currently or on a long-term basis, should be dependent

on the Company’s performance. It is the Committee’s view that more senior officers should have a

greater portion of their compensation at risk, whether through incentive programs based upon the

achievement of performance targets or through stock price appreciation. The principal components of

the executive compensation program are as follows:

I. Annual Compensation

Base Salary. Base salaries for executive officers are determined based on a number of factors,

including the responsibilities of the position, the performance of the executive, and base salaries for

comparable positions at companies in the retail and athletic footwear and apparel industries.

Annual Bonus. Executive officers participate in the annual bonus program, which provides for

payment of a percentage multiple of the executive’s base salary depending upon the Company’s

performance in relation to targets established by the Committee at the beginning of each plan year. In

recent years, including 2005, these targets have been a combination of pre-tax income and return-on-

invested-capital. These performance targets are based on the business plan and budget for the year

reviewed and approved by the Finance and Strategic Planning Committee and the Board of Directors.

27