Foot Locker 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Positioned To Win

As we move forward, we have a number of

growth priorities underway that we are

confident will position our Company for

continued market leadership, strong

financial performance and delivery of

greater value to our shareholders.

The Company's first growth priority is

to fund capital projects designed to

enhance our existing business. During

2005, the Company spent approximately

80 percent of its $163 million capital

expenditures on store maintenance,

remodels and relocations, as well as

enhancements to our infrastructure and

sales support systems. The remaining 20

percent of the Company's 2005 capital

expenditure program was allocated to

opening new retail stores. During the year

we completed 600 real estate projects,

opening 119 new stores, remodeling and

relocating 316 stores, and closing 165

stores.

Acquiring compatible athletic

footwear and apparel retail companies is

another growth priority for our Company.

During the prior year, we explored sever-

al potential acquisition opportunities

that we believe could be a strategic fit

with our Company. We plan to continue to

pursue carefully acquisition opportuni-

ties, maintaining a patient posture to

ensure that potential investments are

accretive to our earnings per share and

generate a rate of return well in excess of

our cost of capital.

We continually seek new opportunities

to grow our Company profitably, while

prudently maintaining a conservative --

yet efficient -- capital structure designed

to minimize our cost of capital. Reducing

our financial liabilities and strengthening

our balance sheet are important consider-

ations as we strive to attain an invest-

ment-grade credit rating. With this prior-

ity in mind, during 2005 we repaid $35

million of long-term debt and contributed

$26 million to our pension plans.

Our Board of Directors is also commit-

ed to enhancing shareholder value

through both capital appreciation and

dividends. Thus, in November 2005, the

Board of Directors increased the cash div-

idend on Foot Locker, Inc.'s common

stock by 20 percent, to an annualized

amount of $0.36 per share, reflecting

confidence in the ability of management

to continue to increase the Company's

profitability. During the second quarter of

2005, we began to implement a share

repurchase program, with 1.6 million

shares purchased for the full year at a

cost of $35 million. Additionally, the

Board of Directors authorized in February

2006 a new three-year $150 million share

repurchase program that may be imple-

mented based upon market prices and

other factors.

Game Plan -- Expanding Our Reach

Looking to the future, we believe we have

many opportunities to accelerate our

growth by expanding the reach of our

business into both new and existing mar-

kets. We expect that these opportunities

will include the continued implementa-

tion of the growth strategy that we have

been successfully executing for several

years, as well as the development of new

initiatives that will allow us to reach a

larger and more diverse customer base.

An integral part of this growth strate-

gy is our real estate program, first

embarked upon in 2001, and geared at

opening 1,000 new stores over several

years. In line with this strategy, we

opened or acquired 961 new stores over

the past five years, while also closing 622

underperforming stores. During this time,

we also expanded our store base into six

new countries, including Greece and

Switzerland this past year.

As we look toward 2006, we have

increased our capital expenditure plan to

$190 million. This will enable us to accel-

erate our store openings to approximate-

ly 175 new stores and to expand our

reach by testing new markets. We esti-

mate that 80 percent of the new stores

will be located in the United States and

20 percent in international markets.

During 2006, we also plan to close

approximately 110 underperforming

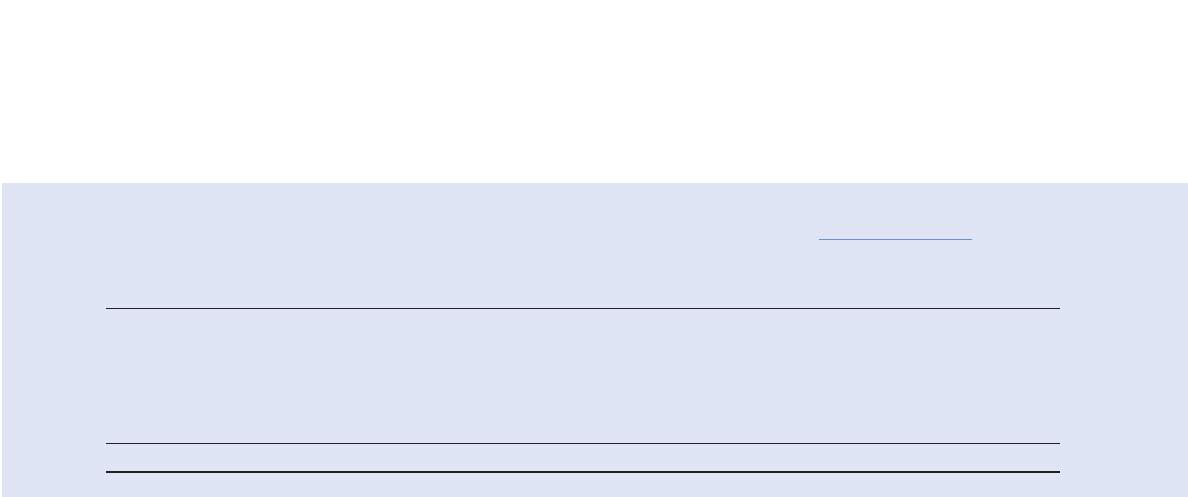

Gross Square Footage

Store Summary 2005 2006

January 29, January 28, Remodeled/ Average Total Targeted

2005 Opened Closed 2006 Relocated Size (thousands) Openings

Foot Locker 1,428 45 75 1,398 124 4,000 5,626 50

Footaction 349 24 10 363 40 4,700 1,718 20

Lady Foot Locker 567 8 21 554 19 2,200 1,241 25

Kids Foot Locker 346 1 20 327 39 2,400 791 20

Foot Locker International 707 30 14 723 38 2,900 2,062 35

Champs Sports 570 11 25 556 56 5,500 3,045 25

Total 3,967 119 165 3,921 316 3,700 14,483 175

3