Foot Locker 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17 Repositioning and Restructuring Reserves

1999 Restructuring

The Company recorded restructuring charges in 1999 for programs to sell or liquidate eight non-core businesses. The

restructuring plan also included an accelerated store-closing program in North America and Asia, corporate headcount

reduction and a distribution center shutdown. The dispositions of Randy River Canada, Foot Locker Outlets, Colorado,

Going to the Game!, Weekend Edition and the store-closing program were essentially completed in 2000. In 2001, the

Company completed the sales of The San Francisco Music Box Company (“SFMB”) and the assets related to its Burger King

and Popeye’s franchises. The termination of the Maumelle distribution center lease was completed in 2002.

In connection with the sale of SFMB, the Company remained as an assignor or guarantor of leases of SFMB related

to a distribution center and five store locations. In May 2003, SFMB filed a voluntary petition under Chapter 11 of the

Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware. During July and August 2003, SFMB rejected

four of the store leases and the distribution center lease and assumed one of the store leases in the bankruptcy

proceedings. During the second quarters of 2003 and 2004, the Company recorded charges of $1 million and $2 million,

respectively, primarily related to the distribution center lease. The lease for the distribution center expires January 31,

2010, while the store leases expired on January 31, 2004. As of January 28, 2006, the Company estimates its gross

contingent lease liability for the distribution center lease to be approximately $3 million, offset in part by the estimated

sublease income of $2 million. The Company entered into a sublease on November 15, 2004 for a significant portion of

the distribution center that will expire concurrent with the Company’s lease term. In addition, the Company is considering

additional sublease offers for the remaining square footage. Accordingly, at January 28, 2006 the reserve balance is

$1 million.

1993 Repositioning and 1991 Restructuring

The Company recorded charges in 1993 and in 1991 to reflect the anticipated costs to sell or close under-performing

specialty and general merchandise stores in the United States and Canada. As of January 28, 2006 the reserve balance

is $3 million.

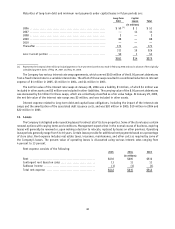

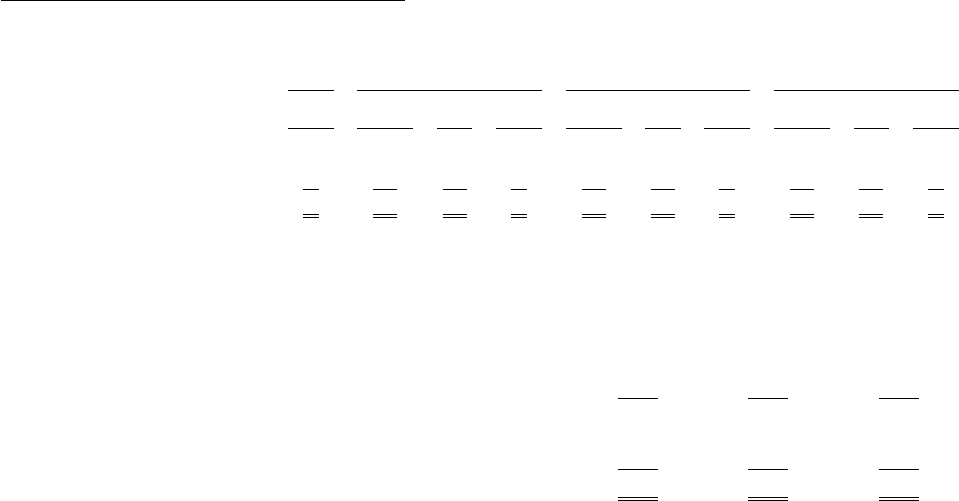

Total Repositioning and Restructuring Reserves

The components of the pre-tax losses (gains) on restructuring charges and disposition activity related to the reserves

are presented below:

2002 2003 2004 2005

Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

(in millions)

Real estate ....................... $2 $ 1 $(1) $2 $ 2 $(1) $3 $— $— $3

Other disposition costs .............. 1 — — 1 — — 1 — — 1

Total ............................ $3 $ 1 $(1) $3 $ 2 $(1) $4 $— $— $4

At January 28, 2006, $1 million of the total restructuring reserves is expected to be utilized within the next twelve

months and the remaining $3 million thereafter.

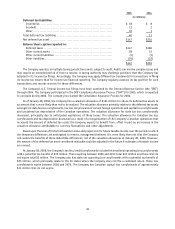

18 Income Taxes

Following are the domestic and international components of pre-tax income from continuing operations:

2005 2004 2003

(in millions)

Domestic ................................................... $309 $222 $186

International ............................................... 96 152 138

Total pre-tax income ....................................... $405 $374 $324

43