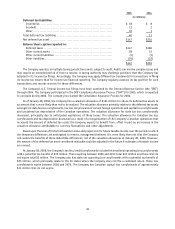

Foot Locker 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

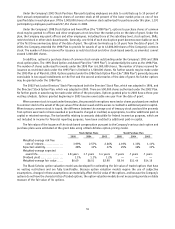

Under the Company’s 2003 Stock Purchase Plan participating employees are able to contribute up to 10 percent of

their annual compensation to acquire shares of common stock at 85 percent of the lower market price on one of two

specified dates in each plan year. Of the 3,000,000 shares of common stock authorized for purchase under this plan, 1,191

participating employees purchased 237,353 shares in 2005.

Under the Company’s 1998 Stock Option and Award Plan (the “1998 Plan”), options to purchase shares of common

stock may be granted to officers and other employees at not less than the market price on the date of grant. Under the

plan, the Company may grant officers and other employees, including those at the subsidiary level, stock options, SARs,

restricted stock or other stock-based awards. Generally, one-third of each stock option grant becomes exercisable on each

of the first three anniversary dates of the date of grant. The options terminate up to 10 years from the date of grant. In

2000, the Company amended the 1998 Plan to provide for awards of up to 12,000,000 shares of the Company’s common

stock. The number of shares reserved for issuance as restricted stock and other stock-based awards, as amended, cannot

exceed 3,000,000 shares.

In addition, options to purchase shares of common stock remain outstanding under the Company’s 1995 and 1986

stock option plans. The 1995 Stock Option and Award Plan (the “1995 Plan”) is substantially the same as the 1998 Plan.

The number of shares authorized for awards under the 1995 Plan is 6,000,000 shares. The number of shares reserved for

issuance as restricted stock under the 1995 Plan is limited to 1,500,000 shares. No further awards may be made under

the 1995 Plan as of March 8, 2005. Options granted under the 1986 Stock Option Plan (the “1986 Plan”) generally become

exercisable in two equal installments on the first and the second anniversaries of the date of grant. No further options

may be granted under the 1986 Plan.

The 2002 Foot Locker Directors’ Stock Plan replaced both the Directors’ Stock Plan, which was adopted in 1996, and

the Directors’ Stock Option Plan, which was adopted in 2000. There are 500,000 shares authorized under the 2002 Plan.

No further grants or awards may be made under either of the prior plans. Options granted prior to 2003 have a three-year

vesting schedule. Options granted beginning in 2003 become exercisable one year from the date of grant.

When common stock is issued under these plans, the proceeds from options exercised or shares purchased are credited

to common stock to the extent of the par value of the shares issued and the excess is credited to additional paid-in capital.

When treasury common stock is issued, the difference between the average cost of treasury stock used and the proceeds

from options exercised or shares awarded or purchased is charged or credited, as appropriate, to either additional paid-in

capital or retained earnings. The tax benefits relating to amounts deductible for federal income tax purposes, which are

not included in income for financial reporting purposes, have been credited to additional paid-in capital.

The fair values of the issuance of the stock-based compensation pursuant to the Company’s various stock option and

purchase plans were estimated at the grant date using a Black-Scholes option-pricing model.

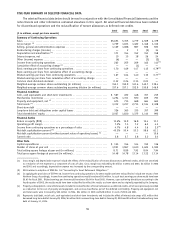

Stock Option Plans Stock Purchase Plan

2005 2004 2003 2005 2004 2003

Weighted-average risk free

rate of interest ................ 3.99% 2.57% 2.26% 4.19% 1.33% 1.11%

Expected volatility ............... 28% 33% 37% 25% 32% 31%

Weighted-average expected

award life...................... 3.8 years 3.7 years 3.4 years .7 years .7 years .7 years

Dividend yield ................... 1.1% 1.1% 1.2% — — —

Weighted-average fair value ..... $6.69 $6.51 $2.90 $5.54 $11.44 $14.15

The Black-Scholes option valuation model was developed for estimating the fair value of traded options that have

no vesting restrictions and are fully transferable. Because option valuation models require the use of subjective

assumptions, changes in these assumptions can materially affect the fair value of the options, and because the Company’s

options do not have the characteristics of traded options, the option valuation models do not necessarily provide a reliable

measure of the fair value of its options.

51