Chevron 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 91

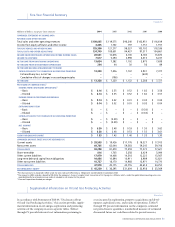

Consolidated Companies

United States International

Gulf of Total Asia- Total Affiliated Companies

Millionsofdollars Calif. Mexico Other U.S. Africa Pacific Indonesia Other Int’l. Total TCO Hamaca

Future cash inflows

from production

Future production costs

Future devel. costs

Future income taxes

Undiscounted future

net cash flows

10 percent midyear annual

discount for timing of

estimated cash flows

Future cash inflows

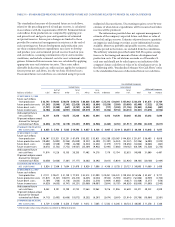

from production $ 30,307 $ 23,521 $ 33,251 $ 87,079 $ 55,532 $ 33,031 $ 26,288 $ 29,987 $ 144,838 $ 231,917 $ 56,485 $ 9,018

Future production costs (10,692) (5,003) (9,354) (25,049) (8,237) (6,389) (11,387) (6,334) (32,347) (57,396) (6,099) (1,878)

Future devel. costs (1,668) (1,550) (990) (4,208) (4,524) (2,432) (1,729) (1,971) (10,656) (14,864) (6,066) (463)

Future income taxes (6,073) (5,742) (7,752) (19,567) (25,369) (9,932) (5,993) (7,888) (49,182) (68,749) (12,520) (2,270)

Undiscounted future

net cash flows 11,874 11,226 15,155 38,255 17,402 14,278 7,179 13,794 52,653 90,908 31,800 4,407

10 percent midyear annual

discount for timing of

estimated cash flows (6,050) (3,666) (7,461) (17,177) (8,482) (6,392) (3,013) (5,039) (22,926) (40,103) (20,140) (2,949)

$ 5,824 $ 7,560 $ 7,694 $ 21,078 $ 8,920 $ 7,886 $ 4,166 $ 8,755 $ 29,727 $ 50,805 $ 11,660 $ 1,458

Future cash inflows

from production $ 27,111 $ 19,671 $ 31,130 $ 77,912 $ 52,513 $ 31,099 $ 28,451 $ 26,531 $ 138,594 $ 216,506 $ 52,457 $ 9,777

Future production costs (11,071) (5,167) (10,077) (26,315) (6,435) (4,534) (9,552) (5,970) (26,491) (52,806) (4,959) (1,730)

Future devel. costs (1,769) (748) (1,116) (3,633) (3,454) (2,516) (1,989) (1,868) (9,827) (13,460) (5,377) (578)

Future income taxes (4,829) (4,655) (6,747) (16,231) (25,060) (10,087) (7,694) (6,797) (49,638) (65,869) (11,899) (2,540)

Undiscounted future

net cash flows 9,442 9,101 13,190 31,733 17,564 13,962 9,216 11,896 52,638 84,371 30,222 4,929

10 percent midyear annual

discount for timing of

estimated cash flows (4,713) (2,493) (6,666) (13,872) (8,252) (6,297) (3,674) (3,691) (21,914) (35,786) (18,964) (3,581)

$ 4,729 $ 6,608 $ 6,524 $ 17,861 $ 9,312 $ 7,665 $ 5,542 $ 8,205 $ 30,724 $ 48,585 $ 11,258 $ 1,348

* 2002 includes certain reclassifications to conform to 2004 presentation.

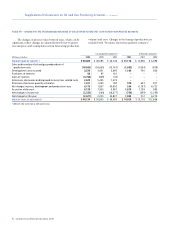

Thestandardizedmeasureofdiscountedfuturenetcashflows,

relatedtotheprecedingprovedoilandgasreserves,iscalculated

inaccordancewiththerequirementsofFAS69.Estimatedfuture

cashinflowsfromproductionarecomputedbyapplyingyear-

endpricesforoilandgastoyear-endquantitiesofestimated

netprovedreserves.Futurepricechangesarelimitedtothose

providedbycontractualarrangementsinexistenceattheendof

eachreportingyear.Futuredevelopmentandproductioncosts

arethoseestimatedfutureexpendituresnecessarytodevelop

andproduceyear-endestimatedprovedreservesbasedonyear-

endcostindices,assumingcontinuationofyear-endeconomic

conditions,andincludeestimatedcostsforassetretirementobli-

gations.Estimatedfutureincometaxesarecalculatedbyapplying

appropriateyear-endstatutorytaxrates.Theseratesreflect

allowabledeductionsandtaxcreditsandareappliedtoestimated

futurepretaxnetcashflows,lessthetaxbasisofrelatedassets.

Discountedfuturenetcashflowsarecalculatedusing10percent

midperioddiscountfactors.Discountingrequiresayear-by-year

estimateofwhenfutureexpenditureswillbeincurredandwhen

reserveswillbeproduced.

Theinformationprovideddoesnotrepresentmanagement’s

estimateofthecompany’sexpectedfuturecashflowsorvalueof

provedoilandgasreserves.Estimatesofprovedreservequantities

areimpreciseandchangeovertimeasnewinformationbecomes

available.Moreover,probableandpossiblereserves,whichmay

becomeprovedinthefuture,areexcludedfromthecalculations.

ThearbitraryvaluationprescribedunderFAS69requiresassump-

tionsastothetimingandamountoffuturedevelopmentand

productioncosts.ThecalculationsaremadeasofDecember31

eachyearandshouldnotberelieduponasanindicationofthe

company’sfuturecashflowsorvalueofitsoilandgasreserves.In

thefollowingtable,“StandardizedMeasureNetCashFlows”refers

tothestandardizedmeasureofdiscountedfuturenetcashflows.