Chevron 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

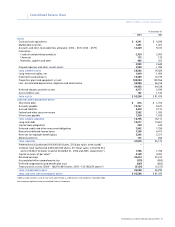

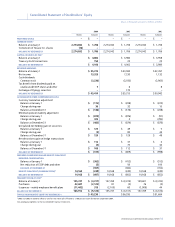

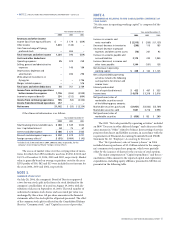

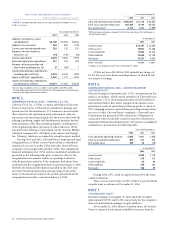

54 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

General ChevronTexacomanagesitsinvestmentsinandprovides

administrative,financialandmanagementsupporttoU.S.and

foreignsubsidiariesandaffiliatesthatengageinfullyintegrated

petroleum,chemicalsandcoalminingoperations.Inaddition,

ChevronTexacoholdsinvestmentsinthepowergenerationbusi-

ness.Collectively,thesecompaniesconductbusinessactivitiesin

morethan180countries.Explorationandproduction(upstream)

operationsconsistofexploringfor,developingandproducing

crudeoilandnaturalgasandalsomarketingnaturalgas.Refining,

marketingandtransportation(downstream)operationsrelate

torefiningcrudeoilintofinishedpetroleumproducts;marketing

crudeoil,naturalgasandthemanyproductsderivedfrompetro-

leum;andtransportingcrudeoil,naturalgasandpetroleum

productsbypipeline,marinevessel,motorequipmentandrail

car.Chemicaloperationsincludethemanufactureandmarketing

ofcommoditypetrochemicals,plasticsforindustrialuses,andfuel

andlubricantoiladditives.

Thecompany’sConsolidatedFinancialStatementsarepre-

paredinaccordancewithprinciplesgenerallyacceptedinthe

UnitedStatesofAmerica.Theserequiretheuseofestimates

andassumptionsthataffecttheassets,liabilities,revenuesand

expensesreportedinthefinancialstatements,aswellasamounts

includedinthenotesthereto,includingdiscussionanddisclo-

sureofcontingentliabilities.Althoughthecompanyusesitsbest

estimatesandjudgments,actualresultscoulddifferfromthese

estimatesasfutureconfirmingeventsoccur.

Thenatureofthecompany’soperationsandthemany

countriesinwhichitoperatessubjectthecompanytochanging

economic,regulatoryandpoliticalconditions.Thecompanydoes

notbelieveitisvulnerabletotheriskofnear-termsevereimpact

asaresultofanyconcentrationofitsactivities.

SubsidiaryandAffiliatedCompanies TheConsolidatedFinancial

Statementsincludetheaccountsofcontrolledsubsidiarycom-

paniesmorethan50percentownedandvariableinterestentities

inwhichthecompanyistheprimarybeneficiary.Undivided

interestsinoilandgasjointventuresandcertainotherassets

areconsolidatedonaproportionatebasis.Investmentsinand

advancestoaffiliatesinwhichthecompanyhasasubstantial

ownershipinterestofapproximately20percentto50percentor

forwhichthecompanyexercisessignificantinfluencebutnot

controloverpolicydecisionsareaccountedforbytheequity

method.Aspartofthataccounting,thecompanyrecognizes

gainsandlossesthatarisefromtheissuanceofstockbyanaffili-

atewhichresultsinchangesinthecompany’sproportionateshare

ofthedollaramountoftheaffiliate’sequitycurrentlyinincome.

Deferredincometaxesareprovidedforthesegainsandlosses.

Investmentsareassessedforpossibleimpairmentwhen

eventsindicatethatthefairvalueoftheinvestmentmaybebelow

thecompany’scarryingvalue.Whensuchaconditionisdeemed

tobeotherthantemporary,thecarryingvalueoftheinvestment

iswrittendowntoitsfairvalue,andtheamountofthewrite-

downisincludedinnetincome.Inmakingthedeterminationas

towhetheradeclineisotherthantemporary,thecompanycon-

siderssuchfactorsasthedurationandextentofthedecline,the

investee’sfinancialperformance,andthecompany’sabilityand

intentiontoretainitsinvestmentforaperiodthatwillbesuf-

ficienttoallowforanyanticipatedrecoveryintheinvestment’s

marketvalue.Thenewcostbasisofinvestmentsintheseequity

investeesisnotchangedforsubsequentrecoveriesinfairvalue.

Subsequentrecoveriesinthecarryingvalueofotherinvestments

arereportedin“Othercomprehensiveincome.”

Differencesbetweenthecompany’scarryingvalueofan

equityinvestmentanditsunderlyingequityinthenetassets

oftheaffiliateareassignedtotheextentpracticabletospecific

assetsandliabilitiesbasedonthecompany’sanalysisofthevarious

factorsgivingrisetothedifference.Thecompany’sshareofthe

affiliate’sreportedearningsisadjustedquarterlywhenappro-

priatetoreflectthedifferencebetweentheseallocatedvaluesand

theaffiliate’shistoricalbookvalues.

Derivatives Themajorityofthecompany’sactivityincommodity

derivativeinstrumentsisintendedtomanagethepriceriskposed

byphysicaltransactions.Forsomeofthisderivativeactivity,

generallylimitedtolarge,discreteorinfrequentlyoccurring

transactions,thecompanymayelecttoapplyfairvalueorcash

flowhedgeaccounting.Forothersimilarderivativeinstruments,

generallybecauseoftheshort-termnatureofthecontractsor

theirlimiteduse,thecompanydoesnotapplyhedgeaccounting,

andchangesinthefairvalueofthosecontractsarereflectedin

currentincome.Forthecompany’stradingactivity,gainsand

lossesfromthederivativeinstrumentsarereportedincurrent

income.Forderivativeinstrumentsrelatingtoforeigncurrency

exposures,gainsandlossesarereportedincurrentincome.Interest

rateswaps–hedgingaportionofthecompany’sfixed-ratedebt–

areaccountedforasfairvaluehedges,whereasinterestrateswaps

relatingtoaportionofthecompany’sfloating-ratedebtarere-

cordedatfairvalueontheConsolidatedBalanceSheet,with

resultinggainsandlossesreflectedinincome.

Short-TermInvestments Allshort-terminvestmentsareclassified

asavailableforsaleandareinhighlyliquiddebtsecurities.Those

investmentsthatarepartofthecompany’scashmanagement

portfolioandhaveoriginalmaturitiesofthreemonthsorlessare

reportedas“Cashequivalents.”Thebalanceoftheshort-term

investmentsisreportedas“Marketablesecurities.”Short-term

investmentsaremarked-to-market,withanyunrealizedgainsor

lossesincludedin“Othercomprehensiveincome.”

Inventories Crudeoil,petroleumproductsandchemicalsaregen-

erallystatedatcost,usingaLast-In,First-Out(LIFO)method.In

theaggregate,thesecostsarebelowmarket.“Materials,supplies

andother”inventoriesgenerallyarestatedataveragecost.

Properties,PlantandEquipment Thesuccessfuleffortsmethod

isusedforcrudeoilandnaturalgasexplorationandproduc-

tionactivities.Allcostsfordevelopmentwells,relatedplantand

equipment,provedmineralinterestsincrudeoilandnaturalgas

properties,andrelatedassetretirementobligation(ARO)assets

arecapitalized.Costsofexploratorywellsarecapitalizedpend-

ingdeterminationofwhetherthewellsfoundprovedreserves.

Costsofwellsthatareassignedprovedreservesremaincapital-

ized.Costsarealsocapitalizedforwellsthatfindcommercially

produciblereservesthatcannotbeclassifiedasproved,pending

Notes to the Consolidated Financial Statements

Millionsofdollars,exceptper-shareamounts