Chevron 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

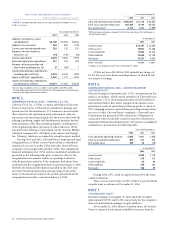

At December 31

2003

Commercial paper* $ 4,078

Notes payable to banks and others with

originating terms of one year or less 190

Current maturities of long-term debt 863

Current maturities of long-term

capital leases 71

Redeemable long-term obligations

Long-term debt 487

Capital leases 299

Subtotal 5,988

Reclassified to long-term debt (4,285)

Total short-term debt $ 1,703

* Weighted-average interest rates at December 31, 2004 and 2003, were 1.98 per-

cent and 1.01 percent, respectively.

Redeemablelong-termobligationsconsistprimarilyof

tax-exemptvariable-rateputbondsthatareincludedascurrent

liabilitiesbecausetheybecomeredeemableattheoptionofthe

bondholdersduringtheyearfollowingthebalancesheetdate.

Thecompanyperiodicallyentersintointerestrateswapsona

portionofitsshort-termdebt.SeeNote8beginningonpage59for

informationconcerningthecompany’sdebt-relatedderivative

activities.

AtDecember31,2004,thecompanyhad$4,735ofcommitted

creditfacilitieswithbanksworldwide,whichpermitthecompany

torefinanceshort-termobligationsonalong-termbasis.The

facilitiessupportthecompany’scommercialpaperborrowings.

Interestonborrowingsunderthetermsofspecificagreements

maybebasedontheLondonInterbankOfferedRateorbank

primerate.Noamountswereoutstandingunderthesecredit

agreementsduring2004oratyear-end.

AtDecember31,2004and2003,thecompanyclassified

$4,735and$4,285,respectively,ofshort-termdebtaslong-term.

Settlementoftheseobligationsisnotexpectedtorequiretheuse

ofworkingcapitalin2005,asthecompanyhasboththeintent

andtheabilitytorefinancethisdebtonalong-termbasis.

ChevronTexacohasthree“shelf”registrationsonfilewiththe

SECthattogetherwouldpermittheissuanceof$3,800ofdebt

securitiespursuanttoRule415oftheSecuritiesActof1933.The

company’slong-termdebtoutstandingatyear-end2004and

2003wasasfollows:

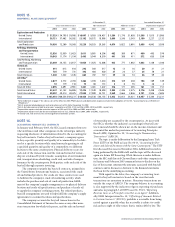

At December 31

2003

3.5% notes due 2007 $ 1,993

3.375% notes due 2008 749

5.5% note due 2009 431

7.327% amortizing notes due 20141 360

9.75% debentures due 2020 250

5.7% notes due 2008 220

8.625% debentures due 2031 199

8.625% debentures due 2032 199

7.5% debentures due 2043 198

8.625% debentures due 2010 150

8.875% debentures due 2021 150

7.09% notes due 2007 150

8.25% debentures due 2006 150

6.625% notes due 2004 499

8.11% amortizing notes due 20042 240

6.0% notes due 2005 299

Medium-term notes, maturing from

2017 to 2043 (7.1%)3 210

Other foreign currency obligations (4.0%)3 52

Other long-term debt (4.3%)3 730

Total including debt due within one year 7,229

Debt due within one year (863)

Reclassified from short-term debt 4,285

Total long-term debt $ 10,651

1 Guarantee of ESOP debt.

2

Debt assumed from ESOP in 1999.

3

Less than $150 individually; weighted-average interest rates at December 31, 2004.

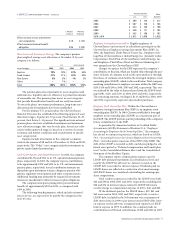

Consolidatedlong-termdebtmaturingafterDecember31,

2004,isasfollows:2005–$333;2006–$149;2007–$2,178;2008

–$1,061;and2009–$455;after2009–$1,639.

In2004,thecompanyrepaid$500of6.625percentnotes

and$240of8.11percentnotesthatmaturedduringtheyear.

Otherrepaymentsduring2004include$300of6percentnotes

dueJune2005and$265invariousPhilippinedebt.

InJanuary2005,thecompanycontributed$98topermitthe

ESOPtomakeaprincipalpaymentof$113.

FASBInterpretationNo.46,“ConsolidationofVariableInterest

Entities”(FIN46)FIN46wasissuedinJanuary2003andestab-

lishedstandardsfordeterminingunderwhatcircumstancesa

variableinterestentity(VIE)shouldbeconsolidatedbyitspri-

marybeneficiary.FIN46alsorequiresdisclosuresaboutVIEs

thatthecompanyisnotrequiredtoconsolidatebutinwhichit

hasasignificantvariableinterest.InDecember2003,theFASB

issuedFIN46-R,whichnotonlyincludedamendmentstoFIN

46,butalsorequiredapplicationoftheinterpretationtoall

affectedentitiesnolaterthanMarch31,2004,forcalendaryear

reportingcompanies.Priortothisrequirement,companieswere

requiredtoapplytheinterpretationtospecial-purposeentities

byDecember31,2003.Thefulladoptionoftheinterpretationas

ofMarch31,2004,includingtherequirementrelatingtospecial-

purposeentities,didnothaveanimpactonthecompany’sresults

ofoperations,financialpositionorliquidity.

FASBStaffPositionNo.FAS106-2,“AccountingandDisclosure

RequirementsRelatedtotheMedicarePrescriptionDrug,Improve-

mentandModernizationActof2003”(FSPFAS106-2) In

December2003,theMedicarePrescriptionDrug,Improvement

andModernizationActof2003(TheAct)becamelaw.TheAct

Notes to the Consolidated Financial Statements

Millionsofdollars,exceptper-shareamounts