Chevron 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 59

income.”Theseactivitiesarereportedunder“Operatingactivi-

ties”intheConsolidatedStatementofCashFlows.

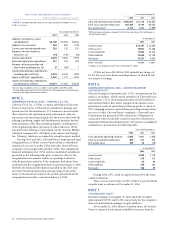

InterestRates Thecompanyentersintointerestrateswapsas

partofitsoverallstrategytomanagetheinterestrateriskon

itsdebt.Underthetermsoftheswaps,netcashsettlementsare

basedonthedifferencebetweenfixed-rateandfloating-rate

interestamountscalculatedbyreferencetoagreednotional

principalamounts.Interestrateswapsrelatedtoaportionofthe

company’sfixed-ratedebtareaccountedforasfairvaluehedges,

whereasinterestrateswapsrelatedtoaportionofthecompany’s

floating-ratedebtarerecordedatfairvalueonthebalancesheet

withresultinggainsandlossesreflectedinincome.

During2004,fournewswapsrelatingtoaportionofthe

company’sfixed-ratedebtwereinitiated.Atyear-end2004,the

interestrateswapsoutstandingrelatedtofixed-ratedebt,and

theirweightedaveragematuritywasapproximatelythreeyears.

Fairvaluesoftheinterestrateswapsarereportedonthe

ConsolidatedBalanceSheetas“Accountsandnotesreceivable”

or“Accountspayable,”withgainsandlossesreporteddirectlyin

incomeaspartof“Interestanddebtexpense.”Theseactivities

arereportedunder“Operatingactivities”intheConsolidated

StatementofCashFlows.

FairValue Fairvaluesarederivedeitherfromquotedmarket

pricesor,ifnotavailable,thepresentvalueoftheexpected

cashflows.Thefairvaluesreflectthecashthatwouldhavebeen

receivedorpaidiftheinstrumentsweresettledatyear-end.

Long-termdebtof$5,815and$7,229hadestimatedfair

valuesof$6,444and$7,709atDecember31,2004and2003,

respectively.

Forinterestrateswaps,thenotionalprincipalamounts

of$1,665and$665hadestimatedfairvaluesof$36and$65at

December31,2004and2003,respectively.

ThecompanyholdscashequivalentsandU.S.dollarmar-

ketablesecuritiesindomesticandoffshoreportfolios.Eurodollar

bonds,floating-ratenotes,timedepositsandcommercialpaper

aretheprimaryinstrumentsheld.Cashequivalentsandmarket-

ablesecuritieshadfairvaluesof$8,789and$3,803atDecember

31,2004and2003,respectively.Ofthesebalances,$7,338and

$2,803attherespectiveyear-endswereclassifiedascashequiva-

lentsthathadaveragematuritiesunder90days.Theremainder,

classifiedasmarketablesecurities,hadaveragematuritiesof

approximately2.3years.

Forthefinancialandderivativeinstrumentsdiscussed

above,therewasnotamaterialchangeinmarketriskfromthat

presentedin2003.

ConcentrationsofCreditRisk Thecompany’sfinancialinstru-

mentsthatareexposedtoconcentrationsofcreditriskconsist

primarilyofitscashequivalents,marketablesecurities,deriva-

tivefinancialinstrumentsandtradereceivables.Thecompany’s

short-terminvestmentsareplacedwithawidearrayoffinancial

institutionswithhighcreditratings.Thisdiversifiedinvestment

policylimitsthecompany’sexposurebothtocreditriskandto

concentrationsofcreditrisk.Similarstandardsofdiversityand

creditworthinessareappliedtothecompany’scounterpartiesin

derivativeinstruments.

Thetradereceivablebalances,reflectingthecompany’sdiver-

sifiedsourcesofrevenue,aredispersedamongthecompany’s

broadcustomerbaseworldwide.Asaconsequence,concentrations

ofcreditriskarelimited.Thecompanyroutinelyassessesthe

financialstrengthofitscustomers.Whenthefinancialstrength

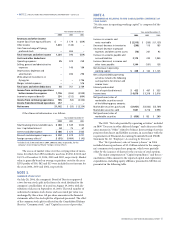

160millionsharesthatwerereservedforissuanceunderthe

ChevronTexacoCorporationLong-TermIncentivePlan(LTIP),as

amendedandrestated,whichwasapprovedbythestockholdersin

2004.Inaddition,approximately622,000sharesremainavailable

forissuancefromthe800,000sharesofthecompany’scommon

stockthatwerereservedforawardsundertheChevronTexaco

CorporationNon-EmployeeDirectors’EquityCompensation

andDeferralPlan(Non-EmployeeDirectors’Plan),whichwas

approvedbystockholdersin2003.RefertoNote3onpage57fora

discussionofthecompany’scommonstocksplit.

CommodityDerivativeInstruments ChevronTexacoisexposed

tomarketrisksrelatedtopricevolatilityofcrudeoil,refined

products,electricity,naturalgasandrefineryfeedstock.

Thecompanyusesfinancialderivativecommodityinstru-

mentstomanagethisexposureonasmallportionofitsactivity,

including:firmcommitmentsandanticipatedtransactionsfor

thepurchaseorsaleofcrudeoil;feedstockpurchasesforcom-

panyrefineries;crudeoilandrefinedproductsinventories;and

fixed-pricecontractstosellnaturalgasandnaturalgasliquids.

Thecompanyalsousesfinancialderivativecommodityinstru-

mentsforlimitedtradingpurposes.

ThecompanymaintainsapolicyofrequiringthatanInter-

nationalSwapsandDerivativesAssociationAgreementgovern

derivativecontractswithcertaincounterpartiestomitigatecredit

risk.Dependingonthenatureofthederivativetransaction,

bilateralcollateralarrangementsmayalsoberequired.When

thecompanyisengagedinmorethanoneoutstandingderivative

transactionwiththesamecounterpartyandalsohasalegally

enforceablenettingagreementwiththatcounterparty,the“net”

marked-to-marketexposurerepresentsthenettingofthepositive

andnegativeexposureswiththatcounterpartyandareasonable

measureofthecompany’screditrisk.Itisthecompany’spolicy

touseothernettingagreementswithcertaincounterpartieswith

whichitconductssignificanttransactions.

Thefairvaluesoftheoutstandingcontractsarereportedon

theConsolidatedBalanceSheetas“Accountsandnotesreceivable,”

“Accountspayable,”“Long-termreceivables–net,”and“Deferred

creditsandothernoncurrentobligations.”Gainsandlosseson

thecompany’sriskmanagementactivitiesarereportedaseither

“Salesandotheroperatingrevenues”or“Purchasedcrudeoiland

products,”whereastradinggainsandlossesarereportedas“Other

income.”Theseactivitiesarereportedunder“Operatingactivities”

intheConsolidatedStatementofCashFlows.

ForeignCurrency Thecompanyentersintoforwardexchange

contracts,generallywithtermsof180daysorless,tomanage

someofitsforeigncurrencyexposures.Theseexposuresinclude

revenueandanticipatedpurchasetransactions,includingforeign

currencycapitalexpendituresandleasecommitments,forecasted

tooccurwithin180days.Theforwardexchangecontractsare

recordedatfairvalueonthebalancesheetwithresultinggains

andlossesreflectedinincome.

Thefairvaluesoftheoutstandingcontractsarereportedon

theConsolidatedBalanceSheetas“Accountsandnotesreceivable”

or“Accountspayable,”withgainsandlossesreportedas“Other

STOCKHOLDERS’ EQUITY – Continued