Chevron 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

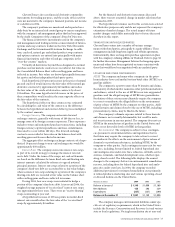

Explanationsfollowforvariationsbetweenyearsforthe

amountsinthetableabove–afterconsiderationoftheeffectsof

specialgainsandcharges–aswellasforotherincomestatement

categories.Refertotheprecedingsegmentdiscussionsinthissec-

tionforinformationrelatingtospecialgainsandcharges.

Salesandotheroperatingrevenueswere$151billionin2004,

comparedwith$120billionin2003and$98billionin2002.Rev-

enuesincreasedin2004and2003primarilyfromhigherprices

forcrudeoil,naturalgasandrefinedproductsworldwide.

Income(loss)fromequityaffiliatesincreasedin2004and

2003,asearningsimprovedforanumberofaffiliates,including

downstreamaffiliatesintheAsia-Pacificarea,Tengizchevroil,

CPChem,DynegyandtheCaspianPipelineConsortium.

Otherincomein2004includednetgainsof$1.6billion,

primarilyfromupstreampropertysales,comparedwithgains

of$286millionand$94millionin2003and2002,respectively.

Interestincomeincreasedto$199millionin2004,compared

withabout$120millionin2003and2002,asaresultofhigher

balancesofcashandmarketablesecurities.Foreigncurrency

losseswere$60million,$199millionand$5millionin2004,

2003and2002,respectively.

Purchasedcrudeoilandproductswere$94billionin2004,

anincreaseof32percentfrom2003,duemainlytohigherprices

andincreasedpurchasesofcrudeoilandproducts.Crudeoiland

productpurchasesincreasedabout25percentin2003,primarily

duetosignificantlyhigherpricesforcrudeoil,naturalgasand

refinedproducts.

Operating,selling,generalandadministrativeexpensesof

$14billionincreasedfrom$13billionin2003.Theincreasesin

2004includedcostsforcharteringofcrudeoiltankersandother

transportationexpenses.During2003,operating,selling,general

andadministrativeexpensesincreasednearly$1billion,primar-

ilyfromhigherfreightratesforinternationalshippingoperations

andhighercostsassociatedwithemployeepensionplansand

otheremployee-benefitexpenses.

Explorationexpenseswere$697millionin2004,$570mil-

lionin2003and$591millionin2002.In2004,amountswere

higherforinternationaloperations,primarilyforseismiccosts

andexpensesassociatedwithevaluatingthefeasibilityofdifferent

projectalternatives.

Depreciation,depletionandamortizationexpensesdidnot

changemateriallybetweenyearsafterconsiderationoftheeffects

ofspecial-itemcharges.

Interestanddebtexpensewas$406millionin2004,com-

paredwith$474millionin2003and$565millionin2002.The

loweramountin2004reflectedloweraveragedebtbalances.The

declinebetween2003and2002reflectedloweraverageinterest

ratesoncommercialpaperandothervariable-ratedebtandlower

averagedebtlevels.

Taxesotherthanonincomewere$19.8billion,$17.9billion

and$16.7billionin2004,2003and2002,respectively.The

increasein2004and2003primarilyreflectedtheweakening

U.S.dollaronforeigncurrency-denominateddutiesinthe

company’sEuropeandownstreamoperations.

Incometaxexpensecorrespondedtoeffectivetaxratesof

37percentin2004,43percentin2003and45percentin2002after

takingintoaccounttheeffectofnetspecialitems.Referalsoto

Note17onpage66totheConsolidatedFinancialStatements.

Merger-relatedexpenseswere$576millionin2002.No

merger-relatedexpenseswerereportedin2004or2003,reflecting

thecompletionofmergerintegrationactivitiesin2002.

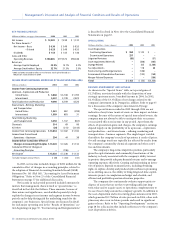

2003 2002

Net Crude Oil and Natural Gas

Liquids Production (MBPD) 562 602

Net Natural Gas Production (MMCFPD)3 2,228 2,405

Net Oil-Equivalent Production (MBOEPD) 933 1,003

Natural Gas Sales (MMCFPD) 4,304 5,891

Natural Gas Liquids Sales (MBPD) 194 241

Revenues From Net Production

Liquids ($/Bbl) $ 26.66 $ 21.34

Natural Gas ($/MCF) $ 5.01 $ 2.89

Net Crude and Natural Gas

Liquids Production (MBPD) 1,246 1,295

Net Natural Gas Production (MMCFPD)3 2,064 1,971

Net Oil-Equivalent Production (MBOEPD)4 1,704 1,720

Natural Gas Sales (MMCFPD) 1,951 3,131

Natural Gas Liquids Sales (MBPD) 107 131

Revenues From Liftings

Liquids ($/Bbl) $ 26.79 $ 23.06

Natural Gas ($/MCF) $ 2.64 $ 2.14

U.S. 933 1,003

International 1,704 1,720

Total 2,637 2,723

Gasoline Sales (MBPD) 669 680

Other Refined Products Sales (MBPD) 767 920

Total5 1,436 1,600

Refinery Input (MBPD)6 951 979

Gasoline Sales (MBPD) 643 620

Other Refined Products Sales (MBPD) 1,659 1,555

Total7 2,302 2,175

Refinery Input (MBPD) 1,040 1,100

1 Includes equity in affiliates.

2 MBPD = Thousands of barrels per day; MMCFPD = Millions of cubic feet per day;

MBOEPD = Thousands of barrels of oil equivalents per day; Bbl = Barrel; MCF =

Thousands of cubic feet. Oil-equivalent gas (OEG) conversion ratio is 6,000 cubic

feet of gas = 1 barrel of oil.

3 Includes natural gas consumed on lease:

United States 65 64

International 268 256

4 Other produced volumes include:

Athabasca Oil Sands – Net 15 –

Boscan Operating Service Agreement 99 97

114 97

5 Includes volume for buy/sell contracts: 90 101

6 The company sold its interest in the El Paso

Refinery in August 2003.

7 Includes volume for buy/sell contracts: 104 96