Chevron 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

OilCompany(Shell)foranyclaimsarisingfromtheguarantees.

Thecompanyhasnotrecordedaliabilityfortheseguarantees.

Approximately45percentoftheamountsguaranteedwillexpire

withinthe2005through2009period,withtheguaranteesofthe

remainingamountsexpiringby2019.

Indemnifications Thecompanyprovidedcertainindemnities

ofcontingentliabilitiesofEquilonandMotivatoShellandSaudi

Refining,Inc.,inconnectionwiththeFebruary2002saleofthe

company’sinterestsinthoseinvestments.Theindemnitiescover

certaincontingentliabilities,includingthoseassociatedwith

theUnocalpatentlitigation.Thecompanywouldberequiredto

performshouldtheindemnifiedliabilitiesbecomeactuallosses.

Shouldthatoccur,thecompanycouldberequiredtomakefuture

paymentsupto$300million.Throughtheendof2004,the

companypaidapproximately$28millionunderthesecontingen-

ciesandhadagreedtopayapproximately$10millionadditional

underanawardofarbitration,subjecttominoradjustmentsyet

toberesolved.Thecompanymayreceiveadditionalrequestsfor

indemnificationpaymentsinthefuture.

Thecompanyhasalsoprovidedindemnitiesrelatingto

contingentenvironmentalliabilitiesrelatedtoassetsoriginally

contributedbyTexacototheEquilonandMotivajointventures

andenvironmentalconditionsthatexistedpriortotheforma-

tionofEquilonandMotivaorthatoccurredduringtheperiods

ofTexaco’sownershipinterestsinthejointventures.Ingeneral,

theenvironmentalconditionsoreventsthataresubjecttothese

indemnitiesmusthavearisenpriortoDecember2001.Claims

relatingtoEquilonindemnitiesmustbeassertedeitherasearly

asFebruary2007,ornolaterthanFebruary2009,andclaims

relatingtoMotivamustbeassertednolaterthanFebruary2012.

Underthetermsoftheindemnities,thereisnomaximumlimit

ontheamountofpotentialfuturepayments.Thecompany

hasnotrecordedanyliabilitiesforpossibleclaimsunderthese

indemnities.Thecompanypostsnoassetsascollateralandhas

madenopaymentsundertheindemnities.

Theamountspayablefortheindemnitiesdescribedabove

aretobenetofamountsrecoveredfrominsurancecarriersand

othersandnetofliabilitiesrecordedbyEquilonorMotivaprior

toSeptember30,2001,foranyapplicableincident.

Securitization Inotheroff-balance-sheetarrangements,the

companysecuritizescertainretailandtradeaccountsreceivable

initsdownstreambusinessthroughtheuseofqualifyingspecial

purposeentities(SPEs).AtDecember31,2004,approximately

$1.2billion,representingabout10percentofChevronTexaco’s

totalcurrentaccountsreceivablebalance,weresecuritized.

ChevronTexaco’stotalestimatedfinancialexposureunderthese

securitizationsatDecember31,2004,wasapproximately$50

million.ThesearrangementshavetheeffectofacceleratingChevron-

Texaco’scollectionofthesecuritizedamounts.Intheeventofthe

SPEsexperiencingmajordefaultsinthecollectionofreceivables,

ChevronTexacobelievesthatitwouldhavenolossexposurecon-

nectedwiththird-partyinvestmentsinthesesecuritizations.

Long-TermUnconditionalPurchaseObligationsandCommit-

ments,ThroughputAgreements,andTake-or-PayAgreements The

companyanditssubsidiarieshavecertainothercontingentlia-

bilitiesrelatingtolong-termunconditionalpurchaseobligations

andcommitments,throughputagreements,andtake-or-pay

agreements,someofwhichrelatetosuppliers’financingarrange-

ments.Theagreementstypicallyprovidegoodsandservices,such

aspipelineandstoragecapacity,utilities,andpetroleumprod-

ucts,tobeusedorsoldintheordinarycourseofthecompany’s

business.Theaggregateapproximateamountsofrequiredpay-

mentsunderthesevariouscommitmentsare2005–$1.6billion;

2006–$1.7billion;2007–$1.6billion;2008–$1.5billion;2009

–$1.5billion;2010andafter–$2.3billion.Totalpayments

undertheagreementswereapproximately$1.6billionin2004,

$1.4billionin2003and$1.2billionin2002.Themostsignifi-

canttake-or-payagreementcallsforthecompanytopurchase

approximately55,000barrelsperdayofrefinedproductsfrom

anequityaffiliaterefinerinThailand.Thispurchaseagreement

isinconjunctionwiththefinancingofarefineryownedbythe

affiliateandexpiresin2009.Thefutureestimatedcommitments

underthiscontractare:2005–$1.2billion;2006–$1.2billion;

2007–$1.3billion;2008–$1.3billion;and2009–$1.3billion.

Additionally,in2004thecompanyenteredintoa20-yearagree-

menttoacquireregasificationcapacityattheSabinePassLNG

terminal.Paymentsof$1.2billionoverthe20-yearperiodare

expectedtocommencein2010.

MinorityInterests Thecompanyhascommitmentsof

approximately$172millionrelatedtominorityinterestsinsub-

sidiarycompanies.

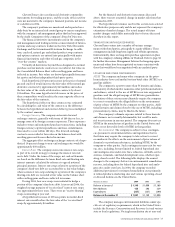

Thefollowingtablesummarizesthecompany’ssignificant

contractualobligations:

ContractualObligations

Millionsofdollars Payments Due by Period

2006 – After

Total 2005 2008 2009 2009

On Balance Sheet:

Short-Term Debt $ 816 $ 816 $ – $ – $ –

Long-Term Debt1, 2 10,217 – 8,123 455 1,639

Noncancelable Capital

Lease Obligations 239 – 110 29 100

Interest Expense 4,830 465 1,120 270 2,975

Off Balance Sheet:

Noncancelable Operating

Lease Obligations 2,232 390 857 236 749

Unconditional Purchase

Obligations 1,000 300 600 100 –

Through-Put and

Take-or-Pay Agreements 9,400 1,350 4,250 1,450 2,350

1 $4.7 billion of short-term debt that the company expects to refinance is included

in long-term debt. The repayment schedule above reflects the repayment of the

entire amount in the 2006 through 2008 period.

2 Includes guarantees of $360 of LESOP (leverage employee stock ownership plan)

debt, $127 due in 2005 and $233 due after 2006.

CommodityDerivativeInstruments ChevronTexacoisexposedto

marketrisksrelatedtothevolatilityofcrudeoil,refinedprod-

ucts,electricity,naturalgasandrefineryfeedstockprices.The

companyusesfinancialderivativecommodityinstrumentsto

manageitsexposuretopricevolatilityonasmallportionofits

activity,includingfirmcommitmentsandanticipatedtransac-

tionsforthepurchaseorsaleofcrudeoilandrefinedproducts;

feedstockpurchasesforcompanyrefineries;crudeoilandrefined

productsinventories;andfixed-pricecontractstosellnaturalgas

andnaturalgasliquids.