Chevron 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 57

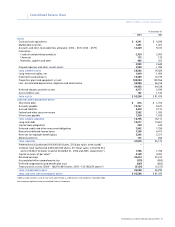

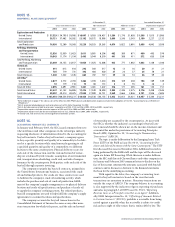

“Netdecreaseinoperatingworkingcapital”iscomposedofthe

following:

Year ended December 31

2003 2002

Increase in accounts and

notes receivable $ (265) $ (1,135)

(Increase) decrease in inventories 115 185

(Increase) decrease in prepaid

expenses and other current assets 261 92

Increase in accounts payable and

accrued liabilities 242 1,845

Increase (decrease) in income and

other taxes payable (191) 138

Net decrease in operating

working capital $ 162 $ 1,125

Net cash provided by operating

activities includes the following

cash payments for interest and

income taxes:

Interest paid on debt

(net of capitalized interest) $ 467 $ 533

Income taxes $ 5,316 $ 2,916

Net (purchases) sales of

marketable securities consist

of the following gross amounts:

Marketable securities purchased $ (3,563) $ (5,789)

Marketable securities sold 3,716 5,998

Net (purchases) sales of

marketable securities $ 153 $ 209

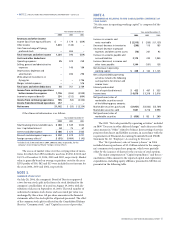

The2003“Netcashprovidedbyoperatingactivities”included

an$890“Decreaseinotherdeferredcharges”andadecreaseofthe

sameamountin“Other”relatedtobalancesheetnettingofcertain

pension-relatedassetandliabilityaccounts,inaccordancewiththe

requirementsofFinancialAccountingStandardsBoard(FASB)

StatementNo.87,“Employers’AccountingforPensions.”

The“Net(purchases)salesoftreasuryshares”in2004

includedsharerepurchasesof$2.1billionrelatedtothecompa-

ny’scommonstockrepurchaseprogram,whichwerepartially

offsetbytheissuanceofsharesfortheexerciseofstockoptions.

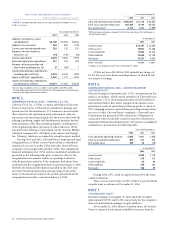

Themajorcomponentsof“Capitalexpenditures”andtherec-

onciliationofthisamounttothereportedcapitalandexploratory

expenditures,includingequityaffiliates,presentedinMD&Aare

presentedinthefollowingtable.

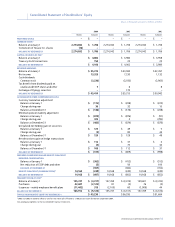

Year ended December 31

2003 2002

Income (loss) from equity affiliates $ 179 $ (829)

Other income (148) –

Gain from exchange of Dynegy

preferred stock 365 –

396 (829)

Operating expenses 329 259

Selling, general and administrative

expenses 146 180

Depreciation, depletion and

amortization 286 298

Write-down of investments in

Dynegy Inc. – 1,796

Merger-related expenses – 576

761 3,109

(365) (3,938)

Income tax expense (benefit) (312) (604)

(53) (3,334)

– –

$ (53) $ (3,334)

Otherfinancialinformationisasfollows:

Year ended December 31

2003 2002

Total financing interest and debt costs $ 549 $ 632

Less: Capitalized interest 75 67

Interest and debt expense $ 474 $ 565

Research and development expenses $ 228 $ 221

Foreign currency effects* $ (404) $ (43)

* Includes $(13), $(96) and $(66) in 2004, 2003 and 2002, respectively, for the

company’s share of equity affiliates’ foreign currency effects.

Theexcessofmarketvalueoverthecarryingvalueofinven-

toriesforwhichtheLIFOmethodisusedwas$3,036,$2,106and

$1,571atDecember31,2004,2003and2002,respectively.Market

valueisgenerallybasedonaverageacquisitioncostsfortheyear.

LIFOprofitsof$36,$82and$13wereincludedinnetincomefor

theyears2004,2003and2002,respectively.

OnJuly28,2004,thecompany’sBoardofDirectorsapproved

atwo-for-onestocksplitintheformofastockdividendtothe

company’sstockholdersofrecordonAugust19,2004,withdis-

tributionofsharesonSeptember10,2004.Thetotalnumberof

authorizedcommonstocksharesandassociatedparvaluewas

unchangedbythisaction.Allper-shareamountsinthefinancial

statementsreflectthestocksplitforallperiodspresented.Theeffect

ofthecommonstocksplitisreflectedontheConsolidatedBalance

Sheetin“Commonstock”and“Capitalinexcessofparvalue.”

SPECIAL ITEMS AND OTHER FINANCIAL INFORMATION – Continued