Chevron 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

THE “BIG 5” We are moving forward on our “Big 5” projects. These are

legacy developments that are expected to boost production and reserves

over the next five years. Three of the projects are in the deep water: the

Agbami Field in Nigeria, the Tahiti Field in the U.S. Gulf of Mexico and the

Benguela Belize-Lobito Tomboco development in Angola. Additionally, we

are moving forward with a major expansion at the Tengizchevroil joint

venture in Kazakhstan. We expect these and other capital projects to add

approximately 850,000 net barrels of oil-equivalent production per day by

2009. Also in our “Big 5” lineup is the development of the giant Greater

Gorgon Area natural gas fields offshore Western Australia (see Page 9).

EXPLORATION SUCCESSES For the third consecutive year, our explora-

tion efforts achieved excellent results. Major discoveries were made in

the U.S. Gulf of Mexico, Western Australia, Venezuela, Nigeria, Thailand,

the U.K. North Sea, and the offshore area between Angola and the Repub-

lic of Congo. We acquired new acreage in the U.S. Gulf of Mexico, offshore

eastern Canada, Nigeria, Venezuela, Norway and the U.K. Atlantic Margin.

We also increased our position in the Mackenzie Delta in northern Canada

and extended exploration rights in Angola. In an ongoing effort to move

more resources into reserves, we are appraising recent high-potential

discoveries in the deepwater Gulf of Mexico, Nigeria and Angola.

NEW BUSINESS DEVELOPMENT We intend to build our reputation as

a partner of choice to secure major new opportunities in resource-rich

areas of the world. In 2004, we announced a Memorandum of Under-

standing with Russia’s Gazprom to begin feasibility studies for oil and

natural gas projects in Russia and the United States. We also are pursu-

ing opportunities in northern Africa and the Middle East.

Our downstream strategy is to improve returns by focus-

ing on areas of market and supply strength. In 2004, we completed a

reorganization along global, functional lines, which created efficiencies and

significant earnings improvements across the organization.

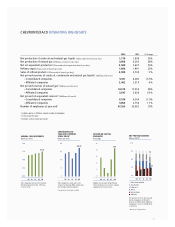

REFINING Our refinery operations are located in strong markets, have

the flexibility to exploit market opportunities and can run significant

volumes of lower-quality, lower-priced crude oil. Our refinery utiliza-

tion rate, an industry measure that incorporates the economic value of

each refinery process unit, has risen approximately 2 percent since 2003.

Improved utilization rates have enabled us to capitalize on high margins,

especially in Asia.

A REFINING SYSTEM

STRATEGICALLY LOCATED

AND CONFIGURED

Our refining portfolio is very competi-

tive. Approximately 60 percent of our

refining capacity is located in the

Asia-Pacific and on the North Ameri-

can West Coast, where margins have

been particularly strong. In 2004,

we increased our ownership in the

Singapore Refining Company to take

advantage of Asia’s growing energy

demand. Our refineries also are flexible

and able to run significant volumes of

lower-quality crude oil. Our U.S. West

Coast and Gulf Coast refineries are

complex and positioned for advantage

when light-heavy price differentials

are wide. We currently are focused on

enhancing our light product conver-

sion and heavy crude capability, with

upgrades planned at refineries in Asia,

California and Mississippi.

> In response to Asia’s grow-

ing demand for refined

products, we increased our

ownership in the Singapore

Refining Company from

33 percent to 50 percent.