Chevron 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

Inthefirstquarter2003,thecompanyrecordedanetafter-

taxchargeof$200forthecumulativeeffectoftheadoptionof

FAS143,includingthecompany’sshareofamountsattributableto

equityaffiliates.Thecumulative-effectadjustmentalsoincreased

thefollowingbalancesheetcategories:“Properties,plantand

equipment,”$2,568;“Accruedliabilities,”$115;and“Deferred

creditsandothernoncurrentobligations,”$2,674.“Noncurrent

deferredincometaxes”decreasedby$21.

Uponadoption,nosignificantassetretirementobligations

associatedwithanylegalobligationstoretirerefining,market-

ingandtransportation(downstream)andchemicallong-lived

assetsgenerallywererecognized,asindeterminatesettlement

datesfortheassetretirementspreventedestimationofthefair

valueoftheassociatedARO.Thecompanyperformsperiodic

reviewsofitsdownstreamandchemicallong-livedassetsforany

changesinfactsandcircumstancesthatmightrequirerecognition

ofaretirementobligation.

Otherthanthecumulative-effectnetcharge,theeffectof

thenewaccountingstandardonnetincomein2003wasnot

materiallydifferentfromwhattheresultwouldhavebeenunder

FAS19accounting.Includedin“Depreciation,depletionand

amortization”were$52relatedtothedepreciationoftheARO

assetand$132relatedtotheaccretionoftheAROliability.

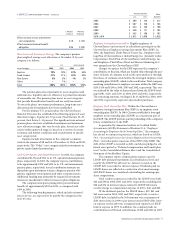

Thefollowingtableillustrateswhatthecompany’snetincome

beforeextraordinaryitems,netincomeandrelatedper-share

amountswouldhavebeeniftheprovisionsofFAS143hadbeen

appliedretroactively:

Year Ended December 31

2003 2002

Pro forma net income before

extraordinary items $ 7,4301 $ 1,1372

Earnings per share – basic3 $ 3.57 $ 0.53

Earnings per share – diluted3 $ 3.57 $ 0.53

Pro forma net income $ 7,4301 $ 1,1372

Earnings per share – basic4 $ 3.57 $ 0.53

Earnings per share – diluted4 $ 3.57 $ 0.53

1 Excludes cumulative-effect charge of $200 ($0.09 per basic and diluted share) for the

adoption of FAS 143.

2 Includes benefit of $5 that represents the reversal of FAS 19 depreciation related to

abandonment offset partially by pro forma expenses for the depreciation and accre-

tion of the ARO asset and liability, net of tax. There is a de minimis effect to net

income per basic or diluted share.

3 Reported net income before extraordinary items was also $3.57 per basic and diluted

shares for 2003 and $0.53 per basic and diluted shares for 2002.

4 Reported net income was $3.48 per basic and diluted shares for 2003 and $0.53 per

basic and diluted shares for 2002.

Notes to the Consolidated Financial Statements

Millionsofdollars,exceptper-shareamounts

FAS 143 – ASSET RETIREMENT OBLIGATIONS – Continued

PriortotheimplementationofFAS143,thecompanyhad

recordedaprovisionforabandonmentthatwaspartof“Accu-

mulateddepreciation,depletionandamortization.”Upon

implementationofFAS143,theprovisionforabandonmentwas

reversed,andAROliabilitywasrecorded.Theamountofthe

abandonmentreserveattheendof2002was$2,263.The2002

pro-formaAROliabilityatJanuary1andDecember31was

$2,792and$2,797,respectively.

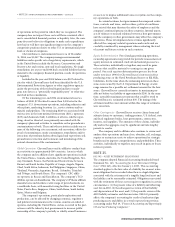

Thefollowingtableindicatesthechangestothecompany’s

before-taxassetretirementobligationsin2004and2003:

2003

Balance at January 1 $ 2,797*

Liabilities incurred 14

Liabilities settled (128)

Accretion expense 132

Revisions in estimated cash flows 41

Balance at December 31 $ 2,856

*Includes the cumulative effect of the accounting change.

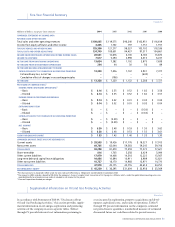

Basicearningspershare(EPS)isbaseduponnetincomeless

preferredstockdividendrequirementsandincludestheeffects

ofdeferralsofsalaryandothercompensationawardsthatare

investedinChevronTexacostockunitsbycertainofficersand

employeesofthecompanyandthecompany’sshareofstock

transactionsofaffiliates,which,undertheapplicableaccounting

rules,mayberecordeddirectlytothecompany’sretainedearn-

ingsinsteadofnetincome.DilutedEPSincludestheeffectsof

theseitemsaswellasthedilutiveeffectsofoutstandingstock

optionsawardedunderthecompany’sstockoptionprograms

(seeNote23,“StockOptions,”beginningonpage74).Thefollow-

ingtablesetsforththecomputationofbasicanddilutedEPS: