Chevron 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

thenaturalgassalespricesintheareasofexcesssupply(before

thenaturalgasistransferredtoacompany-ownedorthird-party

processingfacility)areexpectedtoremainwellbelowsalesprices

fornaturalgasthatisproducedmuchnearertoareasofhigh

demandandthatcanbetransportedinexistingnaturalgaspipe-

linenetworks(asintheUnitedStates).

Partiallyoffsettingthebenefitofhighercrudeoilandnatural

gaspricesin2004wasa5percentdeclineinthecompany’s

worldwideoil-equivalentproductionfromtheprioryear,including

volumesproducedfromoilsandsandproductionunderan

operatingserviceagreement.Thedecreasewaslargelytheresult

oflowerproductionintheUnitedStatesduetonormalfield

declines,propertysalesandproductioncurtailmentsresulting

fromdamagestoproducingoperationscausedbyHurricane

Ivan.Internationaloil-equivalentproductionwasdownmargin-

allybetweenyears.Referalsotopage32foradditionaldiscussion

anddetailofproductionvolumesworldwide.

Thelevelofoil-equivalentproductioninfutureperiodsis

uncertain,inpartbecauseofOPECproductionquotasandthe

potentialforlocalcivilunrestandchanginggeopoliticsthat

couldcauseproductiondisruptions.Approximately25percent

ofthecompany’snetoil-equivalentproductionin2004,including

volumesproducedfromoilsandsandunderanoperatingservice

agreement,wasintheOPEC-membercountriesofIndonesia,

NigeriaandVenezuelaandinthePartitionedNeutralZone

betweenSaudiArabiaandKuwait.Althoughthecompany’s

productionlevelduring2004wasnotconstrainedintheseareas

byOPECquotas,futureproductioncouldbeaffectedbyOPEC-

imposedlimitations.Futureproductionlevelsalsoareaffectedby

thesizeandnumberofeconomicinvestmentopportunitiesand,

fornewlarge-scaleprojects,thetimelagbetweeninitialexplora-

tionandthebeginningofproduction.Refertopages28through

30fordiscussionofthecompany’smajorupstreamprojects.

IncertainonshoreareasofNigeria,approximately45,000

barrelsperdayofthecompany’snetproductioncapacityhas

beenshutinsinceMarch2003becauseofcivilunrestanddamage

toproductionfacilities.Thecompanyhasadoptedaphasedplan

torestoretheseoperationsandhasbegunproduction-resumption

effortsincertainareas.

AsaresultofHurricaneIvaninSeptember2004,production

inthefourthquarterwasabout60,000barrelsperdaylowerthan

itotherwisewouldhavebeen.Damagestoproducingfacilities

areexpectedtorestrictoil-equivalentproductioninthefirst

quarter2005byapproximately35,000barrelsperday.Mostof

theremainingshut-inproductionisexpectedtoberestoredin

thesecondquarterof2005.

Downstream Refining,marketingandtransportationearn-

ingsarecloselytiedtoregionaldemandforrefinedproducts

andtheassociatedeffectsonindustryrefiningandmarketing

margins.Thecompany’scoremarketingareasaretheWestCoast

ofNorthAmerica,theU.S.GulfCoast,LatinAmerica,Asiaand

sub-SaharanAfrica.

Specificfactorsinfluencingthecompany’sprofitabilityin

thissegmentincludetheoperatingefficienciesandexpenses

oftherefinerynetwork,includingtheeffectsofanydowntime

duetoplannedandunplannedmaintenance,refineryupgrade

projectsandoperatingincidents.Thelevelofoperatingexpenses

canalsobeaffectedbythevolatilityofcharterexpensesforthe

company’sshippingoperations,whicharedrivenbytheindus-

try’sdemandforcrude-oiltankers.Factorsbeyondthecompany’s

controlincludethegenerallevelofinflation,especiallyenergy

coststooperatetherefinerynetwork.

Downstreamearningsimprovedin2004comparedwiththe

prioryear,primarilyasaresultofincreaseddemandandhigher

marginsfortheindustry’srefinedproductsinmostoftheareas

inwhichthecompanyanditsequityaffiliateshaveoperations.In

2004,refined-productmarginsinNorthAmericaandAsiawere

attheirhighestlevelinrecentyears.Industrymarginsmaybe

volatileinthefuture,dependingprimarilyonpricemovements

forcrudeoilfeedstocks,thedemandforrefinedproducts,inven-

torylevels,refinerymaintenanceandmishaps,andotherfactors.

Chemicals Earningsinthepetrochemicalssegmentare

closelytiedtoglobalchemicaldemand,inventorylevelsandplant

capacities.Additionally,feedstockandfuelcosts,whichtend

tofollowcrudeoilandnaturalgaspricemovements,influence

earningsinthissegment.

Earningsimprovedin2004comparedwith2003primarily

fromtheresultsofthecompany’s50percent-ownedChevron

PhillipsChemicalCompanyLLC(CPChem)affiliate,which

recordedhighermarginsandsalesvolumesforcommodity

chemicalsandhigherequityaffiliateincome.

Keyoperatingdevelopmentsandothereventsduring2004and

early2005included:

NorthAmerica During2004,thecompanyclosedonthesale

ofmorethan300producingpropertiesandotherassetsinthe

UnitedStatesandCanada,generatingproceedsof$2.5billion.

Thesesales,whichaccountedfor

lessthan10percentoftheoil-

equivalentproductionandreserves

inNorthAmerica,werepartof

plansannouncedin2003todis-

poseofassetsthatdidnotprovide

sufficientlong-termvaluetothe

companyandtoimprovetheover-

allcompetitiveperformanceand

operatingefficiencyofthecompa-

ny’sexplorationandproduction

portfolio.

IntheGulfofMexico,the

companyawardedtwomajor

engineeringcontractsforthe

developmentofsubseasystems

andafloatingproductionfacility

toadvancethedevelopmentofthe

operatedand58percent-owned

Tahitiprospect,amajordeepwater

discovery.Asuccessfulwelltestof

theoriginaldiscoverywellwasalso

conductedin2004.Elsewhereinthe

GulfofMexico,adeepwatercrude

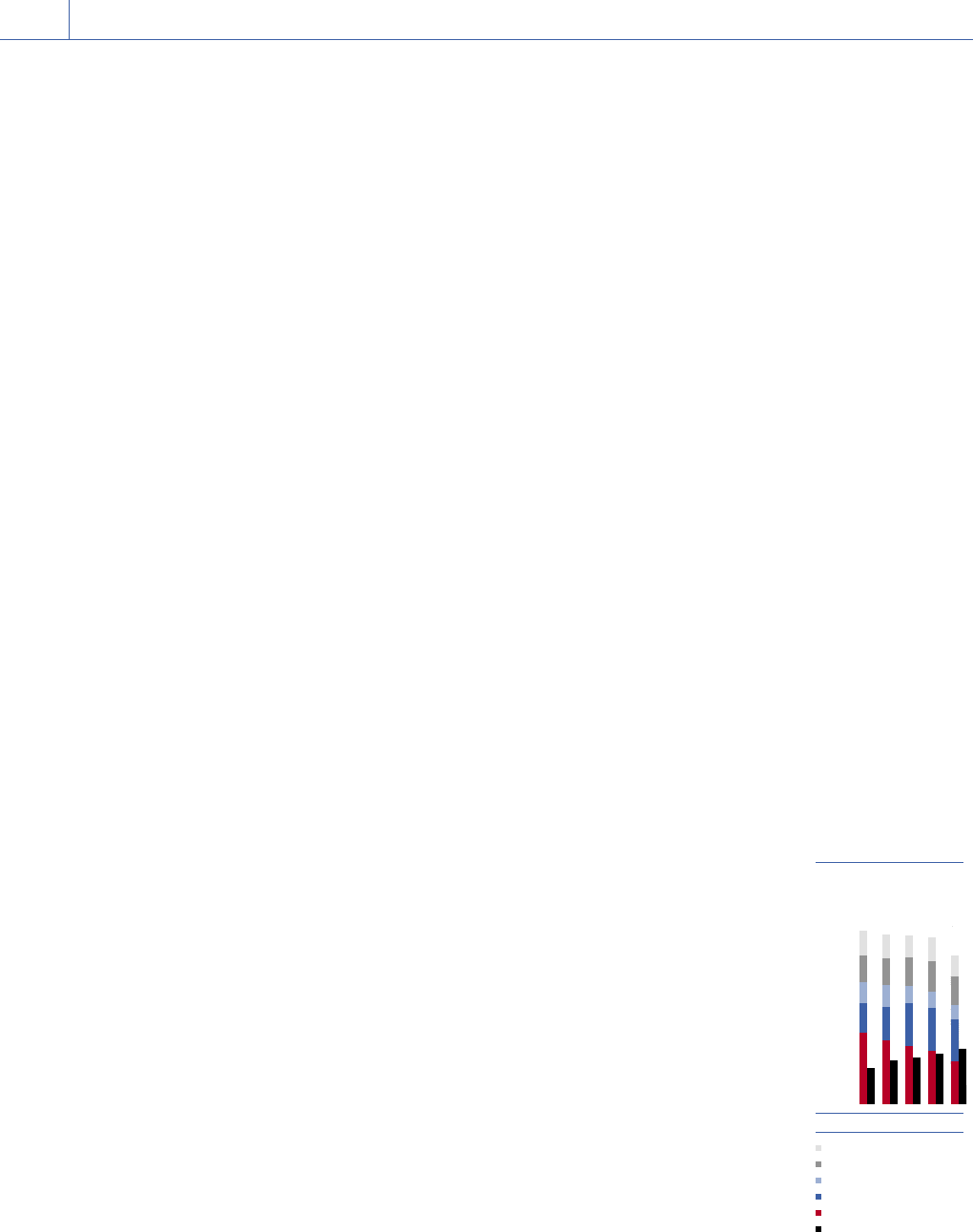

0.0

12.0

6.0

9.0

3.0

0100 02 03 04

8.2

3.1

Net proved reserves for consoli-

dated companies declined 11

percent in 2004, while affiliated

companies’ reserves climbed by

11 percent.

*Barrels of oil-equivalent

NET PROVED RESERVES

Billions of BOE*

Other International

Asia-Pacific

Indonesia

Africa

United States

Affiliates

#14A – Net Proved Reserves (front) – v7