Chevron 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

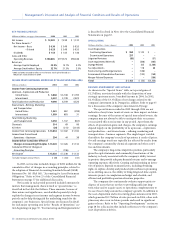

Millionsofdollars,exceptper-shareamounts 2003 2002

Net Income $ 7,230 $ 1,132

Per Share Amounts:*

Net Income – Basic $ 3.48 $ 0.53

– Diluted $ 3.48 $ 0.53

Dividends $ 1.43 $ 1.40

Sales and Other

Operating Revenues $ 119,575 $ 98,340

Return on:

Average Capital Employed 15.7% 3.2%

Average Stockholders’ Equity 21.3% 3.5%

* 2003 and 2002 restated to reflect a two-for-one stock split effected as a

100 percent stock dividend in 2004.

Millionsofdollars 2003 2002

Upstream – Exploration and Production

United States $ 3,160 $ 1,703

International 3,199 2,823

Total Exploration and Production 6,359 4,526

Downstream – Refining, Marketing

and Transportation

United States 482 (398)

International 685 31

Total Refining, Marketing

and Transportation 1,167 (367)

Chemicals 69 86

All Other (213) (3,143)

Income From Continuing Operations $ 7,382 $ 1,102

Income From Discontinued

Operations – Upstream 44 30

$ 7,426 $ 1,132

Cumulative Effect of Changes in

Accounting Principles (196) –

Net Income* $ 7,230 $ 1,132

*Includes Foreign Currency Effects: $ (404) $ (43)

In2003,netincomeincludedchargesof$200millionforthe

cumulativeeffectofchangesinaccountingprinciples,relatedto

theadoptionofFinancialAccountingStandardsBoard(FASB)

StatementNo.143(FAS143),“AccountingforAssetRetirement

Obligations.”RefertoNote25oftheConsolidatedFinancial

Statementsonpage77foradditionaldiscussion.

Netincomeineachperiodpresentedincludedamountsfor

mattersthatmanagementcharacterizedas“specialitems,”as

describedinthetablethatfollows.Theseamounts,becauseof

theirnatureandsignificance,areidentifiedseparatelytohelp

explainthechangesinnetincomeandsegmentincomebetween

periodsandtohelpdistinguishtheunderlyingtrendsforthe

company’scorebusinesses.Specialitemsarediscussedindetail

foreachmajoroperatingareainthe“ResultsofOperations”sec-

tionbeginningonpage30.“RestructuringandReorganizations”

isdescribedindetailinNote12totheConsolidatedFinancial

Statementsonpage63.

Millionsofdollars–Gains(charges) 2003 2002

Asset Dispositions

Continuing Operations $ 122 $ –

Discontinued Operations – –

Litigation Provisions – (57)

Asset Impairments/Write-offs (340) (485)

Dynegy-Related 325 (2,306)

Tax Adjustments 118 60

Restructuring and Reorganizations (146) –

Environmental Remediation Provisions (132) (160)

Merger-Related Expenses – (386)

$ (53) $ (3,334)

Asshowninthe“SpecialItems”table,netspecialgainsof

$1.2billion,associatedmainlywiththedispositionofnon-

strategicupstreamassets,benefitedincomein2004.In2002,

$2.3billionofthe$3.3billionofnetchargesrelatedtothe

company’sinvestmentinitsDynegyInc.affiliate.Refertopage35

foradiscussionofthecompany’sinvestmentinDynegy.

Thespecialitemsrecordedin2002through2004arenot

indicativeofanyfuturetrendsofeventsortheirimpactonfuture

earnings.Becauseofthenatureofspecialitem-relatedevents,the

companymaynotalwaysbeabletoanticipatetheiroccurrence

orassociatedeffectsonincomeinanyperiod.Apartfromthe

effectsofspecial-itemgainsandcharges,thecompany’searnings

dependlargelyontheprofitabilityofitsupstream–exploration

andproduction–anddownstream–refining,marketingand

transportation–businesssegments.Thesinglelargestvariable

thataffectsthecompany’sresultsofoperationsiscrudeoilprices.

Overallearningstrendsaretypicallylessaffectedbyresultsfrom

thecompany’scommoditychemicalssegmentandotheractivi-

tiesandinvestments.

Thecompany’slong-termcompetitiveposition,particularly

giventhecapital-intensiveandcommodity-basednatureofthe

industry,iscloselyassociatedwiththecompany’sabilitytoinvest

inprojectsthatprovideadequatefinancialreturnsandtomanage

operatingexpenseseffectively.Creatingandmaintaininganinven-

toryofprojectsdependsonmanyfactors,includingobtaining

rightstoexplore,developandproducehydrocarbonsinpromising

areas,drillingsuccess,theabilitytobringlong-lead-timecapital-

intensiveprojectstocompletiononbudgetandschedule,and

efficientandprofitableoperationofmatureproperties.

Thecompanyalsocontinuouslyevaluatesopportunitiesto

disposeofassetsthatarenotkeytoprovidingsufficientlong-

termvalueandtoacquireassetsoroperationscomplementaryto

itsassetbasetohelpsustainthecompany’sgrowth.Inadditionto

theasset-dispositionandrestructuringplansannouncedin2003,

whichgenerated$3.7billionofsalesproceedsin2004,othersuch

plansmayalsooccurinfutureperiodsandresultinsignificant

gainsorlosses.Refertothe“OperatingDevelopments”sectionon

page28foradiscussionthatincludesreferencestothecompany’s

assetdispositionactivities.

Management’s Discussion and Analysis of Financial Condition and Results of Operations