Chevron 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

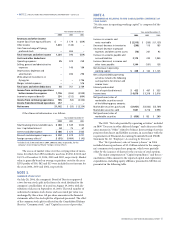

Year ended December 31

2003 2002

Taxes on income1

U.S. federal

Current $ 1,133 $ (80)

Deferred2 121 (414)

State and local 133 21

Total United States 1,387 (473)

International

Current 3,864 3,138

Deferred2 43 333

Total International 3,907 3,471

Total taxes on income $ 5,294 $ 2,998

1 Excludes income tax expense of $100, $50 and $26 related to discontinued opera-

tions for 2004, 2003 and 2002, respectively.

2 Excludes a U.S. deferred tax benefit of $191 and a foreign deferred tax expense of

$170 associated with the adoption of FAS 143 in 2003 and the related cumulative

effect of changes in accounting method in 2003.

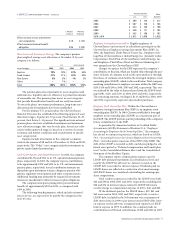

In2004,thebefore-taxincomeforU.S.operations,including

relatedcorporateandothercharges,was$7,776,comparedwitha

before-taxincomeof$5,664in2003andabefore-taxlossof$2,162

in2002.Forinternationaloperations,before-taxincomewas

$12,775,$7,012and$6,262in2004,2003and2002,respectively.

U.S.federalincometaxexpensewasreducedby$176,$196and

$208in2004,2003and2002,respectively,forbusinesstaxcredits.

Thecompany’seffectiveincometaxratevariedfromthe

U.S.statutoryfederalincometaxratebecauseofthefollowing:

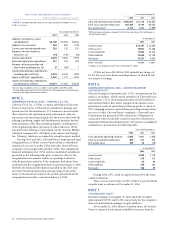

Year ended December 31

2003 2002

U.S. statutory federal income tax rate 35.0% 35.0%

Effect of income taxes from inter-

national operations in excess of

taxes at the U.S. statutory rate 12.8 29.9

State and local taxes on income, net

of U.S. federal income tax benefit 0.5 1.1

Prior-year tax adjustments (1.6) (7.1)

Tax credits (1.5) (5.1)

Effects of enacted changes in tax laws 0.3 2.0

Impairment of investments in

equity affiliates – 12.6

Capital loss tax benefit (0.8) –

Other (1.9) –

Consolidated companies 42.8 68.4

Effect of recording income from

certain equity affiliates on an

after-tax basis (1.0) 4.7

Effective tax rate 41.8% 73.1%

Internationaltaxesin2004werereducedbyapproximately

$129relatedtochangesinincometaxlaws.Thecompanyrecords

itsdeferredtaxesonatax-jurisdictionbasisandclassifiesthosenet

amountsascurrentornoncurrentbasedonthebalancesheetclas-

sificationoftherelatedassetsorliabilities.

companyalsoviewsnettingtheseparatecomponentsofbuy/sell

contractsintheincomestatementtobeinconsistentwiththe

grosspresentationthatFIN39requiresfortheresultingreceiv-

ableandpayableonthebalancesheet.

Thecompany’sbuy/selltransactionsarealsosimilarto

the“barrelback”exampleusedinotheraccountingliterature,

includingEITFIssueNo.03-11,“ReportingRealizedGainsand

LossesonDerivativeInstrumentsThatAreSubjecttoFASBState-

mentNo.133andNot‘HeldforTradingPurposes’asDefined

inIssueNo.02-3”(whichindicatesacompany’sdecisionto

showbuy/sell-typesoftransactionsgrossontheincomestate-

mentasbeingamatterofjudgmentoftherelevantfactsand

circumstancesofthecompany’sactivities)andDerivatives

ImplementationGroup(DIG)IssueNo.K1,“Miscellaneous:

DeterminingWhetherSeparateTransactionsShouldbeViewed

asaUnit.”

Thecompanyfurthernotesthattheaccountingforbuy/sell

contractsasseparatepurchasesandsalesisincontrasttothe

accountingforothertypesofcontractstypicallydescribedby

theindustryasexchangecontracts,whichareconsiderednon-

monetaryinnatureandappropriatelyshownnetontheincome

statement.Underanexchangecontract,forexample,onecom-

panyagreestoexchangerefinedproductsinonelocationfor

anothercompany’ssamequantityofrefinedproductsinanother

location.Upontransfer,theonlyamountsthatmaybeinvoiced

arefortransportationandqualitydifferentials.Amongother

things,unlikebuy/sellcontracts,theobligationsofeachparty

toperformunderthecontractarenotindependentandtherisks

andrewardsofownershiparenotseparatelytransferred.

Asshownonthecompany’sConsolidatedStatementof

Income,“Salesandotheroperatingrevenues”forthethreeyears

endingDecember31,2004,included$18,650,$14,246and$7,963,

respectively,forbuy/sellcontracts.Thecostsassociatedwiththese

buy/sellrevenueamountsareincludedin“Purchasedcrudeoiland

products”ontheConsolidatedStatementofIncomeineachperiod.

66 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

Millionsofdollars,exceptper-shareamounts

ACCOUNTING FOR BUY/SELL CONTRACTS – Continued