Chevron 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 37

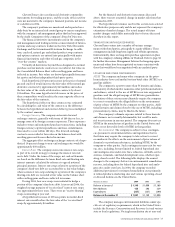

DirectorIndirectGuarantees�

Millionsofdollars Commitment Expiration by Period

2006– After

Total 2005 2008 2009 2009

Guarantees of Non-

consolidated Affiliates or

Joint Venture Obligations $ 963 $ 515 $ 210 $ 135 $ 103

Guarantees of Obligations

of Third Parties 130 70 16 4 40

Guarantees of Equilon Debt

and Leases 215 18 61 18 118

* The amounts exclude indemnifications of contingencies associated with the sale

of the company’s interest in Equilon and Motiva in 2002, as discussed in the

“Indemnifications” section on page 38.

AtDecember31,2004,thecompanyanditssubsidiariespro-

videdguarantees,eitherdirectlyorindirectly,of$963millionfor

notesandothercontractualobligationsofaffiliatedcompanies

and$130millionforthirdpartiesasdescribedbymajorcategory

below.Therearenoamountsbeingcarriedasliabilitiesforthe

company’sobligationsundertheseguarantees.

Ofthe$963millioninguaranteesprovidedtoaffiliates,

$774millionrelatetoborrowingsforcapitalprojectsorgen-

eralcorporatepurposes.Theseguaranteeswereundertakento

achievelowerinterestratesandgenerallycovertheconstruction

periodofthecapitalprojects.Approximately90percentofthe

amountsguaranteedwillexpireby2009,withtheremaining

guaranteesexpiringbytheendof2015.Underthetermsofthe

guarantees,thecompanywouldberequiredtofulfilltheguar-

anteeshouldanaffiliatebeindefaultofitsloanterms,generally

forthefullamountsdisclosed.Therearenorecourseprovisions,

andnoassetsareheldascollateralfortheseguarantees.The

$189millionbalanceofthe$963millionrepresentsobligations

inconnectionwithpricingofpowerpurchaseagreementsfor

certainofitscogenerationaffiliates.Underthetermsofthese

guarantees,thecompanymayberequiredtomakepayments

undercertainconditionsiftheaffiliatedoesnotperformunder

theagreements.Therearenorecourseprovisionstothirdparties,

andnoassetsareheldascollateralforthesepricingguarantees.

Guaranteesof$130millionhavebeenprovidedtothird

parties,includingguaranteesofapproximately$40millionof

constructionloanstohostgovernmentsinthecompany’sinter-

nationalupstreamoperations.Theremainingguaranteesof

$90millionwereprovidedprincipallyasconditionsofsaleof

thecompany’sinterestincertainoperations,toprovideasource

ofliquiditytotheguaranteedpartiesandinconnectionwith

companymarketingprograms.Noamountsofthecompany’s

obligationsundertheseguaranteesarerecordedasliabilities.

About70percentofthetotalamountsguaranteedwillexpirein

2009,withtheremainderexpiringafter2009.Thecompanywould

berequiredtoperformunderthetermsoftheguaranteesshould

anentitybeindefaultofitsloanorcontractterms,generallyfor

thefullamountsdisclosed.Approximately$70millionofthe

guaranteeshaverecourseprovisions,whichenablethecompany

torecoveranypaymentsmadeunderthetermsoftheguarantees

fromsecuritiesheldovertheguaranteedparties’assets.

AtDecember31,2004,ChevronTexacoalsohadoutstanding

guaranteesforapproximately$215millionofEquilondebtand

leases.FollowingtheFebruary2002dispositionofitsinterestin

Equilon,thecompanyreceivedanindemnificationfromShell

and$400millionforsupplyandtransportationprojects,including

pipelinestosupportexpandedupstreamproduction.

Investmentsinchemicalsbusinessesin2005arebudgeted

at$200million.Estimatesforenergytechnology,information

technologyandfacilities,andpower-relatedbusinessestotal

approximately$500million.

PensionObligations In2004,thecompany’spensionplan

contributionstotaled$1.6billion(approximately$1.3billionto

theU.S.plans).In2005,thecompanyexpectscontributionsto

beapproximately$400million.Actualamountsaredependent

uponinvestmentresults,changesinpensionobligations,regu-

latoryenvironmentsandothereconomicfactors.Additional

fundingmayberequiredifinvestmentreturnsareinsufficientto

offsetincreasesinplanobligations.Referalsotothediscussion

ofpensionaccountingin“CriticalAccountingEstimatesand

Assumptions”beginningonpage43.

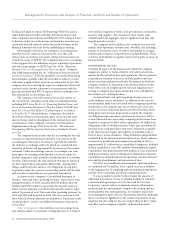

CurrentRatio–currentassetsdividedbycurrentliabilities.The

currentratioisadverselyaffectedbythefactthatChevronTexaco’s

inventoriesarevaluedonaLast-In,First-Out(LIFO)basis.At

year-end2004,thebookvalueofinventorywaslowerthan

replacementcosts,basedonaverageacquisitioncostsduringthe

year,byapproximately$3.0billion.

InterestCoverageRatio–incomebeforeincometaxexpense,

plusinterestanddebtexpenseandamortizationofcapitalized

interest,dividedbybefore-taxinterestcosts.Thecompany’s

interestcoverageratiowashigherin2004,primarilydueto

higherbefore-taxincomeandloweraveragedebtbalances.

DebtRatio–totaldebtasapercentageoftotaldebtplus

equity.Thedecreasebetweenthecomparableperiodswasdue

toloweraveragedebtlevelsandhigherretainedearnings.

FinancialRatios

At December 31

2003 2002

Current Ratio 1.2 0.9

Interest Coverage Ratio 24.3 7.6

Total Debt/Total Debt Plus Equity 25.8% 34.0%

0.0

8.0

6.0

4.0

2.0

0100 02 03

Billions of dollars

United States

International

Explorationandproduction

projectsaccountedfor76percent

oftotalcapitalandexploratory

expendituresin2004.

�Includesequityinaffiliates

0.0

60.0

45.0

15.0

30.0

0

50

40

30

20

10

0100 02 03

Billions of dollars/Percent

Debt (left scale)

Stockholders’ Equity (left scale)

Ratio (right scale)

ChevronTexaco’sratiooftotal

debttototaldebt-plus-equity

fellto20percentatyear-end

asthecompany’sstockholders’

equityclimbed.